Corporate pension plans may be dying a slow death, but that hasn’t stopped asset managers from building thriving businesses out of them. Consider Legal & General Investment Management America. In 2009 the firm, a Chicago-based subsidiary of the asset management arm of U.K. insurer Legal & General, started offering liability-driven investment strategies, which help corporations reduce the risks of their defined benefit plans. The business has grown to $37.7 billion in assets as of the end of 2013, including $17 billion for 66 outside clients. The company has expanded to 70 staff from 14; to cap its success it even moved to Chicago’s tony Loop. That’s not a bad result, considering that corporate pensions are the BlackBerry of the retirement savings world.

Mike Craston, CEO of the American outfit since 2011, says the firm set out to get a toehold in the hypercompetitive U.S. asset management business by drawing on the expertise of its British parent in LDI and fixed income. Some $2 trillion in U.S. corporate pension plan assets make for a fertile hunting ground, even if it’s shrinking. “It’s rare that we find a corporate fund sponsor that isn’t doing something to derisk its pension,” says Craston, who previously led the global institutional business for London-based Legal & General Investment Management (LGIM). Craston is taking steps to launch an index fund business consisting mostly of equity offerings, having hired Chad Rakvin, former head of the global equity index group at Chicago’s Northern Trust Global Investments, to run the unit. The firm also hired Shaun Murphy, who had been Northern Trust’s director of international equity index, as director of index funds.

LGIM provided a successful template for its American offshoot in the esoteric LDI business. The firm, one of the biggest equity index fund and bond managers, landed its first LDI mandate in 2001, after British regulations pushed private corporations to better manage their pension plans. LGIM has since won 250 mandates.

U.S. corporations began considering similar risk-reducing moves in response to the 2006 Pension Protection Act, which requires them to disclose pension funding shortfalls. Under an LDI strategy, companies match assets to liabilities, using long-duration bonds and sometimes derivatives. Legal & General Investment Management America has serious competition: BlackRock, Pacific Investment Management Co., Prudential Financial and specialist NISA Investment Advisors in St. Louis are some of the U.S.-based firms active in LDI.

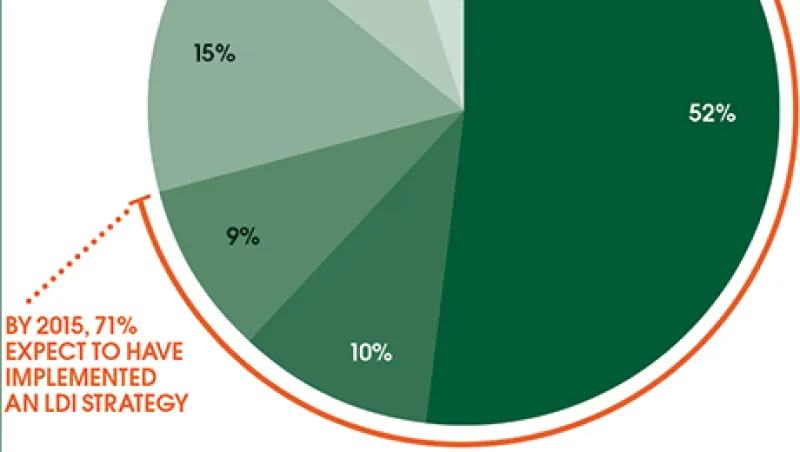

Last year marked a turning point for corporate pension plans as a bull market in equities and higher interest rates got them closer to being fully funded and better able to meet promises to beneficiaries. LDI can be more attractive for better-funded plans: Freed from gunning for growth, corporations can focus on reducing risks. In a 2013 survey by consulting firm Towers Watson on the future of pension risk management, three quarters of the 180 respondents said they cared more about lowering the risk of their defined benefit plans than getting higher returns from their investment managers over the next two to three years. Seventy-one percent had implemented an LDI plan or were at least seriously considering doing so by next year.

But there are hazards to sponsors and to asset managers that cater to corporate plans. With interest rates so low, pension plans are running the risk of buying bonds at inflated prices. As a result, many have sat on the sidelines. Those that waited have been punished as rates have kept moving lower, says Thomas Meyers, head of distribution for LGIM’s American subsidiary: “If companies are hoping to close the funding gap or waiting until rates are higher before making the leap, then they can instead take a couple of bites of the apple at a time.” Many corporate plans have adopted policy statements that map out how they’ll boost their hedged portfolios in line with how their funded status improves, Meyers adds.

There’s money to be made in LDI and in helping companies mitigate the risks of offering pensions to employees who may live well into their 90s. But that may not last. In fact, many corporations must implement an LDI plan so they can eventually jettison their pension risk. General Motors Co. and Verizon Communications off-loaded a big chunk of their pension liabilities by purchasing group annuity contracts from Prudential in 2013. Ford Motor Co. took a different route by offering lump-sum payments to about 90,000 employees. For Legal & General Investment Management America’s parent, though, there’s a silver lining: As an insurer, it can get a piece of the group annuity action. • •

Get more on pensions.