For investors looking to achieve inflation-hedged returns, debt and equity investments in unlisted infrastructure offer the potential for stable, long-term cash flows and attractive diversification away from public equity markets. Over the past 30 years, the asset class has emerged as an attractive addition to institutional portfolios, offering exposure to a diverse range of assets and demonstrating resilience across economic cycles. In the current cycle, as interest rates remain high, market volatility persists, and regulatory frameworks evolve to allow broader participation in private markets, infrastructure investments are once again top of mind among institutional investors.

Unlisted infrastructure investments are typically tangible, long-lived assets that underpin essential services and yield stable and predictable returns. Such assets span an impressive range of sub-sectors, from the traditional (e.g. toll roads, airports and pipelines) to the modern (assets that enable digitalization, artificial intelligence and the energy transition). These combined characteristics offer an opportunity to build resilient investment portfolios with low correlation to equity markets and multiple layers of diversification.

The multi-faceted nature of the asset class continues to drive interest and innovation. Indeed, infrastructure remains a key interest for institutional investors, while the convergence of megatrends—including AI expansion with rising energy demand—underscores infrastructure’s long runway for growth.

For investors, particularly those with an extended investment horizon, unlisted infrastructure investments present a compelling opportunity. These assets typically offer long-term, predictable cash flows and a unique risk-return profile, making them a valuable component in diversified portfolios.

Opening the door to private capital

In the 1990s, several governments, including those in Canada, Australia, and parts of Europe, initiated the investment of private capital in public infrastructure assets in an effort to enhance operating efficiency, reduce public debt, and stimulate private sector investment.

These countries experienced positive responses to their public-private-partnership (“P3”) programs, with Canada adopting this model for more than 50 major businesses including utilities, a railway, an airline, and the air traffic control system. Australia’s approach saw a major airport overhaul become the focal point of P3 efforts. Going a step further, the UK implemented the Private Finance Initiative in 1992, encouraging a blend of public and private partnerships to manage infrastructure projects. This model was later adopted by other countries as well, transforming this sector of private markets.

Interest in private investments, particularly in infrastructure, has surged in recent years, laying the groundwork for the next phase of investment growth and the pursuit of alpha.

The Hunt for Yield and Globalization of Asset Markets

By the early 2000s, infrastructure investment entered a rapid growth phase driven by three primary factors: the hunt for yield in a low-interest-rate environment, the globalization of asset markets, and the increasing maturity of infrastructure as an asset class.

In the aftermath of the Global Financial Crisis (GFC), central banks in developed markets implemented low-interest rate policies. This steered institutional investors toward alternative assets that could deliver stable, long-term cash flows and inflation-linked returns. Infrastructure, with contracted and regulated revenue models, became a key target for institutions like pension funds, sovereign wealth funds, and insurers looking for yield without excessive risk.

As rates have risen and continue to remain elevated, investors are increasingly looking to mitigate risk. And given that infrastructure lending has evolved, so too has the breadth of strategies available to investors for various concerns and goals. One such concern – especially prominent in today’s environment – is interest rate risk. This manifests differently for investors in infrastructure equity versus those in infrastructure debt.

Thirty years of know-how

At IFM Investors – a global infrastructure manager founded in Australia – different asset class teams address this risk differently.

Established in 1990, IFM was founded by a collective of Australian superannuation funds looking to pool resources for substantial investments in private markets. It has been a key institutional investor in these sectors and actively invests in both infrastructure equity and debt asset classes.

“Most of the lending we do is done on a floating rate basis so it can mitigate the impact of rises and falls in interest rates and protect valuations,” says Matt Wade, Executive Director of Infrastructure Debt at IFM. This approach helps infrastructure debt investors stay nimble in volatile rate environments.

While the debt team focuses on flexibility through floating-rate structures, the infrastructure equity team takes a different financing approach – one that’s focused on optimizing the capital structure of the assets they own. Here, interest rate risk is mitigated by locking in fixed-rate debt or hedging floating exposures where appropriate.

For instance, the infrastructure equity team manages assets across the globe, including a stake in the Indiana Toll Road in the U.S., a highly important transport corridor for manufactured goods and one of the principal east-west routes across the United States.

Infrastructure investments have inherent defensive elements that can provide inflation protection while minimizing the impact of interest rates. That’s where having the right portfolio and the right approach really matters. "This isn’t a ‘set it and forget it’ type of asset class – it requires someone who understands how to maximize the inherent characteristics,” says Ashwin Mathur, Head of Portfolio Management within Infrastructure Equity at IFM.

