Over the last two decades, infrastructure equity has transitioned from a niche allocation to a cornerstone component in institutional portfolios looking to achieve low correlation to traditional asset classes and strong, stable returns. Its performance across market cycles has typically demonstrated resilience, positioning the asset class to generate long-term value amid ongoing structural shifts in energy, digital infrastructure, and global logistics.

Infrastructure equity refers to ownership stakes in infrastructure assets - such as transportation networks, energy systems, utilities, and digital infrastructure, typically accessed through private markets. Investors in infrastructure equity hold ownership in these essential, long-lived and capital-intensive assets, earning returns primarily through income (e.g., user fees, contracted revenues) and capital appreciation.

Unlike debt investments, which provide fixed returns through interest payments, equity holders bear more risk – but benefit from greater upside potential. The higher amount and longer holding periods bode well in institutional portfolios, particularly as infrastructure equity investments have historically demonstrated a low correlation to traditional investments and are backed by real assets.

Strong Fundamentals

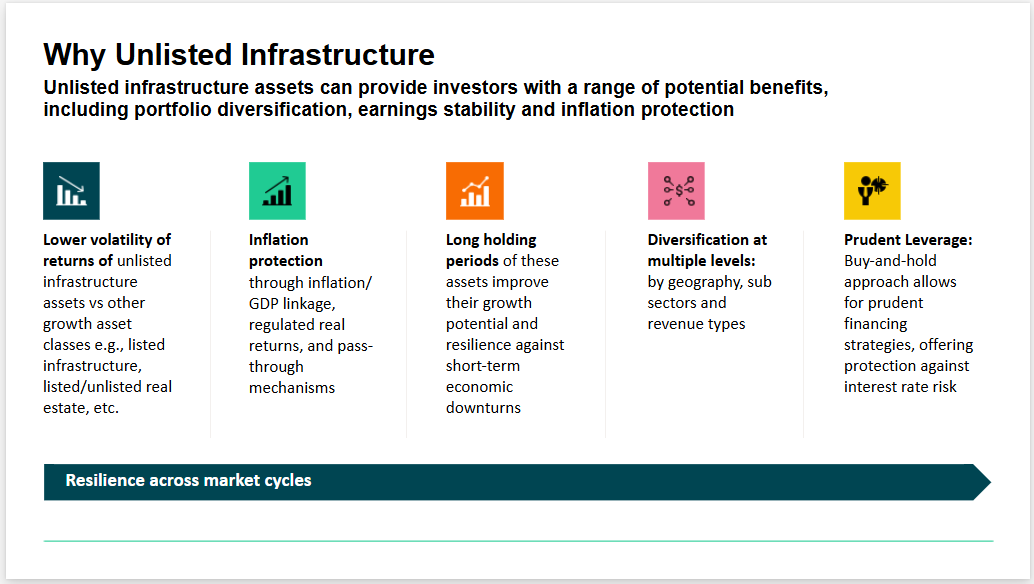

Unlisted Infrastructure offers a distinct investment profile, combining equity-like returns with bond-like volatility. This stability is grounded in the sector’s fundamental characteristics: inflation-linked revenues, essential services, long asset lives, and high barriers to entry.

This consistency is largely due to the inherent features of infrastructure assets:

- Inflation protection: Many infrastructure contracts are indexed to inflation.

- Stable cash flow: Revenues are often supported by long-term contracts, regulations.

- Low correlation: Infrastructure returns tend to be less correlated with traditional public markets, offering diversification benefits.

Ashwin Mathur, head of portfolio management within infrastructure equity at IFM Investors, emphasized that these attributes result in strong Sharpe ratios. “Our research shows that infrastructure delivers consistent performance through various economic environments – including stagflation and low-growth periods. These are the very types of macroeconomic backdrops we potentially face today.”

Analysis of unlisted infrastructure funds reveals they outperform many traditional asset classes on a risk-adjusted basis. Unlisted infrastructure equities have historically delivered an average annualized return of 10%1 with an annualized risk of 11%, according to Global Infrastructure Hub’s 2024 Monitor report. In contrast, listed equities provided a similar return of 10% but at a higher risk of 15%. IFM’s Economics team has undertaken additional analysis using advanced techniques to establish two key findings related to infrastructure’s role in portfolios2. Even when asset valuations are “de-smoothed” using advanced quantitative techniques to better reflect true economic volatility, they find that unlisted infrastructure offers low macro beta (i.e. greater protection against unanticipated changes in economic conditions) as well as higher macro alpha (i.e. excess outperformance after adjusting for macroeconomic factors).

