Amanda Townsley, CME Group

AT A GLANCE

- Crude oil, liquefied petroleum gas and natural gas production and exports rose in 2023, positioning the U.S. as a global leader in energy exports

- In February, U.S. Gulf Coast crude and condensate exports reached a record 4.56 million barrels per day

The United States secured a top spot on the list of the world’s largest energy exporters in 2023, helping to meet rising global energy demand amidst OPEC production restraint and Russian sanctions.

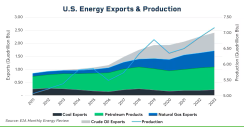

U.S. Energy Exports Surge with Production

The latest data from the Energy Information Administration (EIA) shows that U.S. energy exports rose 7% in 2023, underscoring the country’s growing role as an incremental energy supplier to the world.Crude oil and liquefied petroleum gas (LPG) saw the largest growth, both rising by 12% from 2022 to 2023. Natural gas followed, with growth up 9%. These gains were partially offset by a fall in the exports of petroleum products (gasoline and diesel) which were down about 6% in 2023.

Complementing this rise in exports, the U.S. also set records in production. Crude oil and natural gas liquids (NGLs) output rose 8% in 2023, while natural gas rose 4% year on year.

Industry experts are expecting production of these energy products to keep growing in the coming years. However, production growth is not the only factor determining exports. Infrastructure capacity, shifts in domestic consumption, global supply-and-demand dynamics and regulatory policies can all play important roles. Each of these factors can be headwinds or tailwinds to U.S. energy exports in 2024.

Crude Oil

In 2023, the U.S. exported over four million barrels of crude oil per day, making it one of the top three suppliers to the world. The year-on-year increase of approximately 500,000 barrels per day in exports in 2023 was accompanied by an increase of one million barrels per day in domestic production, mainly coming from the Permian Basin. The amount of crude oil processed at U.S. refineries, which reflects domestic demand, was unchanged in 2023, according to the EIA. Domestic processing levels are expected to fall in the coming years with the closure of LyondellBasell Industries’ Houston refinery and the conversion of some refinery capacity to renewable diesel units.Stagnant domestic demand and rising production could translate to higher exports, but the rate of growth in this area is uncertain. East Daley Analytics – an expert in energy infrastructure, supplies and flows – is forecasting little production growth in the first half of 2024 for natural gas, crude oil, or NGLs from the Permian Basin region until the Matterhorn Express Pipeline begins operations later in the year. This echoes the EIA’s February 2024 Short Term Energy Outlook report that showed U.S. crude output not exceeding December 2023 levels until January 2025.

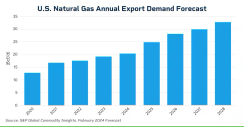

Natural Gas

2023 was a major year for natural gas with the U.S. jumping ahead of Australia and Qatar as top global Liquefied Natural Gas (LNG) supplier. The U.S. is also the world’s largest LNG exporter due to shipments via pipeline. Exports from the U.S. have been largely dictated by the capacity of LNG facilities, which aggregate, treat and refrigerate natural gas down to a temperature of minus 260 degrees Fahrenheit where it becomes a liquid. The technology involved in LNG export terminal development is more complex than that for crude oil or refined products and typically takes three to five years for construction.New facilities are slated to come online in the next few years, contributing to expectations of higher exports. Shell’s LNG Outlook 2024 forecasts that U.S. LNG will make up 30% of global demand by 2030. The timing, however, is uncertain. According to S&P Global Commodity Insights, new capacity additions are not expected to materialize until the end of the year. Slippage in these timelines could limit any export growth until 2025. The recent U.S. government moratorium on new LNG export permits creates uncertainty over how long the uptrend will last.

Liquefied Petroleum Gas (LPG)

U.S. Liquefied Petroleum Gas (LPG) made a splash on the world stage back at the start of the shale boom, paving the way for the U.S. to become a major supplier long before crude oil exports were permitted. LPG refers to natural gas liquids (NGLs) propane and butane, which are primarily coproducts of natural gas production. In addition to their well-known uses for grilling and lighter fluid, LPGs are used as feedstock for the production of ethylene and propylene as well as for heating and cooking in developing parts of the world. The U.S is the largest supplier of propane and butane, exporting two million barrels per day in 2023 – more than twice the volume consumed domestically.Similar to LNG, LPGs need to be cooled to low temperatures before loading onto vessels. The existing LPG export facilities, which are mostly located on the Texas coast, have been operating at high utilization rates. Midstream operators Targa, Enterprise and Energy Transfer have announced LPG export capacity expansions to become operational in 2025. Until then, Houston Ship Channel’s decision to allow for nighttime transit is expected to be a regulatory tailwind for higher LPG exports.

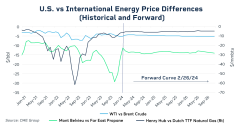

Price Spreads Reflect Continued Export Growth

The prices of U.S. natural gas, LPG and crude oil have been consistently below international equivalents for the last several years. Price spreads in excess of shipping costs encourage growth in export volumes. Spreads significantly in excess of shipping cost, such as those seen between Henry Hub and Dutch TTF natural gas in much of 2022, can reflect insufficient infrastructure to connect the two markets.In times like this, international buyers who have already secured access to U.S. supplies may benefit from lower prices. Domestic producers or traders who have invested in physical infrastructure to deliver product overseas may also benefit from the arbitrage opportunity.

Active futures and options markets for these prices at CME Group allow producers, consumers and traders to manage risks around cargo movements and export infrastructure investments.