As we frequently bring together the world’s most influential financial decision makers, we often gain insight into some of the strategic considerations shaping the financial landscape. These insights, largely taken from our proprietary member events, encompass wide swaths of the industry, from data-driven decision-making to what chief investment officers have on their radar for the year ahead.

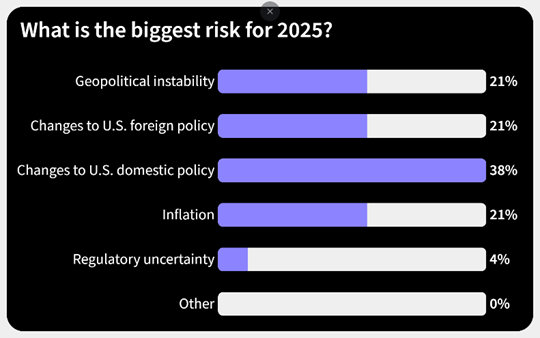

Our recent USI CIO Roundtable was no exception, bringing together some of the industry’s largest chief investment officers and asset managers. During the event, we polled attendees on their biggest perceived risks for 2025, revealing that changes to U.S. domestic policy were of top concern, cited by 38% of repsondents. This is likely in response to growing apprehension over potential shifts in regulations, taxation, and economic policies that could significantly impact business operations in coming months put forth by the current U.S. administration.

Meanwhile, geopolitical instability and changes to U.S. foreign policy each accounted for 21% of the concerns. Interestingly, respondents seemed more concerned about U.S. domestic policy and its impact on investments than U.S. foreign policy response.

Inflation, which has been a dominant risk factor in recent years also registered at 21%, suggesting that although it remains a concern, it may no longer be viewed as the primary threat.

Notably, no respondents selected “other” risks, highlighting that the listed categories likely effectively capture the prevailing anxieties for the coming year. The data underscores the significant weight domestic and foreign policy carry in shaping the current investment landscape – and where we will be sure to maintain our focus as institutional investors respond to emerging risks and evolving global dynamics throughout 2025.

For more insights and to reach our Thought Leadership Department, click here.

Market Intelligence Is Independent of the Institutional Investor Magazine Newsroom