“This can mean taking a conservative view on gearing, fixing or hedging debt, and maintaining long-dated maturities for our debt within the assets,” Mathur adds. “Being conscious of interest rate and inflation risk post-COVID and in this uncertain environment is paramount. We’ve been able to manage through an interest rate upcycle, which has obviously hit client portfolios throughout the world. With that said, infrastructure has held up well, particularly for those managers who’ve structured their portfolios correctly and this has been very valuable to clients’ overall portfolios.”

Key Characteristics Contributing to Infrastructure’s Resilience

Unlisted infrastructure’s strength is marked by a few defining characteristics.

- Stable cash flows: Infrastructure assets typically generate long-term, stable cash flows, attractive to investors seeking predictable returns.

- High barriers to entry: The substantial capital and regulatory requirements create significant barriers to entry, whilst also providing opportunities to reinvest, at attractive rates, in assets where the risks are well understood.

- Long asset lives: Infrastructure investments often span decades, providing extended periods for capital to grow and yield returns.

- Low correlation to public markets: Infrastructure’s limited correlation to stock and bond markets allows for diversification and risk mitigation during periods of market turbulence.

- Lower volatility: Compared to other growth asset classes, infrastructure tends to exhibit lower volatility, providing inflation protection and more stable returns.

- Essential services: Assets like transportation networks and utilities provide essential services, ensuring consistent demand regardless of economic cycles.

