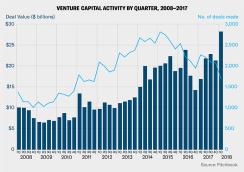

Venture capital firms deployed nearly $30 billion in the first three months of 2018 – more than they've invested in any quarter since 2006, according to PitchBook.

The data firm recorded 1,683 venture-backed deals totaling $28.2 billion between January and March, according to a PitchBook statement expected to be released Tuesday. Valuations were up across the board, with deal sizes increasing across all stages of companies' growth.

"Companies are raising a lot more late-stage capital," Nizar Tarhuni, associate director of research and analysis at PitchBook, said by phone. "These are older businesses that would have gone public in year three, four, or five in the past, but that's not happening."

This flood of venture capital into start-ups during the first quarter follows four of the industry's best fundraising years ever. Investors committed $33.3 billion to venture capital funds last year and $40.9 billion in 2016, PitchBook data show.

The industry is on track for another robust year of fundraising in 2018, though it may fall short of recent highs, according to PitchBook. The first quarter saw $7.9 billion committed across 54 funds, marking a slowdown from 2017 levels. Still, "several prominent venture capital firms" are seeking to raise multi-billion-dollar investment pools, a sign that fundraising activity will pick up as the year goes on, PitchBook said in its Venture Monitor report for the first quarter.

"There's no shortage of capital in venture market so if it was to slow down that wouldn't necessarily be a bad thing," Tarhuni said. "But we're still looking at ample and substantial fundraising this year."

[II Deep Dive: Investors Shelled Out $155 Billion for Venture Capital Deals Last Year]

As fundraising has gone up, the total number of venture capital deals has fallen in the past few years. Last quarter saw the fewest deals close since 2011, even as firms invested more than any three-month period before the financial crisis.

Tarhuni said the decline in deals is partly attributable to very early, pre-seed stage fundraising, which is more difficult to track. The increase in deal size, meanwhile, is reflective of climbing valuations — not just in venture capital, but across public and private equity markets.

"That doesn't mean valuations shouldn't be a concern, but it's not specific to venture capital," Tarhuni said.

The average early-stage deal closed in the first three months of this year was 65 percent larger than similar deals in 2017, while late-stage deals were 42 percent higher on average, according to PitchBook. A record 113 financings were larger than $50 million, accounting for 14 percent of the total deal value in the first quarter.

Meanwhile, exit activity remained "sluggish," according to PitchBook, which reported $8.1 billion in exit value across 188 deals during the quarter, down from $17.2 billion over 233 deals during the same period in 2017.