Nearly a decade after the global financial crisis threw companies into cash-preservation mode, a recent survey of 650 senior finance executives in 19 countries by American Express and Institutional Investor suggests that corporate spending and investment is now poised to rise.

Finance executives at large companies with $500 million or more in annual revenue anticipate spending and investing more to meet the rising demand for goods and services, hone their competitive edge and improve back-office efficiency, according to the 2017 Global Business & Spending Outlook by American Express and Institutional Investor. Companies will take a balanced approach to their expenditures, with an eye toward preserving the bottom line while pursuing growth opportunities.

Economic optimism is at its highest point since the global recession a full decade ago, with 70 percent of all finance executives surveyed expecting their home country’s economy to expand at least modestly in 2017 (up from 64 percent in 2016). Finance executives’ forecasts for spending and investment are also positive. Weighted average forecasts for spending and investment across the globe range from +8.4 percent in Europe to +8.8 percent in North America.

Seeking Profitable Growth

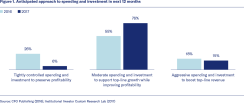

Although spending and investment are expected to increase, most companies will take a conservative approach to expenditures. Instead of aggressive spending, more than three-quarters of all respondents this year anticipate a moderate, measured and disciplined approach to support growth and profitability, compared with just over half of all respondents last year. (See Figure 1.)

Meeting Rising Demand While Gaining Efficiency

Pursuing top-line growth means preparing for the rising demand for goods and services. Survey results show that companies are preparing to address an uptick in demand. Among the major categories of business expenditures, spending on production inputs is most likely to increase this year. The net percentage of all respondents who say spending on direct inputs will increase (i.e., the percentage who expect spending to increase less the percentage who expect a decrease) is +58 percent this year, compared with only +7 percent last year. Other spending categories tied closely to the production and delivery of goods and services, such as transportation and logistics services and labor/headcount, are also expected to increase this year.

Back-office efficiency is another area CFOs plan to invest in, according to the survey results. The net proportion of respondents anticipating increased capital investment to improve administrative efficiency is up dramatically: +41 percent this year, compared with only +6 percent last year. These results suggest that companies are willing to spend and invest not just to drive revenue growth, but also to improve overall efficiency in the interest of nurturing the bottom line.

Senior finance executives appear ready to open up corporate coffers this year, not just to meet the demand for goods and services, but also to fund back-office improvements. Companies will take a moderate approach to spending, versus investing with abandon, to help sustain top-line growth while improving bottom-line profitability.

As a global leader in payments, American Express works with businesses of all sizes to provide insights into complex issues and designs programs that help meet customer objectives in the current global environment.

The information contained herein is for generalized informational and educational purposes only and does not constitute investment, financial, tax, legal or other professional advice on any subject matter. THIS IS NOT A SUBSTITUTE FOR PROFESSIONAL BUSINESS ADVICE. Therefore, seek such advice in connection with any specific situation, as necessary. The views and opinions of third parties expressed herein represent the opinion of the author, speaker or participant (as the case may be) and do not necessarily represent the views, opinions and/or judgements of American Express Company or any of its affiliates, subsidiaries or divisions. American Express makes no representation as to, and is not responsible for, the accuracy, timeliness, completeness or reliability of any such opinion, advice or statement made herein.