Wealth managers are eager to deploy model portfolios in their client accounts, thanks to models’ ready availability, transactional convenience, and the increasingly broad array of model offerings. While advisors often use a target risk model portfolio as the cornerstone of a client’s portfolio, they may be increasingly eager to blend other types of models alongside their core risk/return model.

Demand for new types of model portfolios may well be driven by investors’ eagerness for exposure to unique, sophisticated assets. In a recent study from BlackRock and Institutional Investor’s Custom Research Lab, a solid majority of wealth management clients (60%) say it is extremely important that their advisor has access to and knowledge of investment products of which clients are unaware.1 In this same study, a majority of wealth advisors (53%) say they’re eager to invest client funds in sophisticated financial products containing private market assets, hedge funds, private equity, and private credit, which are typically available only through investment professionals.

“When we think about model portfolios that are really popular today, we see a shift in the last couple of years from core asset allocation in target risk models to things that are outside the box – in asset classes that may be difficult for a financial professional manage from day to day on their own,” says Katie Baker, Senior Director of Model Portfolio Distribution at Manulife John Hancock Investments. These portfolios are typically focused on a particular asset class or portfolio management problem, says Baker: “We think about fixed income portfolios, alternative asset portfolios, and other types of investments that are outside your typical core model portfolio. These are becoming much more popular and much more in demand. And as asset managers, we need to ensure we provide products to financial professionals that they want to use every day in areas that they find difficult to manage.”

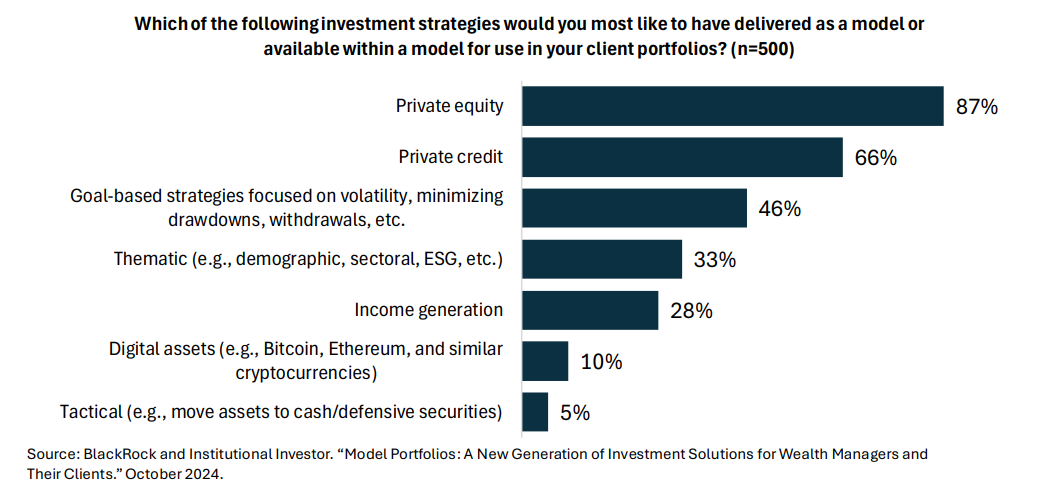

In the recent BlackRock/II Custom Research study, wealth managers appear to be especially eager to have alternative assets made available through model portfolios. A solid majority of the 500 wealth managers participating in the study say they’d like to have private equity (87%) and private credit (66%) exposure available in model portfolios (see figure below).

Advisors say that they supplement the baseline exposure provided by a target risk allocation with one or more models that are tuned to a particular portfolio management problem. “The majority of our advisor clients are looking for standard multi-asset target risk portfolios composed of equities, fixed income, and sometimes alternatives blended in different risk tolerances,” says Karl Desmond, Lead Client Portfolio Manager of Invesco’s Model Portfolio business. These models are built, says Desmond, “all the way from 100% fixed income up to 100% equity, with different increments in between,” tuned to advisory clients’ risk tolerances.

Advisors Call for Exposure to Private Market Assets Through Model Portfolios

Most recently, says Desmond, “We're seeing a lot of demand for model portfolios from financial advisors looking to scale their business and create a consistent investment approach across their book of business. But in particular, custom model portfolios is where we see the most demand. At Invesco, we're able to co-develop these portfolios – that is, we can sit down with advisor teams and build model portfolios based on their investment philosophy and other requirements, such as the inclusion of preferred alternative asset classes” He and his team also provide co-branded marketing materials, advisory firms’ logos and names on product fact sheets, trade rationales and performance commentaries. As a result, Desmond says, advisors are able to offer ready access to best-in-class investment products quickly and cost effectively.

“Advisors are likely to continue to base client portfolios on standard risk/return oriented portfolios”, says Adam Grossman, Global Equity CIO at Riverfront Investment Group: “There tend to be a few common types of models that are in demand for clients – the largest and the most common are accumulation or growth-oriented models, which are built around the idea maximizing total return subject to a level of risk. And these are far and away the most common models in the marketplace.” These models are well-suited to the wealth accumulation stage, when advisory clients are still building their wealth as they approach retirement.

