Options trading may be a good predictor of stock returns — but investors should be wary of trying to profit from the unusual options activity regularly covered by CNBC’s “Fast Money,” according to researchers.

“Our findings suggest that the CNBC coverage of unusual option activity has a destabilizing effect on underlying stock prices and investors cannot profit by simply following the CNBC reporting on the ‘smart money,’” Washington State University finance professor George Jiang and Cuyler Strong of the Securities and Exchange Commission said in a June paper. Strong, who conducted the research at the university before joining the SEC last month, declined to comment on the findings.

The ‘Unusual Option Activity’ segment of CNBC’s “Fast Money: Halftime Report” prompts an “immediate spike in trading volume,” as investors react to commentators pointing to a few stocks with abnormally large option trades earlier in the day, according to the paper. The belief is that “only informed investors would take such large highly levered positions,” the authors said, serving as a predictor of stock returns.

“We test these predictions to see if retail investors really can follow these trades and make abnormal returns,” the researchers said. “We find that the trades that are covered on CNBC are not very unusual and thus do not produce abnormal returns.”

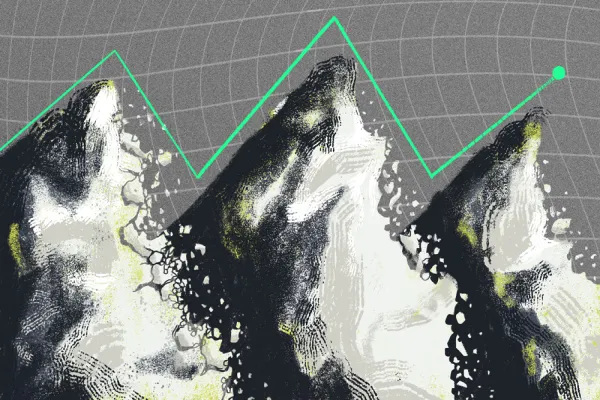

Following the so-called “smart money” based on the program’s recommendations doesn’t produce profits for investors over the longer term, according to the paper. While stocks with “unusual option activity” tend to see a significant rise on the day of CNBC’s coverage, “these same stocks have negative long run cumulative abnormal returns,” the researchers said.

They found that the abnormal returns in the underlying stocks increase at the time of CNBC’s coverage, as trading volume is spiking, and remain positive in the days that follow. But they subsequently turn into losses, according to their findings.

“CNBC coverage induces investors to overreact and destabilizes the price discovery process,” they said in the paper. “We find that stocks with truly ‘unusual option activity’ in call options do have positive abnormal returns in the weeks following the activity.”

The researchers noted in their paper that to identify a “truly” unusual trade, investors must compare trading volume of the single contract to the recent total option trading volume for all option contracts on a particular stock.

“The majority of option trades occur in contracts that are at-the-money,” they said. A stock that runs up or sells off quickly will change which contract is now “at-the-money,” resulting in option traders naturally migrating into those contracts. This can appear to be unusual option activity due to “very little” previous trading, they said, “but it is a common and expected activity in the market.”

[II Deep Dive: GMO Says Stock Market Rally Has Gone Too Far]

For their paper, the authors studied data from ‘Unusual Option Activity’ on CNBC’s “Fast Money: The Halftime Report” from January 2014 to December 2018. They found retail investors drove the jump in trading volume at the time of the program’s coverage.

“While options trades significantly predict stock returns prior to the CNBC coverage, there is a significant reversal in underlying stock prices following the CNBC coverage,” the researchers said. They found no such reversal in the unusual option activities they identified in a large sample of stocks.

A CNBC spokesperson didn’t immediately respond to an email and phone call seeking comment. Nor did Washington State University professor Jiang.