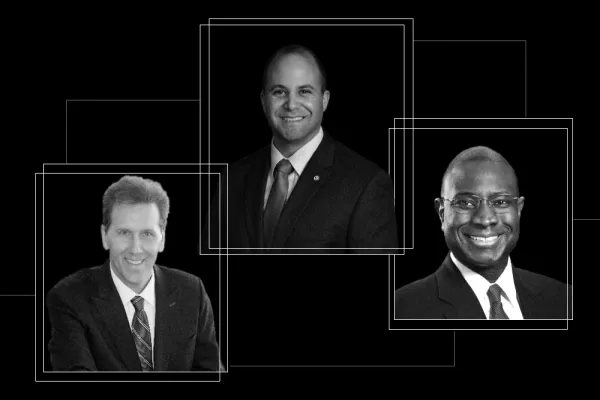

Geoff Berg is leaving a state pension to head a university endowment.

The longtime investment chief for the $50 billion South Carolina Retirement System Investment Commission (RSIC) is leaving the organization to become CIO for the University of Rochester in October. He will replace outgoing CIO Doug Phillips, who plans to retire in September.

At Rochester, Berg will work with the board’s investment committee and nine-person investment team to oversee the university’s $3.7 billion long-term investment pool, as well as the school’s nearly $1 billion in operating capital and $300 million in pension plans.

South Carolina’s RSIC chief executive Michael Hitchcock confirmed in an email that Berg will remain onboard in an advisory role to assist with the transition until September. Deputy CIO Bryan Moore has been named Interim CIO while the commission seeks a permanent replacement.

Berg, who joined RSIC in 2008, became interim investment chief in 2015 before the role became permanent the following year. During his tenure as CIO, the portfolio nearly doubled in size from almost $28 billion to more than $50 billion.

At South Carolina, Berg restructured the investment process to establish top-down targets and objectives for each asset class and set up a system to measure how key investment choices, like where to invest, how to structure the portfolio, and which managers to pick affected performance.

Phillips joined the university in October 2000 as VP for investments after 14 years in a similar role at Williams College. University Board Chair Rich Handler congratulated Phillips on his “ability to ignore the tremendous noise that occurs in every market dislocation and focus entirely on backing the highest quality managers and the right diversification strategy.”

In his farewell statement, Phillips thanked the “thousands of donors who expressed confidence” in the school’s future “through their donations to endowment funds.” Phillips plans to stay in the Rochester area and serve on the University of Pittsburgh Medical Center’s investment committee.

David Barrett from executive recruiting firm BraddockMatthewsBarrett conducted the search on the university’s behalf.

The University of Rochester’s LTIP returned a net 9.5 percent for the fiscal year ended June 30, 2024, well below the benchmark return of 16.5 percent. The pool also lagged its benchmark for the three and five years ended June 30, 2024 (though it exceeded the 10-year benchmark). The annual report attributes the recent underperformance to AI driving a price frenzy with Mag7 stocks and a negative three-year return on private partnerships.