Like many widely shared misconceptions, the idea that tech stocks are especially vulnerable to rising interest rates began logically enough. For starters, it’s almost certainly true that a dollar today is worth more than a dollar tomorrow, given the uncertainties of the future and the tendency of fiat currencies to lose purchasing power. And few investors would dispute that many companies in the tech sector, especially those that have just begun to tap their addressable markets, are expected to generate a greater share of their earnings over more distant tomorrows than are mature companies in fading sectors. It therefore stands to reason that tech stocks might be more sensitive to changes in interest rates, and this notion has become an investment mantra as swiftly and thoroughly as Omicron has become the dominant Covid-19 variant.

Unfortunately, the narrative that higher rates are kryptonite for tech stocks has two fatal flaws. First, it depends on finding an off-label use for duration in the equity market, even though this essential bond-market tool is ill-suited for explaining changes in stock prices. Second, the empirical record flatly contradicts the narrative, if one considers any more than a pandemic-distorted sliver of it.

Bond Math Doesn’t Apply to Stocks

Duration, which is the weighted-average life of a bond’s scheduled stream of payments, also approximates the way its market value will mirror changes in interest rates. It arms investors with a standard metric for comparing interest-rate sensitivity across bonds, and fixed-income markets could scarcely operate without it. It is especially useful for Treasuries, whose holders can be certain of receiving every scheduled payment on time and in full. It would be useful to have a duration measure for equities, but they have no maturity date, and their future stream of earnings does not respond consistently to changes in interest rates.But don’t just take our word for it. A review of the empirical data mercilessly exposes equity duration’s shortcomings. Over the nearly 70 years of accurate 10-year Treasury-yield data, monthly S&P 500 total returns have exhibited a barely noticeable negative correlation with monthly changes in interest rates — rate moves explain just 1 percent of the variability in equity returns. A more relevant comparison for the next few years might be the three-decade bond bear market that ended in 1982, but even though the relationship was stronger during that stretch, it was still quite weak, with changes in rates explaining only 5 percent of equity variability.

The relationship between interest rates and the purportedly long-duration tech sector is no stronger. Over the 32 years that sector price indexes have been constructed in accordance with Global Industry Classification Standard (GICS) sector classifications, tech returns have exhibited a weak positive correlation with interest rates, which is to say that tech stocks have performed slightly better when rates have risen than when they’ve fallen. But regardless of the direction, the relationship is tenuous: Interest-rate moves have explained a mere 2 percent of the variability in tech sector returns. In other words, changes in interest rates have no particular explanatory power over the relative returns of tech stocks. When it comes to duration and stocks, there’s simply no there there.

Ordinary Popular Delusions

So how can it be that every market participant apparently now knows that tech stocks are long-duration assets that are acutely vulnerable to a backup in yields? Well, when overwhelming quantitative evidence fails to get traction, we can only suppose that cognitive biases are at work. In this case, it appears that the power of narratives — mixed together with recency bias and innumeracy — has convinced investors to believe something that simply isn’t true.To trace the ways that interest rates might impact equity returns, we broke stock prices down into their essential building blocks: future earnings and the multiple that investors are willing to pay for them. S&P 500 tech earnings are less sensitive to changes in interest rates than are overall S&P 500 earnings because tech companies have just over half the debt financing that the index ex-tech does, and because the two companies that account for nearly half of sector market cap, Apple and Microsoft, do not sell big-ticket items that their customers have to finance.

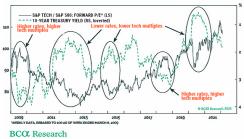

Empirical data supports the assertion. Since the global financial crisis, the relationship of relative tech earnings to the 10-year yield has ranged from modestly inverse to flatly indifferent, except during 2020, when those earnings rose with falling rates and slipped when rates rose. But although 2020 represents no more than a sliver of the full data set, investors have fixated on it. Furthermore, although one might think that 2020, the year in which Covid-19 most severely disrupted economic activity, was prone to be especially anomalous, investors were hoodwinked into conflating correlation with causation while disregarding the lack of co-movement between rates and relative performance in 2021.

In the absence of an interest-rate/tech-earnings relationship, the purported link between interest rates and relative tech-stock performance must come down to price-earnings multiples. But for the first ten years following the global financial crisis, tech’s relative multiples rose and fell in tandem with interest rates:

What appears to have happened is that the herd has disregarded the preponderance of the data disproving its intuition and has latched on to a fleeting stretch during which the observed correlation was powerfully negative. In this showdown between data and a popular narrative, the data didn’t stand a chance.

BCA Research is not bullish on the tech sector. There are plenty of reasons why tech’s outperformance may have run its course — the law of large numbers will make it increasingly difficult to sustain historic growth rates, legal and regulatory headwinds are emerging, and a shift from pandemic winners to pandemic losers may already be underway — but rising rates are not one of them.

Doug Peta is chief strategist for U.S. investment strategy and global ETF strategy at BCA Research. BCA is a global independent research provider owned by Euromoney Institutional Investor.