As we frequently bring together the world’s most influential financial decision makers, we often gain insights into some of the strategic considerations shaping the financial landscape. These insights, largely taken from our proprietary member events, encompass wide swaths of the industry, from data-driven decision-making to where the C-suite projects profits to land at the end of the year.

Our event in April, the CFO/COO Roundtable, was no exception bringing together the chief financial and chief operating officers from some of North America’s most prominent asset management firms.

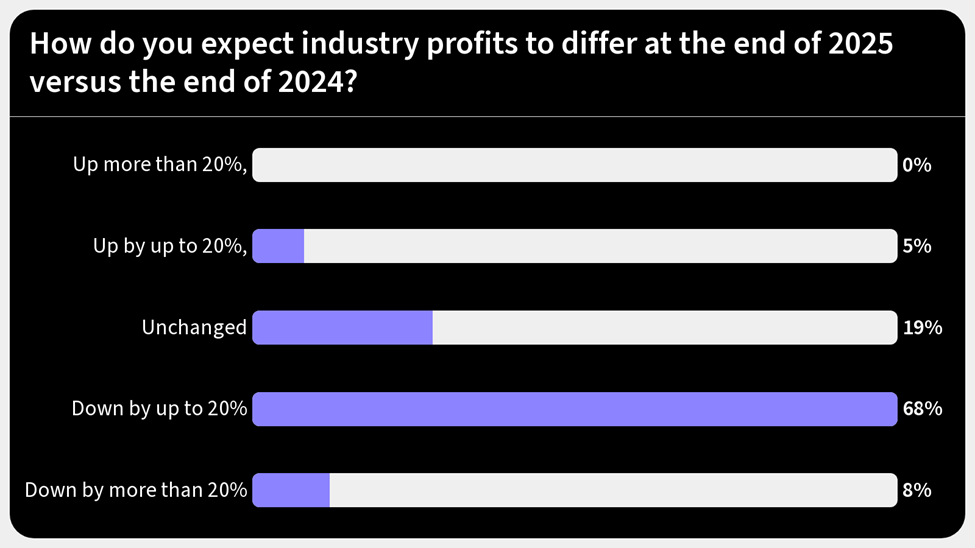

Source: US Institute CFO/COO Roundtable

Polling from the event revealed the majority (68%) of CFOs and COOs believe industry profits will decrease by as much as 20% at the end of 2025 in relation to the year prior. Another 8% believe the decrease will exceed 20%, reflecting possible growing concern among financial and operational leaders about near-term profitability across industries.

Only 5% of respondents had faith that profits would increase by up to 20%, with no respondents hopeful of profits exceeding the figure at all.

A number of reasons could have contributed to this dismal outlook. Ongoing elevated borrowing costs are impacting corporate debt servicing and investment plans, squeezing margins and making overall operations more difficult. Additionally, economic uncertainty, including weaker demand in key markets such as Europe and China, is reducing revenue growth potential. Stubborn inflation is also keeping input costs high in areas like labor, energy, and raw materials while pricing power is eroding in some sectors, creating a difficult environment for outsized returns.

These economic tensions also come at a time where geopolitical conflicts and trade disputes are disrupting supply chains and increasing costs, particularly in manufacturing and logistics-heavy sectors. Moreover, firms are having to simultaneously absorb artificial intelligence (AI) transition costs, as many firms are investing heavily in AI and digital transformation to maintain competitiveness and scale, which may increase short-term costs before delivering long-term returns.

It will be an interesting second half of the year, as trade disputes in China and the U.S. do not show signs of slowing down and the global economy both pushes ahead and attempts to keep pace with the change.

As markets evolve, we will be keen to see if CFOs and COOs maintain their fairly bleak outlooks for the year, or if future developments alter outlook perspectives.

For more insights and to reach our Thought Leadership department, click here.

Market Intelligence Is Independent of the Institutional Investor Magazine Newsroom