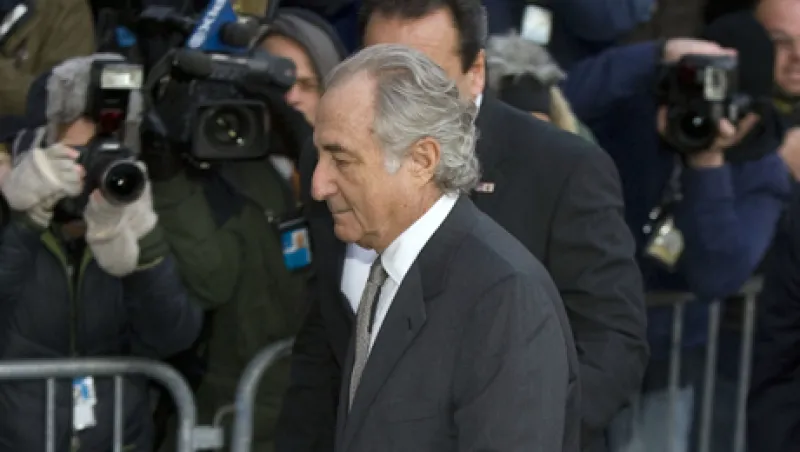

Solus Alternative Asset Management, a $2.5 billion fund manager specializing in credit and distressed assets, has launched a new fund that has invested in claims on bankruptcy and litigation cases, including creditor claims against Lehman Brothers, Nextel and the estate of Bernard Madoff.

The Solus Recovery Fund closed on July 2 with just under $500 million in committed capital, according to investor materials obtained by Institutional Investor. Solus exceeded its target of $400 million and has already invested $270 million since March of this year, with performance up over 8 percent between March and June.

The fund’s top holdings include claims against Lehman Brothers, the Madoff estate, Nortel, NextWave Wireless and Adelphia. These five issuers made up 57 percent of the portfolio construction as of June. The fund buys liquidation and litigation claims from creditors at anywhere from 59 cents to 70 cents on the dollar and expects to earn about 15 percent in three-year cycles as the courts award cash distributions to creditors.

C.J. Lanktree and Scott Martin will be the co-managers of the Recovery Fund. Both joined Solus in February. They had previously worked together as co-heads of Deutsche Bank’s distressed products group. At Deutsche Bank they oversaw a multibillion dollar portfolio and were part of the bank’s participation in complex restructurings and reorganizations including Lehman Brothers, Enron, Visteon and Refco. Christopher Pucillo remains president and CIO of the fund management firm. Pucillo founded Solus in 2007 as a spinoff of the hedge fund strategies group of Stanfield Capital Partners. From January 2002 to June 2012, annualized returns of the funds under Pucillo’s management were 21.75 percent.

The fund’s managers look for relatively small claims against bankrupt companies, banks, government agencies and individuals. In all cases, however, the entities must be far enough along in bankruptcy or litigation proceedings to have demonstrated a high level of cash recovery along with a timeline for distribution or monetization. The investor materials say Solus believes the strategy “exhibits an asymmetric risk/return profile with low volatility and is generally uncorrelated to major market indices.”

According to the investor materials, Solus has begun raising money for a second fund to deploy a similar strategy, the Solus Recovery Fund II, with a target of launching in the fall of 2012 with around $200 million.