The portion of asset owners considering offloading a least some of their portfolio grew by a third between late 2016 and October 2017, according to a survey released Thursday by Natixis Investment Managers.

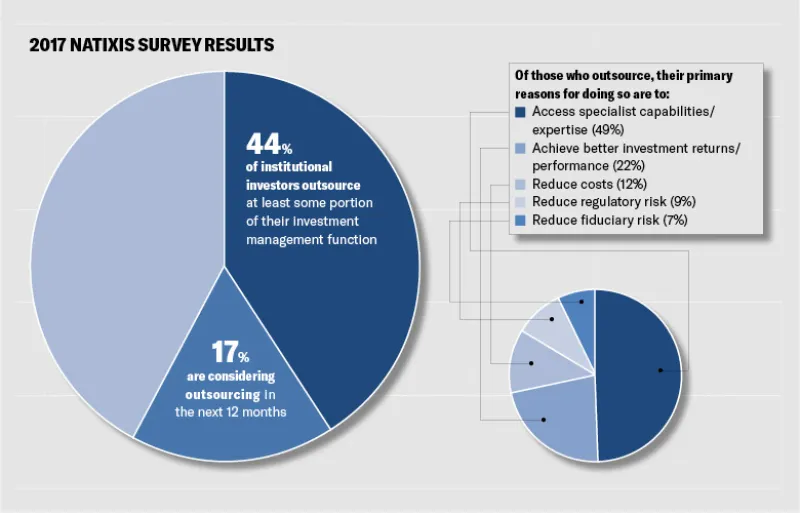

Four-in-ten institutional investors said they already outsource to some extent, and 17 percent were interested in doing so over the next 12 months. A year ago, 13 percent said they were eyeing the services.

Natixis’ sixth annual poll of institutional investors garnered 500 responses globally in September and October 2017, from a cross-section of public and private pension funds, nonprofits, insurers, and sovereign wealth funds.

Several high-profile U.S. institutions have moved entirely to the outsourced-CIO (OCIO) model since Natixis’ survey was conducted.

The American Red Cross, for example, in December made the surprising decision to shut down its in-house investment team, which managed about $4 billion in assets.

“We have decided to change the investment strategies of the pension and the endowment funds, and we will no longer have the scale to require the expense of funding an in-house investment management team,” a Red Cross spokesperson told Institutional Investor when the story broke.

Cost reduction motivated 12 percent of institutions to outsource, according to Natixis’ latest findings. But the number one driver, cited by 49 percent of respondents, was access to “specialist capabilities/expertise.” Achieving better investment returns came in second at 22 percent.

For a small portion of asset owners, offloading their portfolios was all about avoiding regulatory and fiduciary risk, as opposed to improving investment outcomes.

[II Deep Dive: The Most Dangerous Asset Management Client]

One business consultant to asset managers recently warned firms about these very risks in dealing with OCIOs.

“The risks are all about the transparency of the decision-making and pricing to the client,” Amanda Tepper, founder and CEO of Chestnut Advisory Group, told II last month. “With OCIO, you as an asset manager have no direct contact with clients anymore.”

But more and more, that’s precisely what institutions seem to want.