By: Owain Johnson

Divorce is always a challenging event, particularly when the couple in question have been together for so long.

U.S. crude oil and natural gas prices have gone through their own separation in recent years and their relationship shows no signs of getting back on track. Prices for the two fuels were historically closely related because they were both impacted by similar supply/demand dynamics.

Drilling for oil typically produces some natural gas and vice versa so the supply side of these key commodities tended to be locked together. Meanwhile, on the demand side, some electric power utilities could switch between natural gas and residual fuel oil – a product of crude oil. The ability to switch fuels helped to ensure that oil and gas prices never moved too far away from each other.

As a result, oil and natural gas prices stayed roughly in line for decades. The breakdown only really began with the 2008 financial crisis.

Strained Relationship

An economic downturn can put a lot of pressure on any relationship and oil and gas prices were no exception. Crude oil prices suffered a significant decline during the recession, outpacing declines in natural gas prices. But the increased geopolitical risk brought about in part by the Arab Spring helped to move momentum in favor of crude oil. Oil price gains outpaced natural gas prices in 2009-12.

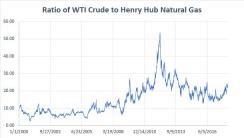

Based on the energy value of crude oil and natural gas, the price ratio between the two products should be 6:1. The increase in crude oil prices from their recession-driven lows pushed this ratio to a record level of 54 by 2012 before easing back. The ratio has since eased back into a range of 15-25, still well ahead of its long-run average.

Growing Apart

The dynamics of oil and natural gas have continued to diverge in recent years.

Production of both products has surged since the U.S. shale revolution but the impact on gas prices has been more severe. Since the lifting of the U.S. crude oil export ban at the end of 2015, U.S. shale oil has had an international outlet, relieving some of the downward pressure on prices.

The U.S. has also begun natural gas exports in the form of liquefied natural gas (LNG) but export facilities are still ramping up and the pressure remains strong on natural gas prices.

Events like a sudden cold snap, regional storage dynamics, and severe weather activity also affect natural gas more than crude oil as oil often tends to act more as a geopolitical barometer of risk.

The electricity fuel-switching mechanism that limited price divergence is also less and less relevant. Lower natural gas prices encouraged power utilities to move their fleet to gas and to close aging oil-fired production, which was also significantly more polluting. Gas-to-oil switching is an ever-smaller factor in the price relationship between natural gas and crude oil.

Power Couple

Natural gas and crude oil are both extremely important to the U.S. economy. Traditionally, the energy content of the two fuel sources was a major factor in determining their long-term price relationship, which was relatively stable.

The U.S. shale revolution has led to a boom in production of both crude oil and natural gas. This has led to a breakdown in the relationship of oil and gas prices.

This separation is likely to continue during the short term. But the expected upsurge in U.S. LNG exports over the next few years may relieve some of the downward pressure on natural gas prices. A greater focus on international exports for both crude oil and natural gas could help align their prices once more, bringing this powerful couple back together again.

Owain Johnson is Managing Director of Energy Research and Product Development at CME Group. He is based in London.