The benefits of unlisted infrastructure

This combination of low macro beta, and high macro alpha, makes the asset class particularly attractive for accessing an avenue of diversification outside of traditional 60/40 methods.

Private Markets Advantage: Alpha Through Active Ownership

While infrastructure assets are inherently resilient, unlocking their full potential requires active ownership. “These aren’t set-it-and-forget-it investments,” Mathur notes. “You need to buy well, actively manage them, mitigate asset-specific risks, and optimize performance.”

While listed infrastructure equities exist, private markets provide a more direct and flexible avenue to access the asset class’s full benefits. Open-ended, core infrastructure strategies – often unlisted – benefit from a longer-term investment horizon, enabling active managers to engage deeply with assets. Compared to listed markets, the private structure allows for more patient capital deployment, longer hold periods, and the execution of value-creating strategies without the pressures of quarterly earnings.

This enables outperformance not only from the intrinsic qualities of the asset but also from alpha generated through disciplined portfolio construction and operational efficiency.

Thematic Tailwinds Driving the Next Five Years

Looking ahead, infrastructure equity is expected to benefit from transformative global shifts. Mathur outlines three key sectors poised for significant capital deployment:

- Logistics & Transportation

With a rising focus on national resilience and supply chain reconfiguration, transportation infrastructure – including rail, ports, and intermodal logistics – is seeing renewed investment. The reshoring of manufacturing and just-in-time delivery models is creating a surge in demand for efficient, modern logistics networks.

- Energy Transition & Security

Energy infrastructure remains a three-legged opportunity:

- Transmission and distribution networks that connect renewable assets to demand centers.

- Continued investment in traditional energy transport, essential to global energy stability.

- Massive buildouts in renewables and new technologies to meet rising energy demand.

- Digital Infrastructure

Data storage, fiber networks, AI computing power, and cloud infrastructure are now as critical as roads and bridges. With digital sovereignty and national security gaining prominence, governments and private investors alike are accelerating digital infrastructure investment.

US Market: A Growing Allocation Gap and Untapped Potential

Despite these opportunities, U.S. institutional investors are underweight infrastructure equity relative to their global peers. While Canadian, Australian, and UK funds have allocated significantly to unlisted infrastructure for years, many U.S. investors are now only starting to close the gap.

“The actual allocations are below target levels – and those targets themselves are low compared to other markets,” Mathur says. This shortfall creates significant headroom for growth both in asset flows and sector development.

One structural challenge in the U.S. has been the slow pace of private investment. Unlike Canada or Australia – where governments actively unlocked infrastructure assets decades ago – the U.S. landscape remains largely state-owned. Yet, change may be coming.

“If state and federal entities begin to embrace the value of private investment – especially with aging assets and constrained public budgets – the U.S. could see a wave of public-private partnerships,” Mathur adds. “This could spark a virtuous cycle: more opportunities drive more investor interest, which in turn supports a more robust private market.”

Infrastructure Equity’s Moment

For institutional investors building resilient, long-term portfolios, infrastructure equity is an increasingly essential tool. It aims to deliver uncorrelated, stable returns in turbulent markets, is positioned at the heart of global economic transformation, and benefits from structural shifts toward private capital involvement.

The demand for infrastructure investment is further amplified by the significant capital needs across energy, digital, and transportation systems. With trillions in upcoming capital requirements, infrastructure equity is no longer just a diversifier – it is projected to be a strategic allocation with long-term relevance.

Taken together, infrastructure equity seeks to offer institutional investors a compelling combination of stable returns, inflation protections, and exposure to transformative global trends. Its strategic importance in portfolio construction is underscored by its resilience and potential for long-term value creation.

To learn more about infrastructure investing, please visit IFM’s Communities on Infrastructure.

1https://cdn.gihub.org/umbraco/media/5545/section-3_financial-performance-of-infrastructure-investment_monitor-2024.pdf

2https://www.ifminvestors.com/en-au/news-and-insights/thought-leadership/building-robust-portfolios-with-private-assets-the-importance-of-macro-alpha-and-beta/