Almost every portfolio manager, analyst, and employee has heard some variation of the phrase “people are our most important asset.” And few would question that, as the U.S. economy has become a knowledge economy, motivating and engaging talent has only grown in importance given its positive effect on productivity. All companies may say the same thing about their employees, but to borrow from Lake Woebegone, “not everyone can be above average.”

Some companies simply do a better job of building and maintaining relationships with their employees than their peers. In those companies, engagement, motivation, trust, pride, productivity and innovation thrive. While these attributes aren’t captured in traditional financial statements, it stands to reason that if they could be, it would provide forward-thinking portfolio managers a distinct competitive advantage over their peers.

This is the core of the Human Capital Factor, a new (and trademarked) investment factor that quantifies the link between human capital and future equity value.

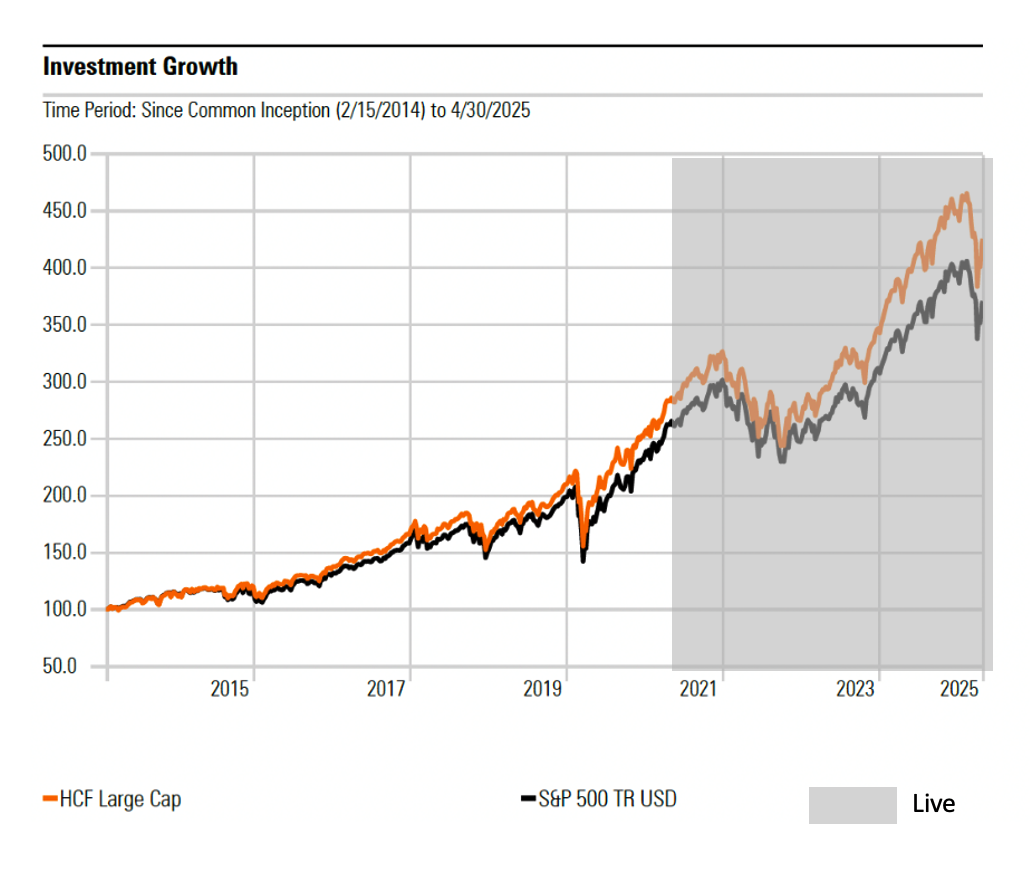

According to the J.P. Morgan Research Report entitled “U.S. ‘Human Capital Factor,’ Still Going Strong,” from February 2014 through October 2024, the Human Capital Index (HCF – Large-Cap), “exhibits a perfect track record for calendar year outperformance, [beating] the benchmark in every single year of our sample. While [the index] did so marginally in three years, the overall performance record for this period is stellar.”

The index, which was launched in October 2020 to provide investors with exposure to large-cap companies with strong Human Capital Factor scores, validates the underlying research.

Earlier this year, S&P Global released its annual SPIVA Scorecard, which measures the performance of active managers versus their respective indices. The results revealed that the majority of large-cap active managers were trounced by their benchmark, the S&P 500. In 2024, 65 percent of managers underperformed; over three years, that figure rose to 85 percent; and over the full 24-year history of the survey, more than 90 percent of managers lagged the benchmark.

Given these results, it is not surprising that many investors have forgone the expense and risk of attempting to outperform and have shifted their assets to passive investments that merely seek to match an index. Indeed, over the past five years, new money flowing to S&P 500 tracking strategies has grown to $660 billion and now represents approximately 55 percent of all large-cap blend ETF assets.

These results, both the performance and investment flows, suggest that the process used to evaluate a company’s prospects for delivering shareholder returns could use a refresh.

The origins of stock analysis can be traced back to the iconic 1934 book co-authored by Benjamin Graham and David Dodd titled “Security Analysis.” In this book, the authors detail a comprehensive approach to evaluating stocks that focuses on evaluating an array of metrics including liquidity, debt-to-equity, dividend history, price-to-earnings, and price-to-book in order to make informed investment decisions.

Less important to Graham and Dodd were subjective or qualitative judgments which they feared could lead to inconsistent outcomes. For example, they wrote: “Objective tests of managerial ability are few and far from scientific. In most cases, the investor must rely upon a reputation which may or may not be deserved.”

Nearly 100 years later, our world and lives have changed dramatically as a result of a wide range of innovations. What if the qualitative aspects of securities analysis that bedeviled Graham and Dodd could be made more quantitative and less speculative? Is it possible to take their foundation and upgrade it to reinvent the balance sheet for the modern era?

The Human Capital Factor takes the immutable tenets of Graham and Dodd’s approach and updates them for today’s economy. This new investment factor enables investable access to those firms getting the relationships and connections right with their employees. There is now independently verified, statistical evidence that when managers get their most important asset right, their companies are rewarded with enhanced future equity value. And unlike the 85 percent of managers sited in the recent SPIVA Scorecard, the Human Capital Factor has outperformed the S&P 500 every year since its launch in 2020.

For asset managers willing to embrace this approach, there appears to be an opportunity to reverse historic performance challenges and shape a new era for active management.

Prior to his retirement, James Walker was a managing director and Global Head of Investments for J.P. Morgan Private Bank. In this role, he was responsible for overseeing over $500 billion in client assets under management with a particular focus on private investment relationships. He currently serves on the boards of several firms, including the Advisory Board of Irrational Capital.

Opinion pieces represent the views of their authors and do not necessarily reflect the views of Institutional Investor.