As economies pivot toward decarbonization and digitalization, the infrastructure sector is undergoing dramatic evolution – and infrastructure credit is emerging as a core strategy for long-term, defensive investing. This shift is driven by the need for substantial capital to modernize energy systems, expand digital networks, and build resilient supply chains.

The global push for decarbonization requires massive investments in renewable energy, energy storage, grid modernization, and other energy solutions. Additionally, the proliferation of data centers and 5G networks combined with onshoring and nearshoring trends necessitate significant capital, often financed through infrastructure debt.

“I believe it’s an under-allocated area of investing that can provide good diversification to investors’ portfolios,” says Matt Wade, executive director at IFM Investors. Wade sees infrastructure debt as a powerful diversifier that can deliver consistent, bond-like income while remaining largely uncorrelated to public markets or even traditional private credit.

“These are real assets,” he explains. “Many of the assets are also cash flowing, so they’re producing bond-like coupons.”

Despite macroeconomic headwinds, infrastructure debt has demonstrated remarkable growth. Since 2015, assets under management (AUM) in infrastructure debt have expanded at a compound annual growth rate (CAGR) of 23.1%, outpacing inflows to the broader infrastructure class, which grew at a CAGR of 19.7%1 during the same period. In the first half of 2024 alone, infrastructure funds raised over $40 billion2, indicating strong investor confidence in an asset class poised to remain a vital component of institutional investment strategies. According to the CFA Institute, since 2017, the overall global private infrastructure investment market has more than doubled, reaching over $1 trillion annually.

Supply and Demand Forces at Play

Investor appetite is being fueled not only by a search for yield and diversification, but by the growing demand for capital to support digital transformation and energy transition.

“In addition to the defensiveness and resiliency, we simply have so many tailwinds in this part of the market,” Wade says. “Digitalization, decarbonization, and energy independence – these forces aren’t going away. These are themes that are going to be in place easily for the next five to ten years.”

Historically, infrastructure lending was the domain of commercial banks and a niche group of institutional players. That’s changing. “Now, it is growing because people are looking to diversify their portfolios in addition to being able to harness the tailwinds of these broader themes we’re seeing.”

On the supply side, infrastructure spending is ballooning as countries seek to upgrade legacy systems to meet the demands of a digital, low-carbon future. Opportunities have been expanding across energy, transportation, and social infrastructure.

Demand is just as robust. Infrastructure debt is increasingly viewed as a key diversifier within broader private credit allocations. While some investors have chased higher yields through mezzanine debt, Wade believes senior secured infrastructure debt provides the optimal balance of downside protection and consistent returns.

IFM’s strategy remains centered on senior secured debt – both investment-grade and sub-investment grade – with a focus on the most resilient part of the capital stack.

“That’s where you get the best positioning from a defensive standpoint. It’s a low probability, high recovery perspective,” he notes, pointing to historical data from Moody’s and S&P supporting this approach. “We also invest in senior secure investment grade and sub-investment grade, and we’ve seen very good relative value with sub-investment grade debt.”

IFM will occasionally look higher up the capital structure – such as holding company debt – but always with a focus on core, cash-generative assets. “That’s where we have good revenue stability and transparency in terms of cash flows,” Wade adds.

A Widening Opportunity Set

The sector’s evolution has led to an expanded investable universe. In North America, the explosive growth of AI and digital infrastructure is fueling demand for both data centers and the energy sources that power them. Across OECD countries, there is a need to both transition energy systems toward lower-carbon power generation while maintaining the reliability of the grid.

The emergence of next-generation infrastructure technologies – including storage, waste-to-energy, and newer renewables – is another promising frontier. IFM has responded by developing new strategies focused on these innovations, working alongside technical experts to assess technological and commercial viability. IFM is investing in projects that co-locate renewable energy sources with energy-intensive infrastructure, an approach that enhances energy efficiency and power reliability.

Wade adds that digitalization, renewable energy, and power generation have evolved into core infrastructure lending opportunities, with stable revenues and strong long-term prospects. “Digitalization has become a core infrastructure opportunity with strong cash flow lending characteristics, and we expect it to remain exciting over the next three to five years,” he said.

Renewable energy is emerging as an area where “large amounts of refinancing needs to occur,” Wade notes. “These sites have tremendous value as they are interconnected with the grid, and there are possibilities to re-lever or repower them as well.”

The need for renewable energy refinancing has increased significantly in recent years, driven by rapid growth in clean energy capacity and evolving financial structures. Globally3, capital inflows are almost double those to fossil fuels. This surge reflects the expansion of renewable energy projects, many of which require refinancing to optimize capital structures and take advantage of favorable market conditions. Developers are adapting to financial pressures, such as high interest rates, by securing multi-year deals and innovative financing strategies to hedge against uncertainties.

