Richard Stevens, CME Group

At a Glance:

- Trading volume in foreign exchange (FX) options is on the rise.

- The EUR/USD currency pair is seeing the most activity.

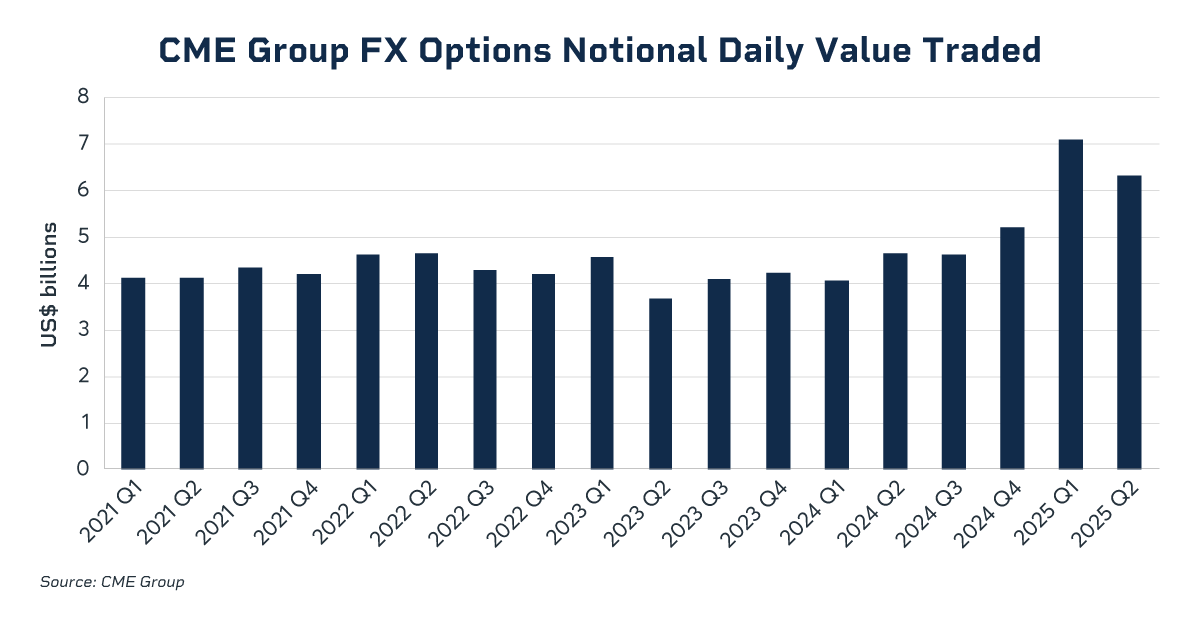

Data from the Federal Reserve and the Bank of England show multi-period increases in FX options volumes, a trend that is also reflected across CME Group’s FX options suite. Traded volumes have increased 52% in the first six months of the year, compared to the same period in 2024, with volumes in April 2025 reaching $7.74 billion in notional value per day.

Hedge Funds Drive Trading Volume

Further information is available to provide greater insight into the types of institutions that are conducting this business. In the United States, the CFTC publishes weekly data on the holders of large positions in exchange listed futures and options. The data also includes information on the size of the combined positions held by various user groups. Data is published for futures only, and for futures and options combined – options data is not published separately but can be derived from the published information.

