As assets pile up and mega funds dominate fundraising, consultants at McKinsey & Co. have concluded that private capital firms will need to adapt to succeed at an increasingly large scale.

“As the sector continues to grow in 2018, we’re rightly seeing a renewed emphasis on process — on sourcing deals, diligence, portfolio company transformation, and talent,” said Aly Jeddy, senior partner at McKinsey, in a statement.

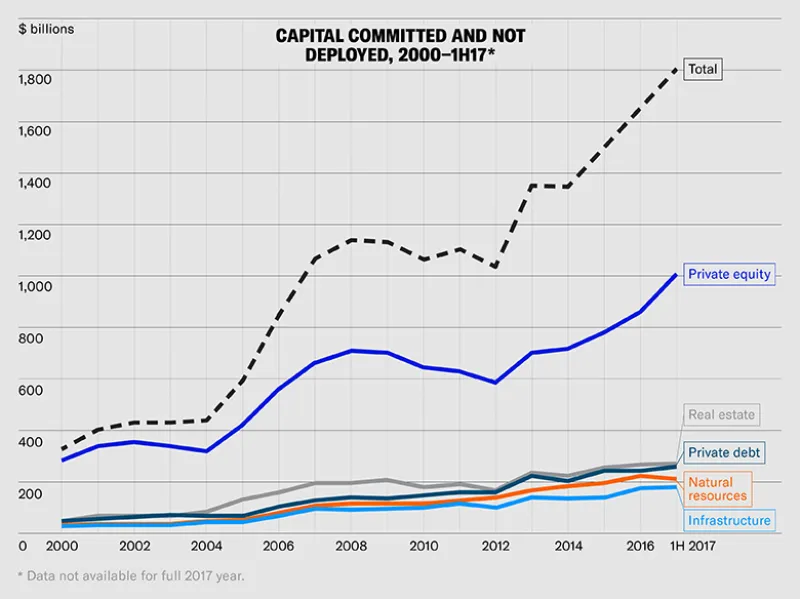

Jeddy is one of the co-authors of a McKinsey report, released late Tuesday, that identifies the new challenges faced by private market managers as assets under management grow to record heights. According to McKinsey, the private capital sector — including private equity and venture capital as well as infrastructure, private debt, natural resources, and real estate — surpassed $5 trillion in 2017 as fund managers raised a record sum of nearly $750 billion. Much of this fundraising was driven by so-called mega funds, or funds larger than $5 billion.

[II Deep Dive: Private Equity’s Capital Avalanche]

“The big story in 2017 was about scale,” said McKinsey partner and co-author Bryce Klempner in a statement. “Mega funds raised more than twice as much in 2017 as the year before.”

Without the surge in mega fundraising, Klempner added, overall private market fundraising would have fallen by 4 percent last year.

“The renewed interest in the biggest funds, and the biggest firms, is because they’ve delivered great performance, have been leading the way in terms of institutionalization, and have proven they’re capable of deploying large mandates,” he said in the statement.

As the biggest firms get bigger, however, the persistency of firm performance has weakened. According to the McKinsey report, new data suggest that the average successor to a top-quartile fund has only a 30 percent chance of top-quartile performance — down from 40 percent previously. Moreover, these follow-on funds have become four times as likely to be bottom-quartile performers.

“These are early signs, and are not conclusive — but are suggestive of a challenge for both camps, particularly for LPs and the process of manager selection,” the consultants wrote.

To accommodate the “massive” capital inflows, the consultants noted that general partners are having to “build more discipline, structure, and scale into their processes.” This has included forming billion-dollar-plus strategic partnerships with limited partners, formalizing succession plans, strengthening risk management processes, and better integrating data and analytics tools.

Deal-making, too, will need to be a major focus for general partners, particularly given that deal count has declined over the last two years, according to McKinsey. The consultants suggested that firms “future-proof” their deal-making by taking steps such as using analytics to source deals and creating value at portfolio companies through operational improvement.

“Fund managers’ biggest challenge is now how to deploy capital, rather than raise it,” Jeddy said.