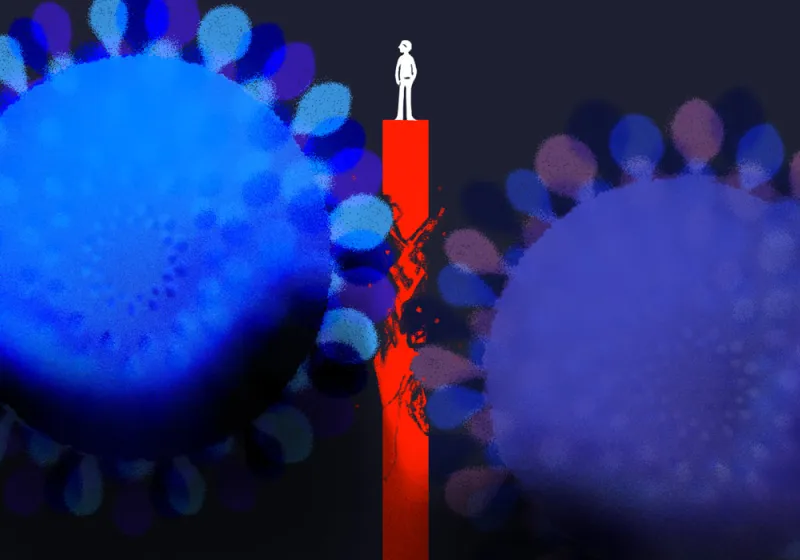

Older venture capital funds are heading through the coronavirus recession with more capital at risk than during the great financial crisis, while aggressive valuations set before the pandemic have left the industry in a vulnerable spot, according to PitchBook.

VC pools from older vintages have been taking longer to liquidate, meaning they’re retaining more unrealized value, PitchBook analysts said in the report. With more capital tied up in these funds compared with older vintages in the 2008 crisis, investors are likely to find a relatively larger portion of their assets impaired.

Investors, who had grown accustom to positive net cash flows from VC funds in each of the past years since 2012, will probably collect less in distributions this year than their contributions, according to the analysts. They also warned that newer vintages of VC funds are susceptible to the downturn because of their “aggressive writeups” in the run-up to the coronavirus pandemic.

“Valuation concerns were arising even before recent economic disruptions, with many high-profile companies taking a haircut at exit,” they said. “This pressure will only intensify in the coming quarters as the IPO window has closed and late-stage startups begin to grapple with the need to raise capital in a market of depressed valuations.”

[II Deep Dive: Hedge Funds, Family Offices Fuel Surge in Mega VC Deals]

Funds hit hardest by the prior downturn were those that had deployed nearly all their capital in the lead-up to the great financial crisis, according to PitchBook. The analysts said funds from the 2001-2003 vintages suffered permanent impairment from the 2008 crisis.

“Funds of slightly later vintages, however, were able to rebound past their pre-crisis” total valuation levels, the analysts said, partly because the managers had more dry powder to invest in the economic recovery.

Before the start of the pandemic, newer VC funds were steadily increasing their pace of investing.

The average fund from vintages 2012-2015 had deployed about three-quarters of its capital by its fourth year, compared with an average of about 65 percent through the 2000s, according to PitchBook. Younger funds appeared to be investing even more quickly — despite raising bigger pools, the analysts said in the report, citing initial data from vintages 2016 and later.

“These VCs are often relying on new fundraises to support follow-on financings,” they said, adding that the average time between funds declined to less than three years in 2019.

Many venture capital managers will probably curtail new investments to concentrate on their existing portfolios during the pandemic, according to the report. “Even considering the elevated deal activity of recent years, VC funds have ample capital at their disposal,” the analysts said, pointing to global dry powder levels of about $185 billion as recently as the third quarter of last year.