As we frequently bring together the world’s most influential financial decision makers, we often gain insights into some of the strategic considerations shaping the financial landscape. These insights, largely taken from our proprietary member events, encompass wide swaths of the industry, from data-driven decision-making to the markets the C-suite have on their radar.

Our event in April, the CFO/COO Roundtable, was no exception bringing together the chief financial and chief operating officers from some of North America’s most prominent asset management firms.

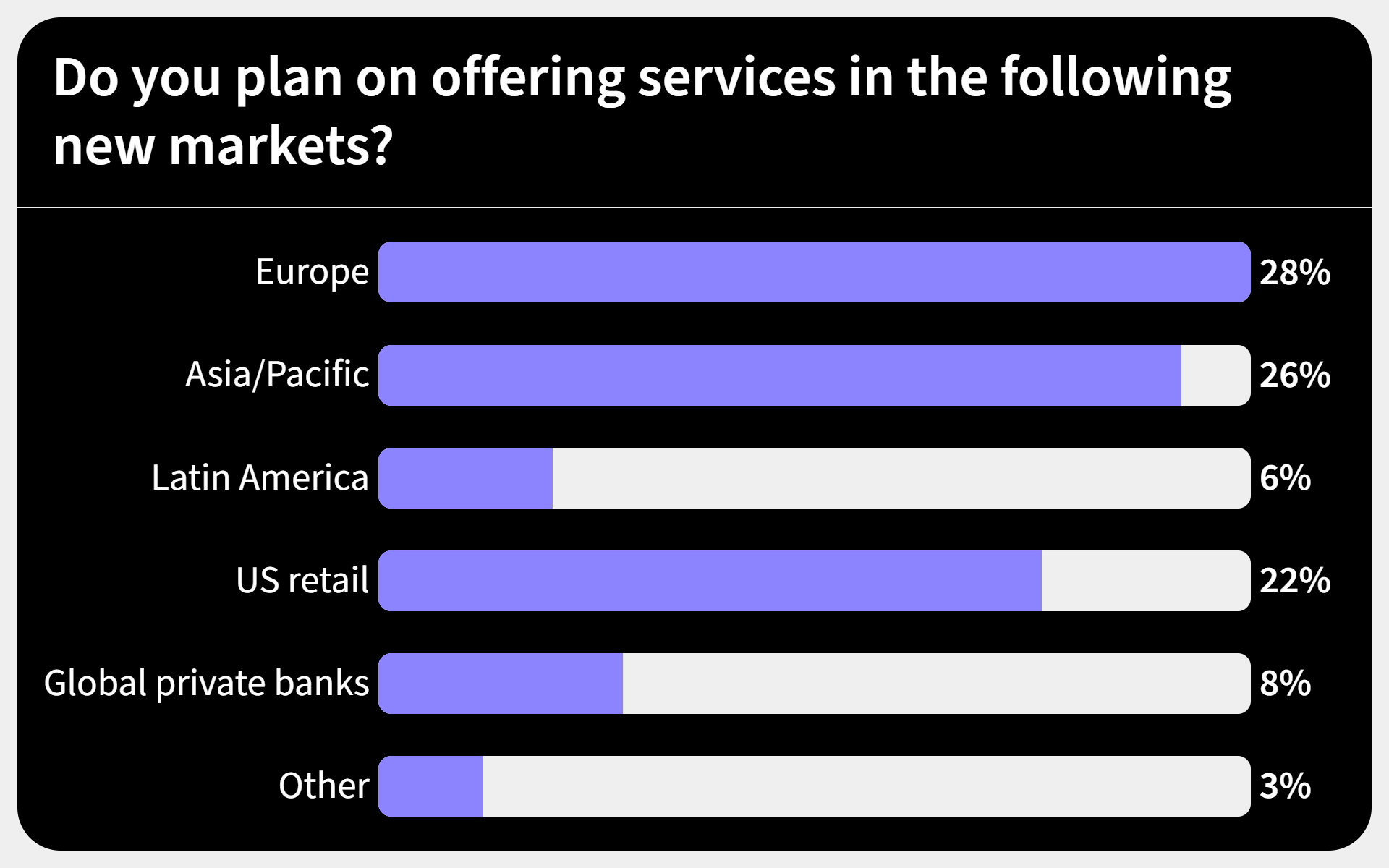

Polling during the event reveals where asset managers are looking to expand their services to. Europe leads with 28% of respondents targeting the region, followed closely by Asia/Pacific and U.S. retail, each at 26%. Global private banks (8%), Latin America (6%), and “Other” markets (6%) attracted less interest, suggesting that most firms are prioritizing developed regions with established infrastructure and demand over emerging or niche segments.

There are several possible scenarios that may contribute to this. Demand for emerging markets (EM) has experienced a nuanced shift recently, influenced by a combination of global economic factors, geopolitical tensions, and investor sentiments. Investor enthusiasm for EMs has been tempered by several challenges in recent years.

The MSCI Emerging Markets Index has lagged behind the S&P 500 for 11 of the past 12 years, leading some investors to question the long-term value proposition of EM investments.1 Additionally, many EM currencies have weakened against the U.S. dollar, diminishing returns for dollar-based investors and contributing to capital outflows. Ongoing conflicts and political instability in certain regions have also heightened risk perceptions, causing some investors to adopt a more cautious approach.

These factors may be the influencing force that sway CFOs and COOs towards Europe and other more developed markets. Indeed, European markets offer access to skilled talent and emerging digital hubs. Southern European cities in particular like Barcelona, Thessaloniki, and Lisbon have emerged as attractive destinations for digital hubs, offering a growing and impressive pool of technology talent, cost-effective operations, and supportive business infrastructure environments.

Europe’s regulatory landscape may also be an attractive determinant. Frameworks like the General Data Protection Regulation (GDPR), provide a structured approach to data privacy and security. For C-suite officers – like those who provided their insights for this polling – operating within this environment ensures a level of compliance with stringent data protection standards that are simply not as pronounced in emerging markets.

As markets evolve, we will be keen to see if CFOs and COOs maintain their primary interests in Europe, or if future developments make emerging markets the more compelling choice.

For more insights and to reach our Thought Leadership department, click here.

1 Gokoluk, S., & Sivabalan, S. (2024, December 22). For emerging markets, ‘better luck next year’ is a hard sell. BNN Bloomberg. https://www.bnnbloomberg.ca/business/international/2024/12/22/for-emerging-markets-better-luck-next-year-is-hard-to-believe/

Market Intelligence Is Independent of the Institutional Investor Magazine Newsroom