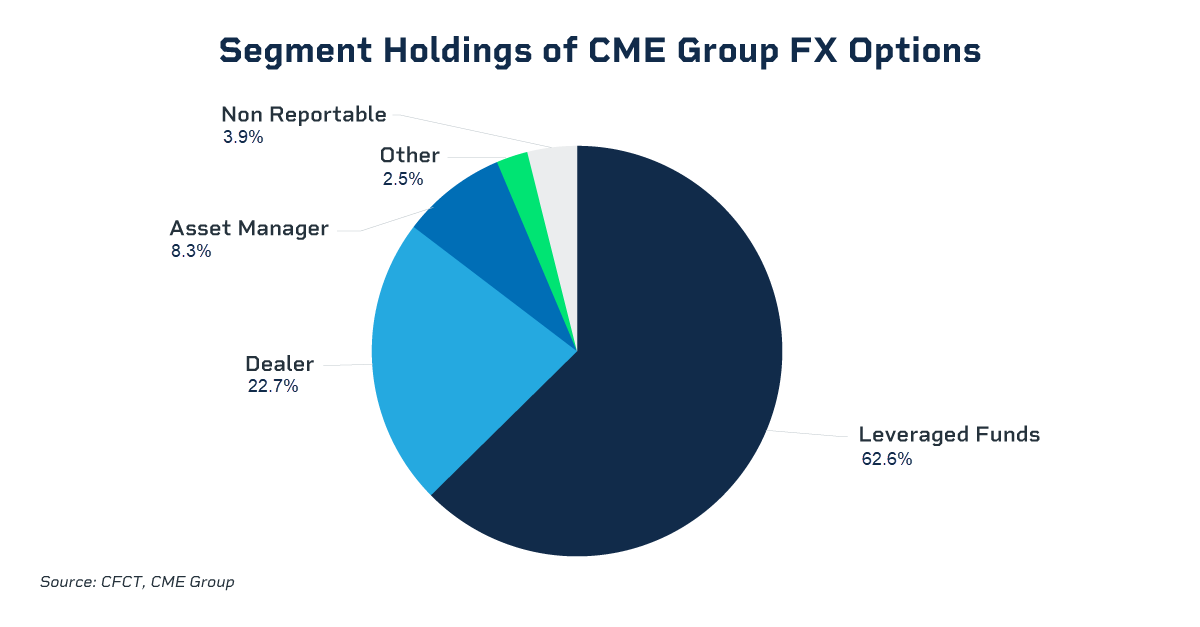

When the options information is distilled, two interesting patterns emerge. Firstly, while Asset Managers and Dealers hold the bulk of positions in FX futures, for FX options by far the largest constituency is Leveraged Funds – the CFTC’s term for hedge funds and similar structures. Recent data shows that Leveraged Funds hold 63% of all CME Group’s FX options open interest.

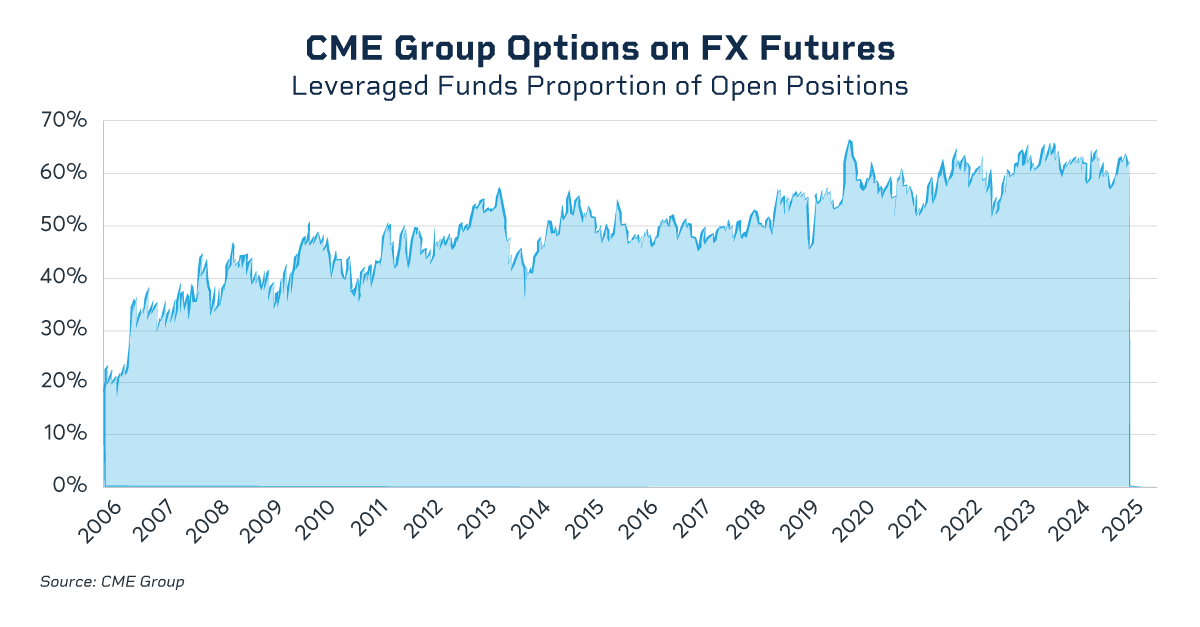

The second pattern of note is that the exposure of hedge funds in FX options has been increasing steadily for the last few years. This has occurred at a faster pace than growth in the equivalent exposure in FX futures.

