State Street will on Friday have to answer questions about contract language it used with the nation’s largest public pension funds; the California State Employees Retirement System (CalPERS) and California State Teachers Retirement System (CalSTRS) – at question is at least $56 million in underpayments and overcharges.

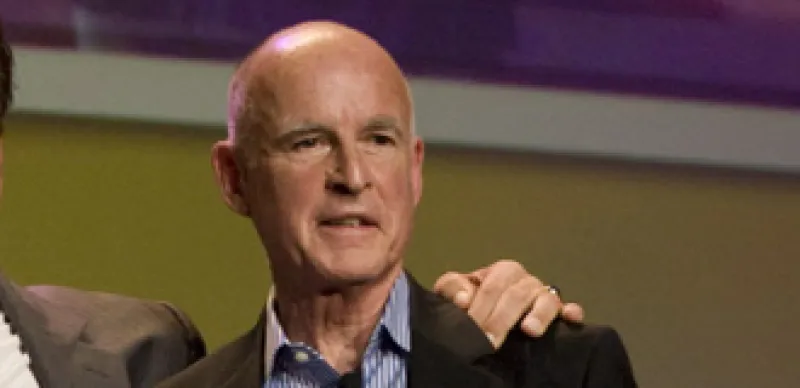

The funds and the California Attorney General (now Governor-elect) Edmund Brown Jr do not interpret the bank’s assurances on FX trade prices the way State Street says it intended. This dispute is at the heart of the civil fraud suit filed by California last year, which alleges “a fraudulent custody FX trading system” that led to the $56 million in charges. The entire suit could turn on this point, says a source. But State Street’s 20-year custodial relationship with the two million-member, $330 billion-funds doesn’t appear threatened and, if renewed, could generate for the bank considerably more revenue for years to come.

State Street routed all FX trade requests from the pension funds through State Street Global Markets, LLC, a subsidiary of State Street Corp., which would “mark up” the custody FX exchange rate above the Interbank Rate (the rate at which major banks buy and sell currency) at the time the trade was executed and would “mark down” the rates below the Interbank Rate when executing repatriation trades, the Attorney General claimed in his civil fraud charges.

“Global Markets would enter these false exchange rates into State Street Bank’s MOMS system and other electronic trading platforms,” reads the complaint. This is contrary to the funds’ contract with State Street, the state claims, since it was guaranteed in writing that it would receive the most competitive rates available for all FX transactions, regardless of size, currency, or contract type, because all trades would be priced based upon the Interbank Rate at the time the trades were executed. However, California contends that the funds were charged “marked up” prices “far in excess of the Interbank Rate” for a loss to the funds of at least $56 million.

State Street has countered that the “Interbank Rate was the starting point for exchange rates they used when determining the FX price charged,” according to California Deputy Attorney General Jeffrey Simpton, who spoke to Institutional Investor. “That contract interpretation does not make sense,” Simpton contends, since identifying the starting point for the exchange rates guarantees nothing, and certainly does not guarantee competitive prices. In recently filed court documents, the Attorney General’s Office asserts that State Street’s failure to respond to discovery in the case “exposes their competitive pricing guarantee as illusory and reveals the absurdity of their proffered contract interpretation.”

“This is ongoing litigation and we don’t have any comment regarding various developments in the case,” a spokesperson for State Street said in an emailed response to a request for comment on the story.

Another state entity, the Washington State Investment Board (WSIB), on October 26, 2010, settled an FX contract dispute, where it asserted that “the terms of the trades were inconsistent with the contract,” with State Street. The bank paid $11.7 million to WSIB’s funds, without admitting fault. Ironically, it was news of the California case, which began with evidence supplied by as yet unnamed whistle blowers, that piqued the WSIB and Washington’s Treasurer James L. McIntire’s interest. “We read about California in the press and decided to take a look,” says McIntire. He referred the trade records to Washington’s Attorney General’s office, which back-checked the transactions that are used for paying capital calls for private equity transactions and buying shares, and for repatriating distributions from stock sales, says the WSIB’s Executive Director, Theresa Whitmarsh. The $11.7 million represents transactions and interest over the 10 years the Board used State Street as custodian - 1997 to 2007.

“With regard to the Washington settlement (it) resolves a contract dispute relating to the manner in which we priced some FX transactions during our ten year relationship with the State of Washington that ended in 2007,” a State Street spokesperson emailed in response to Institutional Investor’s inquiry. “Our contractual obligations to the State of Washington were significantly different from those presented in our ongoing litigation in California. You will note that we are vigorously defending the State of California’s allegations, which is consistent with our conclusion that these circumstances are significantly different.”

In its 10Q for the quarter filed November 5, 2010, State Street, which promotes itself as the “No. 1” pension servicer with $16.4 trillion in AUM (as of mid-2009), noted the WSIB payout, the California case and alluded to possibly more: “We provide custody and foreign exchange services to government pension plans in other jurisdictions, and attorneys general from a number of these other jurisdictions, as well as the U.S. Attorney General’s office, have requested information in connection with inquiries into our foreign exchange pricing. In October 2010, we entered into a $12 million settlement with the State of Washington. This settlement resolves a contract dispute related to the manner in which we priced some foreign exchange transactions during our ten-year relationship with the State of Washington that ended in 2007. Our contractual obligations to the State of Washington were significantly different from those presented in our ongoing litigation in California.”

Protestations of the defendant aside, even the Sisters of Charity of the Blessed Virgin Mary, in Dubuque, Iowa, a religious order of nuns, sought legal advice over bond investments made through State Street. A spokesman for the law firm, Krislov & Associates, in Chicago, declined comment. But the Sister’s director of communications, Angie Connolly, told Institutional Investor, the matter was “resolved” on February 4, 2010, and no details are being disclosed.

Ironically, State Street could be renewed as master custodian to CalPERS at a higher fee. The fund’s Investment Committee is currently reviewing RFPs from State Street, JP Morgan (WSIB’s new master custodian), and Bank of New York/Mellon, despite some of State Street’s internal emails unearthed in litigation. A senior vice president is quoted, in the AG’s complaint, writing to another executive that “[i]f providing execution costs will give [CalPERS] any insight into how much we make off of FX transactions, I will be shocked if [a State Street V.P.] or anyone would agree to reveal the information.” The master custodian contract, whose selection CalPERS must announce in mid-February, is expected to rise at least 20% above the $10 million plus a year the funds are paying now.

CalPERS declined to comment on current litigation, but in the minutes from the investment committee’s October 18, 2010, meeting Operations, Performance & Technology Division Chief Matt Flynn gave a glimpse of why the fund might stay with State Street: “The master custodian is our bank. And as a global investor, they’re involved in basically everything we do with respect to the movement of securities, the safekeeping of our assets, pricing and valuation of all of our assets, and all of the requisite control structures that need to be in place. So to say that this is a complicated and important relationship is a bit of an understatement.”

In fact, CalPERS Chief Investment Officer Joe Diehr is recorded as saying that the budget projected for custodial services may be too low. “We might not be paying enough and then not getting the quality level of service that reflects the complexity of the portfolio.”

However, Flynn and the committee also make clear that they’re turning a corner on what they will require as higher standards of the next contractor. Flynn told the others, “Those standards will allow us to have a fully transparent, very competitive, cost-efficient way to obtain foreign exchange for our custodial trades.”