Paul Woolman, CME Group

AT A GLANCE

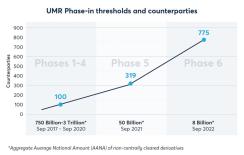

- The sixth and final phase of uncleared margin rules arrives in September, with more than 700 investment management firms affected

- As firms prepare to meet the requirements applying to margin on OTC derivatives, listed equity index and FX markets are seeing increased activity

Sources: Monticello Consulting Group and Ascendant Strategy

With the various market challenges, we have seen over the last two years through the pandemic, inflation concerns, predicted rate normalization and the Ukraine-Russia conflict, it is easy to see why attention may have been diverted from managing UMR impact and the capital efficiency challenges this may present. However, the clock is ticking and clients will likely concentrate more on this topic as the September deadline draws ever closer.

What is UMR and how does it impact market participants?

UMR are a set of rules that apply to margin (collateral) on uncleared OTC derivatives and were introduced by regulators in the wake of the 2008 financial crisis. Following the crisis, regulators wished to increase transparency, reduce systemic risk and increase the resilience of markets, especially in times of stress. OTC derivatives which were bi-lateral, opaque and often involved leverage, were focused upon as one area for improved oversight.Uncleared margin rules have been phased in over time, initially affecting only those clients with the largest OTC exposures. However, the threshold notional of OTC exposure used to determine whether a client is affected by UMR has been consistently lowered in phases. In September 2022, phase 6 of UMR will commence, which means clients with a calculated uncleared OTC exposure over $8 billion notional will be subject to the rules.

The amount of margin that needs to be posted is often calculated according to ISDA’s Standard Initial Margin Model known as SIMM and the SIMM levels are adjusted over time.

What is the UMR impact on capital efficiency?

Capital efficiency is one factor when assessing which instrument is optimal to deploy for a given investment strategy. Other factors such as liquidity, bid-ask spread and commissions all come into the total cost equation. However, UMR’s impact is mainly on capital efficiency, and there are a variety of reasons why this is important. These include:

- To avoid performance drag caused by not being fully invested in the market

- To increase market exposure and free up capital

- To optimize capital deployment

Other asset classes such as FX are also seeing clients increasingly look to the capital efficiency on offer via listed solutions. One area is in FX options where a recent paper identified up to 86% more capital efficiency for a given exposure via listed option instruments vs. OTC bilateral positions. The paper helps expand on the this and looks at the increasing use of listed FX options and emerging market (NDF) FX futures by real money clients.

As of May 10, CME Group saw a record in holders of large open positions in FX futures of 1,312, which followed the all-time level of open interest in FX futures and options of over 3 million contracts (~$290bn notional) earlier in the month. Asset manager adoption led the growth surge, with their positions growing by 60% since the end of Q2 2020. Buyside accounts held the most open interest positions in cleared, listed EUR/USD FX futures (60%), with hedge funds and dealers also holding significant positions at 15.4% and 24.1% respectively.

These growth trends in listed derivatives across asset classes may well continue with the clock ticking to the UMR phase deadline in September. With hundreds more firms required to meet UMR requirements, this marks an additional market development worth watching in 2022, even as all asset classes are affected by macro events.

Read more articles like this at OpenMarkets