Investors are increasingly committing to private debt funds on the advice of top investment consultants, according to Private Credit Fund Intelligence’s first-quarter report on consultant activity.

Nine out of the ten top consulting firms, measured by total client commitments, advised on at least one private debt mandate in the past 12 months, resulting in private debt comprising 12 percent of all consultant-led allocations, according to the report, which was released on Tuesday. Private debt commitments advised by the top five private debt consultants — Cambridge Associates, Meketa Investment Group, Versus Investments, NEPC, and Callan — had increased in volume by 44 percent over the same period, PCFI said.

Cambridge Associates was the top consulting firm in terms of client private debt commitments, according to the report. It advised on $2.9 billion in private debt investments over the past 12 months. But PCFI suggested that Cambridge could be “displaced at the top, with several peers, including Meketa and NEPC, accelerating private debt plans in 2021 to keep pace with investor AUM growth.”

In the first quarter of 2021, nine out of the 10 top consulting firms by potential mandates documented at least one opportunity in private debt for clients, according to the report.

“NEPC disclosed the most opportunities (five), having recommended several clients to increase their private debt targets at the expense of hedge funds,” PCFI said in the report. “RVK, Aon Hewitt, Callan, Versus, and Meketa all recommended private debt searches to multiple investors.”

PCFI noted that the number of commitments and searches in the first months of the year was likely impacted by the ebbs and flows of the fiscal calendar. The report cited a “likely fleeting” drop in the number of potential private debt searches in the first quarter of 2021 compared to the last quarter of 2020. For example, NEPC, which touted seven potential private debt client mandates in the last quarter of 2020, dropped to five in 2021’s first quarter, confirming that “the most active consultants instigated many of their clients plans/reviews at the end of 2020,” PCFI said. RVK, Meketa, and Verus followed suit, recording fewer potential debt mandates in the first months of 2021.

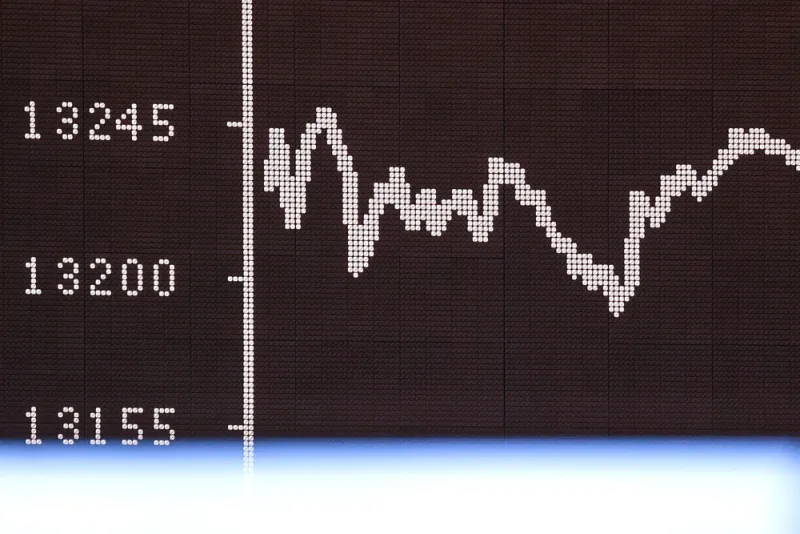

“The trend is upward, but it’s not necessarily a smooth line,” Tony Griffiths, head of research at PCFI Insights, said in a phone interview with Institutional Investor.

Griffiths noted that the data used in the report is heavily weighted toward U.S. investors. As for the future of the private debt asset, PCFI predicted that private debt commitments will hasten in the second quarter of 2021 now that client plans have been secured.

[II Deep Dive: Private Debt Gets All the Action]

The report also provided an overview of other asset classes in the private markets, including private equity, equity, fixed income, real estate, infrastructure and real assets, and hedge funds. In private equity, PCFI predicted an increase in commitment activity as in-person meetings begin to resume. The research firm likewise expected “new chances” for public equity mandates after a turbulent 2020.

In fixed income, meanwhile, PCFI said there had been a consolidation of advised capital among the top three consulting firms, which included Aon Hewitt, NEPC, and Callan.

As for real estate, the research firm said that recent allocations have been driven by opportunities in “the private rental sector and various investment strategies linked to increased western governmental support for affordable housing.” In infrastructure and real assets, PCFI said the top 10 consultants (by client infrastructure commitments) had completed 54 mandates over the past 12 months. The research firm expects an uptick in manager appraisals as the asset class continues to expand.

Hedge fund commitments, meanwhile, were very concentrated among the top three hedge fund consultants. PCFI said it expects consultant-led hedge fund flows to continue to come from a “small group of specialists.”