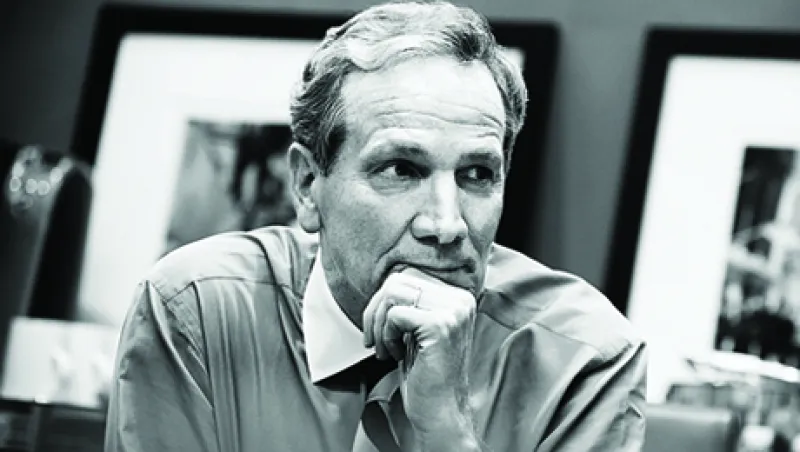

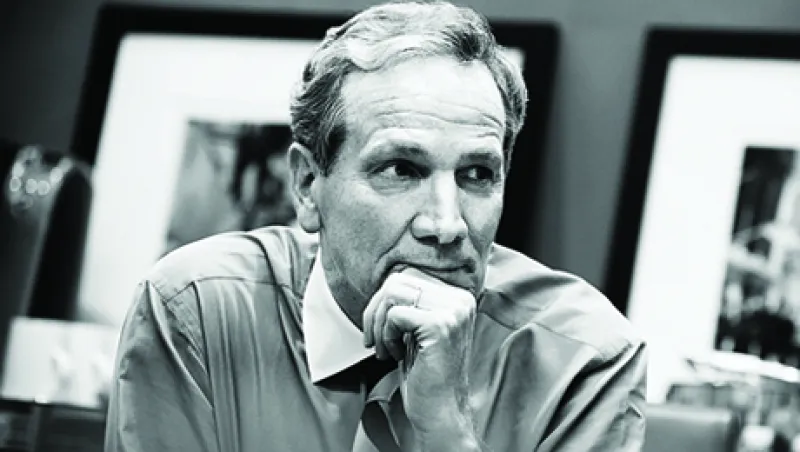

Alan Schwartz Makes Guggenheim Partners an M&A Player

As executive chairman of Guggenheim, the former Bear Stearns CEO has built a full-service investment bank for the firm.

David Rothnie

October 7, 2016