Avoiding portfolio managers who are on a losing streak may seem like obvious advice, but new research shows it may be worth steering clear of managers on a hot streak, too.

That’s because winning or losing streaks — making profits every day or losing money every day — played with managers’ heads and changed their behavior to the detriment of their portfolios, according to new research released Monday by Essentia Analytics. The firm, which studies neuroscience and economics to help active managers understand their behavior, found that half of the active equity portfolio managers in the study’s sample exhibited some change in behavior after experiencing a winning or losing streak.

Almost one-quarter of fund managers changed their behavior when winning and 41 percent did so when losing, according to the study, entitled “Holding the Line: How Winning and Losing Streaks Affect Fund Manager Behavior.” The firm defined a winning streak as any sequence of five days in which fund profit was positive on each day and a losing streak as any sequence of five days in which fund profit was negative on each day. The research used anonymized data from Essentia’s client base from 2008 to the present, analyzing trade and holdings information from 29 active equity portfolios across 21 different firms located in North America, Europe, and Asia.

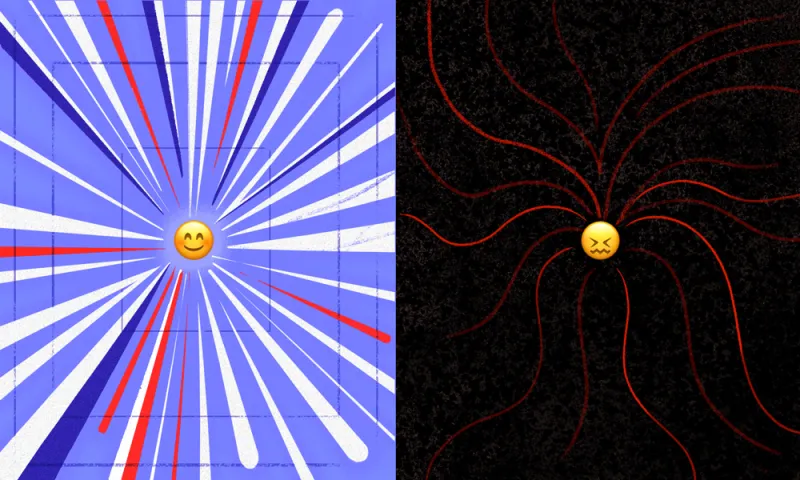

Fund managers on winning streaks made fewer decisions about their portfolios, and their portfolios exhibited reduced turnover. Winning managers made worse decisions, but those decisions were tempered by a lack of trading.

But one-third of managers in a confidence-sapping losing streak increased trading in their portfolios — and their worse decisions had a big impact on performance, according to the study. The 35 percent of fund managers who traded a lot more when losing killed 2.3 basis points of the value of their portfolios per streak when they were either on a five-day winning or a five-day losing streak, the study found. Given that the average portfolio manager has 16 streaks a year, Essentia found, the 35 percent of managers that trade a lot more when losing ended up sacrificing 35 basis points of relative performance lost to bad decisions each year on average.

“What if you won for five days in a row?” said Chris Woodcock, head of product and research at Essentia and one of the study’s authors, last week at an Essentia-sponsored conference. “You’d feel great, right? What if you lose for five days in a row? You’d cry.”

[II Deep Dive: Your Brain Wants You To Make Bad Decisions. Here’s How To Avoid Them.]

Those emotions can affect even the most rational investor. Twenty-one percent of fund managers on a winning streak in the study changed their behavior meaningfully when it came to daily portfolio turnover. Two-thirds of those managers reduced turnover by 16 percent at the median. But the remaining one third increased their turnover by 69 percent, Essentia found, a much larger amount than those who reduce it.

Essentia attributes the substantial increase in turnover to the so-called “House Money Effect,” as it was called in a 1990 academic paper, where people take more risk when they have had recent gains. It can also be explained by what Essential calls the victory effect, when people take more risk after a big win.

“If you ask most fund managers or traders whether they behave differently, vis-a-vis investment decision-making, when they are on a winning or losing streak, they will say ‘probably.’ But very few could tell you exactly how their behavior changes, or whether the quality of their decisions actually improves or deteriorates,” wrote Essentia founder and CEO Claire Flynn Levy in the paper’s foreword.

Losing was more problematic. According to the study, one in four managers acted far differently when on a losing streak compared with when they were winning. All managers traded more when losing, with a median increase of 110 percent. A portion of those managers actually traded three to four times as much when losing.

“When on a losing streak, they were instinctively acting as though the likelihood of the decisions they were taking being right was somehow significantly greater than usual, as though taking the view that not only is ‘it broke’ but that they could ‘fix it,’” according to the study.