Grossman expects two other types of model portfolios to become very popular in the years to come. “In the next phase, when clients begin to take systematic withdrawals out of their accumulation, income models are increasingly popular. And for people who may not have enough principal to completely move to a distribution phase, a hybrid of total return and income/drawdown models may well be the most suitable,” says Grossman.

1 BlackRock and Institutional Investor. “Model Portfolios: A New Generation of Investment Solutions for Wealth Managers and Their Clients.” October 2024.

Important Information

For Institutional & Financial Professional Use Only - Not for the General Public

This information should not be relied upon as investment advice, research, or a recommendation by BlackRock regarding (i) the funds, (ii) the use or suitability of the model portfolios or (iii) any security in particular. Only an investor and their financial professional know enough about their circumstances to make an investment decision.

Carefully consider the investment objectives, risk factors, charges and expenses of funds within the model portfolios before investing. This and other information can be found in the funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting each fund company's website or calling their toll-free number. For BlackRock and iShares Funds, please visit www.BlackRock.com or www.iShares.com. Read the prospectuses carefully before investing.

Investing involves risk, including possible loss of principal.

Asset allocation and diversification may not protect against market risk, loss of principal or volatility of returns.

The BlackRock model portfolios are provided for illustrative and educational purposes only. The BlackRock model portfolios do not constitute research, are not personalized investment advice or an investment recommendation from BlackRock to any client of a third party financial professional, and are intended for use only by a third party financial professional, with other information, as a resource to help build a portfolio or as an input in the development of investment advice for its own clients. Such financial professionals are responsible for making their own independent judgment as to how to use the BlackRock model portfolios. BlackRock does not have investment discretion over, or place trade orders for, any portfolios or accounts derived from the BlackRock model portfolios. BlackRock is not responsible for determining the appropriateness or suitability of the BlackRock model portfolios, or any of the securities included therein, for any client of a financial professional. Information concerning the BlackRock model portfolios – including holdings, performance, and other characteristics – may vary materially from any portfolios or accounts derived from the BlackRock model portfolios. There is no guarantee that any investment strategy or model portfolio will be successful or achieve any particular level of results. The BlackRock model portfolios themselves are not funds.

The BlackRock model portfolios include investments in shares of funds. Clients will indirectly bear fund expenses in respect of portfolio assets allocated to funds, in addition to any fees payable associated with any applicable advisory or wrap program. BlackRock intends to allocate all or a significant percentage of the BlackRock model portfolios to funds for which it and/or its affiliates serve as investment manager and/or are compensated for services provided to the funds ("BlackRock Affiliated Funds"). BlackRock has an incentive to (a) select BlackRock Affiliated Funds and (b) select BlackRock Affiliated Funds with higher fees over BlackRock Affiliated Funds with lower fees. The fees that BlackRock and its affiliates receive from investments in the BlackRock Affiliated Funds constitute BlackRock’s compensation with respect to the BlackRock model portfolios. This may result in BlackRock model portfolios that achieve a level of performance less favorable to the model portfolios, or reflect higher fees, than otherwise would be the case if BlackRock did not allocate to BlackRock Affiliated Funds.

This material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice.

Any information on funds not managed by BlackRock or securities not distributed by BlackRock is provided for illustration only and should not be construed as an offer or solicitation from BlackRock to buy or sell any securities.

This information is intended for use in the United States. This information is not a solicitation for or offering of any investment, product, or service to any person in any jurisdiction or country in which such solicitation or offering would be unlawful.

Investing in digital assets involves significant risks due to their extreme price volatility and the potential for loss, theft, or compromise of private keys. The value of the investment is closely tied to acceptance, industry developments, and governance changes, making them susceptible to market sentiment. A disruption of the internet or a digital asset network would affect the ability to transfer digital assets, and, consequently, would impact their value.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/developing markets and in concentrations of single countries.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics ("factors"). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

Alternative investments present the opportunity for significant losses and some alternative investments have experienced periods of extreme volatility. Alternative investments may be less liquid than investments in traditional securities.

Actively managed funds do not seek to replicate the performance of a specified index, may have higher portfolio turnover, and may charge higher fees than index funds due to increased trading and research expenses.

Transactions in shares of ETFs may result in brokerage commissions and will generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders. Certain traditional mutual funds can also be tax efficient.

ETFs are obliged to distribute portfolio gains to shareholders by year-end. These gains may be generated due to index rebalancing or to meet diversification requirements. Trading shares of ETFs may also generate tax consequences and transaction expenses.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial advisors for more information regarding their specific tax situations.

BlackRock is not affiliated with Manulife John Hancock Investments, Riverfront Investment Group or Invesco.

Prepared by BlackRock Investments, LLC, member FINRA.

©2025 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK, ALADDIN, iBONDS, and iSHARES are trademarks of BlackRock, Inc., or its affiliates. All other trademarks are those of their respective owners.

iCRMH0525U/S-4432652