The private equity (PE) industry has long been defined by its twin pillars: venture capital (VC) for funding disruptive startups and leveraged buyouts (LBOs) for restructuring mature companies. Institutional investors have historically allocated capital to these strategies to capture an illiquidity premium and benefit from active management. Private equity has offered diversification benefits through lower correlation with public markets, and compelling investment returns. Yet, the structural constraints of traditional private equity, including capital lock-up periods, limited transparency, significant manager due diligence, and wide variability in fund returns, have presented nuanced challenges in allocating to the asset class while managing total portfolio risk and liquidity.

Private equity’s structural challenges are both its defining strength and unavoidable limitation. Venture capital funds often require a decade-long commitment, with returns skewed by a handful of “unicorn” exits. Buyout funds demand heavy leverage and operational expertise, yet even top-quartile managers struggle to consistently outperform public markets after fees. Meanwhile, limited partners (LPs) face a paradox: while private markets now represent nearly 12%1 of global equity market capitalization and encompass a significantly larger number of companies compared to public markets, traditional institutional portfolios remain overwhelmingly allocated to public stocks.

The growing prominence of private markets has led to a convergence with public markets, but the industry has yet to see the emergence of widely adopted passive investment options for PE. In response, Morningstar and PitchBook, have introduced two compelling indexes that can serve as a basis for capturing private equity exposure: access to late-stage venture capital through the Unicorn 30 Index, and a new approach to public market index replication of buyout strategies using machine learning via the Buyout Replication Index. These indexes, rather than traditional investable products, are frameworks that support the development of investment strategies with private market characteristics – without the operational friction.

The $1.2 Trillion Opportunity: Mobilizing Dry Powder

This reimagining of PE strategies with index-based approaches is now coming into reality as LPs face pressure to deploy capital that fulfills asset class targets while managing liquidity more efficiently. Recent market volatility has added to overall uncertainty on top of a challenging last few years for private equity. In 2024, returns declined to 3.8%, the third consecutive year where public markets outperformed private equity 2, this represented a decrease from 5.7% the year prior, well below the historical average of roughly 14.5% since 2010.

Despite this progression, dry powder still sits at near-historic levels. A 2024 report by Bain Capital3 showed $3.9 trillion in unspent capital, with $1.2 trillion in buyout funds alone. Prior to and during the pandemic, PE firms accumulated significant uninvested capital. This capital, combined with a slowdown in deal activity during the early stages of the pandemic, led to a buildup of funds ready for deployment. As market conditions stabilized, firms became eager to invest this capital, leading to a flurry of buyout activity. With over a trillion dollars in dry powder sitting uninvested amid a liquidity crunch, the industry faces pressure to innovate as asset owners look to maintain their target allocations to PE.

The Institutional Case for Index-Based Private Equity Exposure

Unlike traditional PE fund investments, these new indexes are designed to provide transparency, liquidity, and systematic exposure. This positions them as useful tools for institutions seeking to solve three key challenges:

- Deploying dry powder efficiently in the face of declining deal volume and manager dispersion.

- Managing liquidity across a portfolio without relying on costly secondary sales or fire-sale exits.

- Benchmarking private equity performance with better-aligned public market proxies.

Asset owner demand for more nimble capital increases during times of policy and market uncertainty. Recent reports of potential private equity secondary market sales from two leading university endowments (Yale & Harvard), long emulated for their large allocations to alternatives, highlights the pressing need to manage a dual mandate of constructing portfolios for long-term returns and staying well-positioned for short-term liquidity needs. At the same time, the rise of secondary markets and advances in data analytics have created an inflection point - investors no longer need to accept illiquidity as the price of admission to private markets. Research by Morningstar Indexes and PitchBook reveals that late-stage venture and buyout strategies can now be replicated with near public-market efficiency, unlocking three critical advantages:

- Enhanced liquidity, bypassing decade-long lockups.

- Lower fees, with index-based strategies offering an alternative to PE’s “2-and-20” model.

- Representative exposure, minimizing reliance on individual fund managers.

These new innovations enable a timely alternative to existing solutions: liquid alternatives that mirror private equity’s risk/return profile without the operational friction.