Leveraged Funds’ exposure to CME Group FX options has been growing for over a decade and this segment has accounted for over 60% of holdings for much of the past two years – a period that has also seen the value of open positions increase 33%.

EUR/USD in Focus

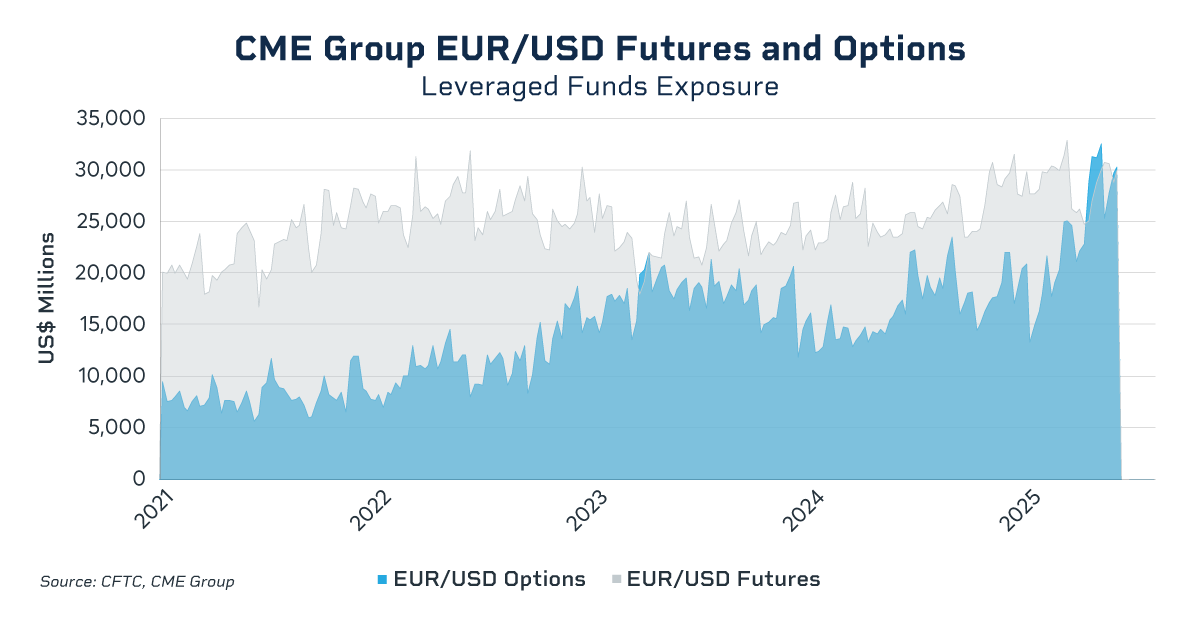

The EUR/USD currency pair is the most actively traded. The recent exposure of Leveraged Funds in EUR/USD futures and options at CME Group is of particular note. In the weeks leading up to the June 2025 expiry, gross exposures in options had a greater dollar value than gross exposures in futures.

The net exposure of Leveraged Funds to the value of the Euro fluctuates between positive and negative, indicating that there is a wide array of strategies and viewpoints making up this segment, with each viewpoint bringing additional pricing information to the market.

While CFTC data doesn’t show specific strategies or outline reasons behind this increased exposure, recent analysis from Risk.net suggests some challenges inherent in the over-the-counter market for options. These include frictions and uncertainty around the OTC option exercise process and the absence of reliable netting in the system.

In contrast, CME Group’s FX options contracts are structured to ensure an automatic and guaranteed exercise of in-the-money positions, alongside a rapid and standardized flow of information to all parties. Furthermore, portfolio netting is at the core of the futures and options clearing model. This condenses and centralizes exposure, greatly improving operational efficiency compared to the over-the-counter experience. A recent piece of analysis highlighted this, as well margin savings in excess of 80% for hedge funds using options on futures.

These features could explain the growth in the use of CME Group’s FX options by hedge funds, though market volatility likely also played a role and will remain a key area to monitor moving forward.

CME Group futures are not suitable for all investors and involve the risk of loss. Full disclaimer. Copyright © 2025 CME Group Inc.