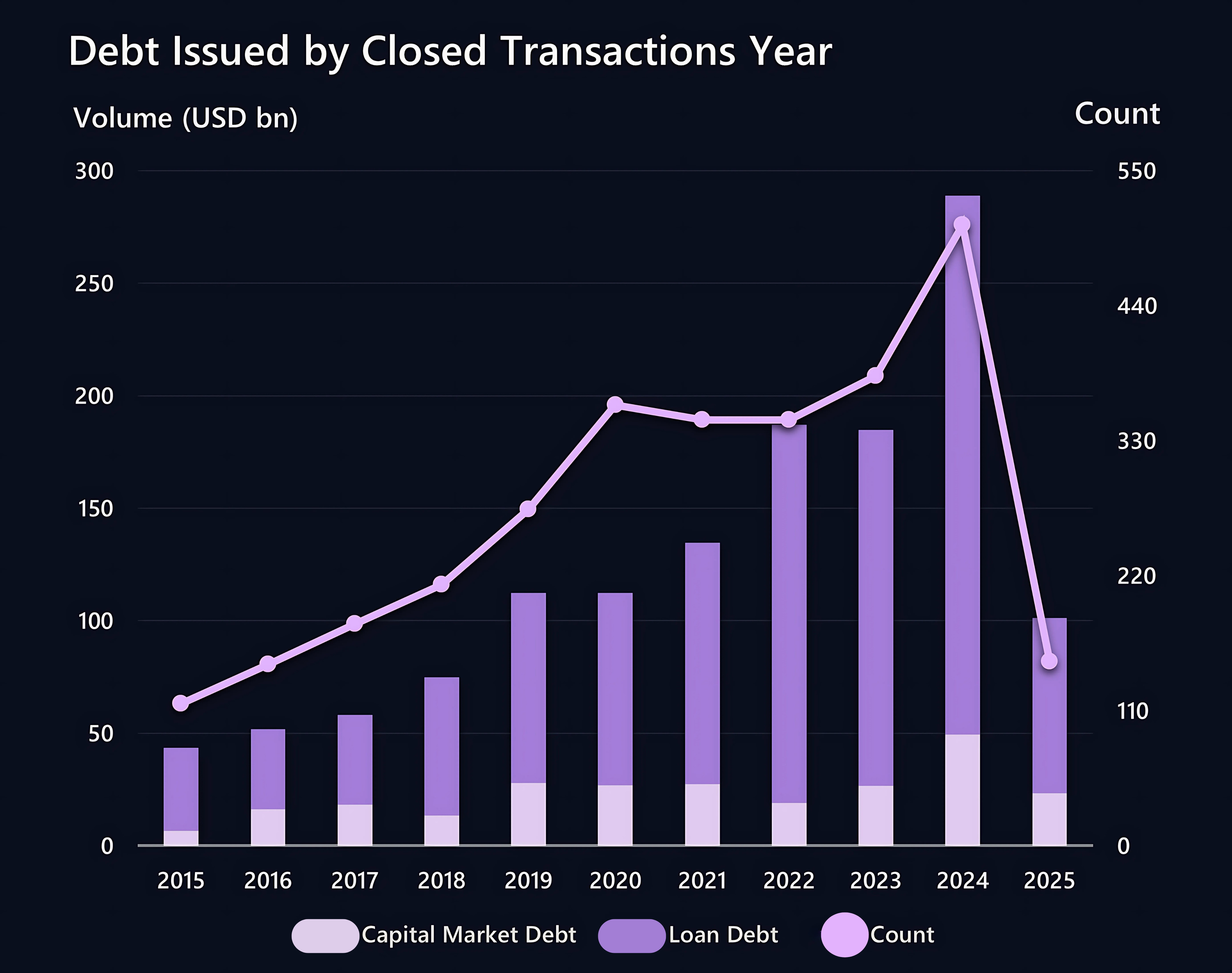

The landscape of opportunities is expanding

Source: Infralogic4

Natural gas is also experiencing a resurgence. “We’ve seen a bit of a renaissance,” Wade observes, driven by rising power demand from AI buildouts, onshoring trends, and the decommissioning of older coal plants. The resurgence of domestic manufacturing, particularly in energy-intensive sectors such as semiconductors and data centers, has escalated electricity demand. Natural gas has emerged as an attractive energy source due to its reliability, cost-effectiveness, and lower emissions compared to coal. Data centers, facing lengthy grid connection delays, are increasingly partnering with pipeline companies to establish onsite natural gas-fired generation, ensuring immediate and scalable power solutions, prompting significant investments in natural gas infrastructure.

Long Runway for Infrastructure Debt Growth

Infrastructure debt offers a distinct risk-return profile, characterized by low correlation with public markets and potential exposure to an illiquidity premium. Higher interest rates and inflation have, counterintuitively, been a net positive for infrastructure debt portfolios. Because most infrastructure debt is structured on a floating rate basis, yields have risen in tandem with rates. Moreover, many infrastructure assets include inflation-linked revenues, preserving real returns.

With a generational shift underway and technological transformation accelerating, infrastructure debt is well-positioned for continued growth. As credit markets tighten and volatility rises, Wade believes infrastructure debt will become more compelling. “The resilience of infrastructure as a lending class adds value,” he says. “Even though we’ve got tightening credit spreads in a few areas, the relative value that the illiquidity premium for infrastructure lending can generate – plus the defensive characteristics – I really think is quite powerful.”

To learn more about infrastructure investing, please visit IFM’s Communities on Infrastructure.

1Taylor, B., Sangha, R., & McCormack, D. (2024, July 1). Infrastructure debt: First among equals. Macquarie Asset Management. https://www.macquarie.com/us/en/about/company/macquarie-asset-management/institutional-investor/insights/perspectives/infrastructure-debt-first-among-equals.html

2CBRE Investment Management. (2024, October 3). Infrastructure Quarterly: Q3 2024. https://www.cbreim.com/insights/articles/infrastructure-quarterly-q3-2024

3International Energy Agency. (2024). World Energy Investment 2024: Overview and key findings. https://www.iea.org/reports/world-energy-investment-2024/overview-and-key-findings

4 Chart is representative of figures from January 1, 2025 through March 31, 2025.