Reframing Late-Stage VC Exposure: The Unicorn 30 Index

Venture capital has surged from a niche asset class to a trillion-dollar global market. Giants like ByteDance (TikTok’s parent), SpaceX, and OpenAI exemplify the shift – staying private for over a decade while reshaping industries. The median age of VC-backed companies now stands at 10.7 years, up from 6.9 years in 2014, as private markets offer unprecedented access to capital through crossover funds, corporate VCs, and secondary trading platforms like Forge Global. As private markets redefine the sources of global growth, new innovations are bridging the gap for investors to gain increased access to private strategies. The Morningstar PitchBook Unicorn 30 Index crystallizes this opportunity – translating once-inaccessible markets into an index that can support replicable investment strategies.

While several tradeable products provide access to private markets, there are key differences in how they offer exposure and how they track underlying assets. For example, listed private equity indexes like the Morningstar PitchBook Developed Markets Listed Private Equity Index tracks publicly traded private equity firms (e.g., Blackstone, KKR).

Investment products based on this type of index give investors indirect exposure to private companies by holding the asset managers’ equity. These listed PE products reflect broader private markets while correlating closely with public equity volatility. In contrast, the Unicorn 30 Index offers a direct approach by providing exposure to pre-IPO, late-stage ventures (e.g., SpaceX, OpenAI), capturing the growth and innovation of private companies before they go public.

Differences in risk/return profile are also driven by the approach to pricing the private company constituents in the Unicorn 30 Index. The index utilizes daily secondary market transactions and noise-reduction algorithms to price private companies, avoiding stale NAVs or self-reported valuations. Similar products might rely on estimated NAVs, which lag real-time private market transaction data, or utilize public market proxies, which correlate with broader equity markets.

Buyout Replication in Public Markets: A Machine-Learning Approach

Buyout funds have long relied on the narrative of value creation through operational improvements and financial engineering. However, Morningstar’s research shows that much of this return can be attributed to sector exposure, leverage, and systematic stock selection – elements that can be replicated algorithmically in public markets.

The Morningstar PitchBook Buyout Replication Index applies machine learning to over a decade of buyout transactions and public company data. It constructs a dynamic portfolio with similar sector tilts and leverage characteristics, delivering returns that mirror the risk/return profile of traditional buyout funds. From 2014 through November 2024, the index outperformers the Morningstar US Small Cap Extended Index by 6.1 percentage points annualized.

Crucially, this index provides:

- Daily mark-to-market transparency

- Cost efficiency with fees more aligned with public equity based products

- Scalability and liquidity, with no multi-year lockups of J-curve effects

For LPs, this index offers a public market equivalent benchmark that better aligns with buyout funds’ risk profiles than general small-cap indexes. When used as the basis of an investment strategy, it can provide a transparent and liquid alternative to traditional private equity investments, capturing the characteristics of buyout strategies through disciplined, systematic factors: value-oriented stock picking, sector rotation, and leverage.

Visualizing the Landscape: Correlation and Liquidity

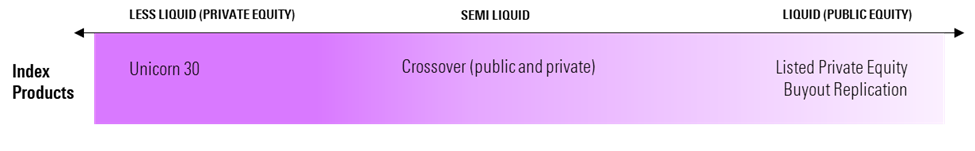

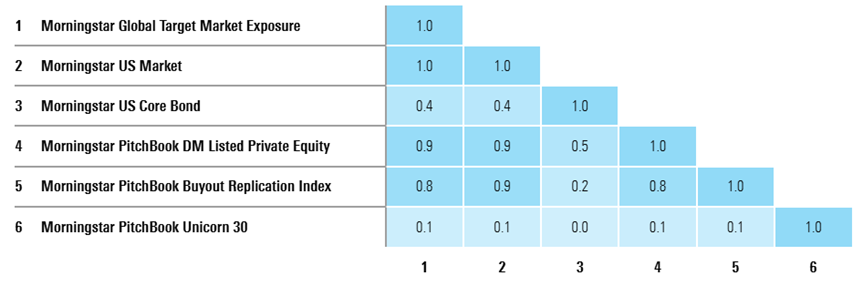

The existing suite of index options can be evaluated along multiple dimensions, including liquidity and expected risk/return attributes. To help institutional investors assess how these index-based approaches fit within portfolio frameworks, it is helpful to map them on two axes:

