First RealFund has begun offering real estate deals to institutional investors on a crowdfunding platform.

The New York-based firm will provide short-term real-estate investments in high-growth neighborhoods, according to co-founder and Chief Executive Officer Dan Drew. “Brooklyn has a lot of those right now, so we have offerings in those types of neighborhoods,” Drew said by phone Friday. “They’re value-add deals where you can go in and make a lot of capital improvements.”

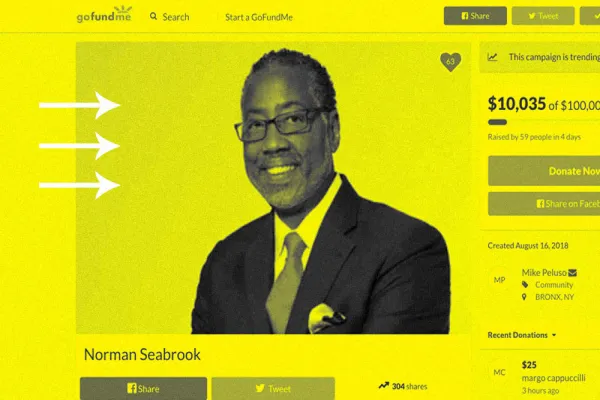

First RealFund, expected to announce its crowdfunding business on October 23, is the latest company using an online platform to seek investments for a niche project or sector. GoFundMe, for example, raises money to defray people’s medical bills and Indiegogo funds technology and design products before they go mainstream. First RealFund will offer opportunities to co-invest alongside the firm in residential and commercial real-estate deals.

The “deals are compelling because they’re short term and generate a tremendous amount of yield,” Drew said. He projects potential returns of 12 percent to 24 percent on investments lasting one to three years.

First RealFund has a $5 million pipeline of deals and plans to co-invest $100,000 in each of its first two offerings, according to Drew. He said investors can allocate between $500,000 and $3 million in each of the real estate assets offered by First RealFund.

Once investors are vetted and approved by First RealFund, they can view the firm’s offerings and allocate capital to the deals they like by linking their bank accounts and signing off on the allocation through First RealFund’s website, according to Drew. Before co-founding the firm, Drew was head of real estate at iFunding, also a crowdfunding business.

[II Deep Dive: A New Source of Private Credit: the Crowd]

“We’re offering property-specific investments,” he said. “You can allocate a lot or a little to each of our offerings.”

The co-investment piece of the business, which includes capital from First RealFund, may help attract investors by giving them a sense of comfort.

“Having your own skin in the game is a key differentiator in this market,” Jim Dowd, chief executive officer of North Capital Private Securities Corp., said in the statement expected to be released Monday. North Capital Private Securities is the placement agent for First RealFund’s platform.