Performance Across Economic Cycles

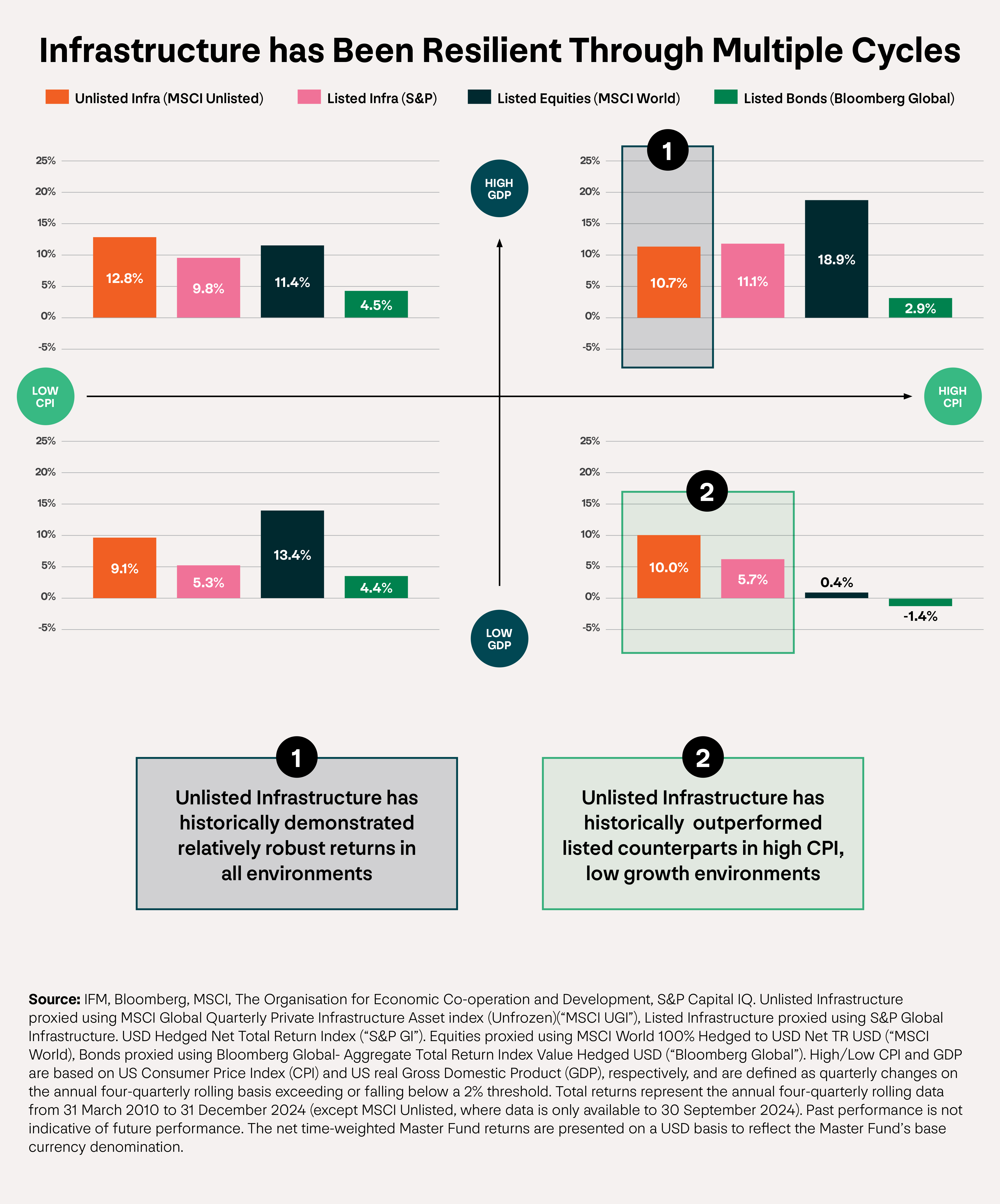

Infrastructure investments have demonstrated resilience across various economic scenarios, including periods of high or low GDP growth, inflation, or even during financial crises. The long-term, essential nature of many infrastructure assets allows them to remain robust despite market fluctuations. The asset class’s unique ability to provide predictable, inflation-linked returns has been a defining characteristic, especially during times of economic uncertainty.

For example, in times of high inflation, infrastructure assets tied to regulated revenues, such as utilities, or those with favorable concession agreements such as toll roads, often have the ability to adjust their rates in line with inflation. Similarly, during economic slowdowns, demand for essential infrastructure services – such as transportation, utilities, and communications – remains relatively stable, providing investors with stable income streams.

Infrastructure lending has also demonstrated notable resilience during economic challenges, with the COVID-19 pandemic serving as the most recent example. A study by the Global Infrastructure Hub1 revealed that, during the pandemic, infrastructure debt exhibited improved credit risk metrics, including lower default rates and higher recovery rates compared to non-infrastructure debt.

Wade says he believes these defensive attributes are “underscored by asset-heavy structures, stable revenues from contracts or regulation, and transparent operating costs. Non-recourse, Special Purpose Vehicle (SPV) lending for example ensures projects are self-sustaining, complemented by liquidity reserves covering 6-12 months.” SPV lending involves creating a separate legal entity to isolate the financial risk and facilitate specific financing objectives.

Financial structures further incorporate covenants and reporting requirements, including quarterly unaudited and audited reports, along with construction monitoring. “Many of our projects also have a 30-40% equity cushion, demonstrating sponsors’ commitment and willingness to risk exposure,” he adds.

These mechanisms facilitate early detection of issues and promote proactive engagement among sponsors, borrowers, and lenders. Equity cushions provide a buffer against potential financial challenges.

Areas of Opportunity and Emerging Trends

Looking ahead, macro and regulatory conditions remain uncertain, but the asset class is poised for growth as investor commitment to the sector remains robust and fundamentals remain strong. The push towards decarbonization and finding renewable sources of energy is a significant area of opportunity for infrastructure investments.

“Decarbonization efforts, including the retirement of coal and older natural gas power plants, are driving a transition toward renewable energy sources,” says Wade. “We believe the shift presents investors with opportunities to engage in sustainable infrastructure projects, particularly in renewable energy and the broader energy transition,” he adds. Natural gas, which has been a major component of power production and plays a significant role in the energy sector, is something that Wade says, “will likely be around a bit longer than people originally anticipated.”

Additionally, the export landscape for liquified natural gas (LNG) is becoming more favorable. The U.S. has emerged as a leading LNG exporter, with exports reaching a record 9.3 million metric tons in March 2025, driven by increased production capacities and global demand, particularly from Europe and Asia.

Further, the ongoing digitalization trend, encompassing the expansion of data centers and fiber networks, continues to play a large role in the future of infrastructure investing. Driven by AI advancements, digitalization is fueling demand for data centers and fiber networks, necessitating substantial investments in digital infrastructure. Moreover, the U.S. Department of Energy is designating federal sites for AI infrastructure development, including data centers and power plants, to meet the growing energy needs of AI technologies. In fact, investment in GenAI infrastructure nearly quadrupled globally in 2024 to almost $26 billion, up from $6.86 billion in 2023. This will continue to increase.

These shifts offer investors opportunities to engage in sustainable infrastructure projects and diversify their portfolios beyond traditional methods. The assets not only offer diversification benefits but also provide exposure to transformative global trends, such as decarbonization and digitalization. By integrating high-quality, unlisted infrastructure assets into their portfolios, investors can position themselves to capitalize on these secular shifts, promoting long-term stability and growth.

To learn more about infrastructure investing, please visit IFM’s Communities on Infrastructure.

1Global Infrastructure Hub. (2023, April 27). Infrastructure debt passed the stress test of the COVID-19 pandemic. https://www.gihub.org/infrastructure-monitor/insights/infrastructure-debt-passed-the-stress-test-of-the-covid-19-pandemic/

IFM-24APRIL2025-4439081