Liquidity Spectrum – ranging from illiquid PE funds to fully liquid public equity proxies.

Correlation matrix – illustrating how index strategies relate to public markets, listed PE, and traditional private funds. Looking at the 10-year historical index levels reveals the low correlation with public equity markets, including the Listed PE universe:

These visual guides help clarify how indexes like the Unicorn 30 and Buyout Replication indexes bridge the gap between offering new tools for asset allocation, benchmarking, and liquidity management.

A New Set of Tools for a Changing PE Landscape

As institutions grapple with how to maintain private market exposure in the face of mounting dry powder, lower returns, and portfolio-level liquidity constraints, index-based solutions offer a timely and powerful alternative.

The Morningstar PitchBook Unicorn 30 Index and Buyout Replication Index do not seek to replace traditional private equity – but to complement it. They provide scalable, transparent, and cost-effective frameworks that can support both benchmarking and investable strategies. For CIOs and asset allocators, these indexes mark the emergence of a new category of tools designed to make PE exposures more compatible with modern institutional needs.

To learn more, click below:

- Breaking barriers redefining equity market portfolios with venture capital

- Taking the private out of private equity with the Morningstar PitchBook buyout replication index

1 HarbourVest. (n.d.). How does the size of private markets compare to public markets? HarbourVest. Retrieved April 14, 2025, from https://www.harbourvest.com/insights-news/insights/cpm-how-does-the-size-of-private-markets-compare-to-public-markets/

2 McKinsey & Company. (2025, February 13). Global private markets report 2025: Private equity emerging from the fog. https://www.mckinsey.com/industries/private-capital/our-insights/global-private-markets-report

3 Bain & Company. (2024). Global private equity report 2024. https://www.bain.cn/pdfs/202403121040275554.pdf​:contentReference[oaicite:1]{index=1}

Disclaimer

The Morningstar PitchBook Unicorn 30 Index and the Morningstar PitchBook Buyout Replication Index are the exclusive property of Morningstar, Inc (“Morningstar”).

It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. Morningstar does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Morningstar makes no assurance that investment products based on an index will accurately track index performance or provide positive investment returns. Morningstar is not an investment advisor, and Morningstar makes no representation regarding the advisability of investing in any such investment fund or other investment vehicle. A decision to invest in any such investment fund or other investment vehicle should not be made in reliance on any of the statements set forth in this document. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment fund or other vehicle. Morningstar is not a tax advisor. A tax advisor should be consulted to evaluate the impact of any tax-exempt securities on portfolios and the tax consequences of making any particular investment decision. Inclusion of a security within an index is not a recommendation by Morningstar to buy, sell, or hold such security, nor is it considered to be investment advice.

These materials have been prepared solely for informational purposes based upon information from sources believed to be reliable. No content contained in these materials (including index data, index history, ratings, credit-related analyses and data, research, valuations, model, software or other application or output therefrom) or any part thereof (collectively “Content”) may be modified, reverse engineered, reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of Morningstar. The Content shall not be used for any unlawful or unauthorized purposes. Morningstar, its affiliates and subsidiaries, its direct and indirect information providers and any other third party involved in, or related to, compiling, computing or creating any Morningstar Index (collectively, “Morningstar Parties”) do not guarantee the accuracy, completeness and/or timeliness of the Morningstar indexes or any data included therein and shall have no liability for any errors, omissions, or interruptions therein. None of the Morningstar Parties make any representation or warranty, express or implied, as to the results to be obtained from the use of the Morningstar indexes or any data included therein.