By Phil Moore

One of the enduring mysteries of institutional asset allocation over the last decade has been the persistent underweighting of emerging equity and debt markets among investors. There are several reasons explaining institutions’ historical mistrust towards emerging markets (EM).

The prevailing perception among institutional investors has been that EM are characterized by high levels of volatility and illiquidity. There has also been a belief that the benefits of strong economic growth in EM may be eroded by the impact of idiosyncratic factors such as political uncertainty, poor governance, high debt, and weak currencies.

Other concerns have been the vulnerability of EM to contagion from U.S. monetary policy and a potential slowdown in China, twinned more recently with the likely impact on emerging regions of protectionism. The recent performance of some EMs suggests that many of these misgivings do not stand up to scrutiny. Karen Bater, EM Debt Specialist at Aberdeen Standard Investments, points to the performance of the Mexican peso since the U.S. Presidential Election of 2016 as evidence of the resilience of EM. Neither the prospect of rising U.S. interest rates, nor the threat to NAFTA, nor the planned construction of a wall along the Mexico-U.S. border has prevented the peso from being among the world’s best performing currencies over the last 12 months.

Scott Conlon, Equity Investment Specialist at Aberdeen Standard Investments, says that fears of protectionism have been overstated. He adds that they are compensated for by other U.S. economic policies that are likely to promote global growth and therefore strengthen the case for emerging markets.

A compelling investment case

More broadly, Conlon argues that the investment case for EM is supported by compelling macroeconomic, demographic, and structural factors. Each of these should lead institutions to review their exposure to EM in an era of relatively high valuations in developed regions. At a time of lower global growth and relatively subdued inflation, these stretched valuations may constrain potential risk-adjusted returns in developed markets. They are also likely to sustain high geographical and asset class correlations across the developed world.

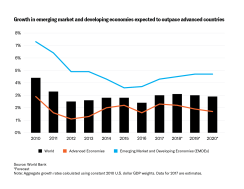

The macroeconomic drivers of the potential outperformance of EM are persuasive. Emerging economies are expected to grow at an annual rate of between 5% and 7% over the next few years, compared with 2% in developed markets. This will elevate their share of global GDP to 45% by 2020, and to as much as 60% within 15 years, according to the Institute of International Finance (IIF).

Growth in emerging market and developing economies expected to outpace advanced countries

The demographic dividend

Much of this longer-term growth will be underpinned by demographic dynamics arising from the emergence of a young, educated, and aspirant middle class twinned with increasing disposable income levels across many developing regions. This demographic dividend is also leading to a rise in infrastructure investment across the EM universe, which will be another impetus for economic growth and job creation.

At a structural level, meanwhile, investor reservations about illiquidity, restricted free-floats, local institutional demand, and the dominance of a handful of sectors and companies within individual EM should have receded over the last decade. With governments across the EM universe increasingly committed to promoting local capital markets, and with privatizations and IPOs adding to their depth and diversity, the liquidity of these markets has grown dramatically. When the MSCI EM Index was introduced in 1988, its constituents were 10 countries representing less than 1% of the world’s market capitalization. Today, 24 countries are represented in the index, representing about 12% of global market cap.

This weighting is poised to grow as more countries graduate from frontier to EM status, and as some (such as China) reach levels of disclosure and governance required for index inclusion. It will also expand as others (such as Saudi Arabia) open up markets that were previously inaccessible to foreign investors.

The case for EM Debt

The structural evolution of emerging debt markets should also have strengthened their appeal to institutional investors hunting for enhanced risk-adjusted returns and low correlations with mainstream bond markets.

Investors attracted by the growth potential of developing markets now have several alternative asset classes to choose from in emerging and frontier debt markets, each of which offers different risk-return characteristics and diversification opportunities. The first is hard currency (generally dollar-denominated) issuance from sovereign borrowers. The second is local currency sovereign debt, which is becoming increasingly accessible to overseas investors in economies that were traditionally closed, notably China and India. Local currency sovereign debt is now the largest component of the EM fixed income universe, valued at almost $9 trillion, compared with just under $1 trillion for the hard currency market.

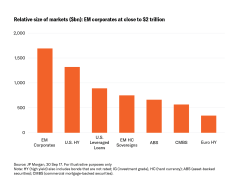

A third option for institutions allocating to EM fixed income is the corporate debt market. This is one of the fastest-growing asset classes in the world, having expanded from about $600 billion in 2006 to $2.2 trillion today, making it larger than the U.S. high yield market.

Relative size of markets ($bn): EM corporates at close to $2 trillion

As Aberdeen Standard Investments’ Bater notes, potential returns across the universe of emerging and frontier market debt should be enticing to institutional investors starved of returns in developed markets. As one example, she points to Ghana, where current yields are around 16%, with interest rates and inflation falling, and where correlations to U.S. Treasuries are negative. As another, she notes Sri Lanka, where a vibrant tourism sector is supporting a strengthening trade balance, and where yields are close to 10%.

Active management is essential

Conlon cautions, however, that in EM equity as well as debt markets, harnessing opportunities such as these calls for extensive bottom-up research. “It is essential to take an active approach to EM investment,” he says. “Our EM team typically looks to own stocks over a horizon of several years. They will only do so when they have met with a company multiple times to ensure they are comfortable with their management, business model, balance sheet and approach to managing business risks. Identifying the highest quality companies and owning them for the long term is a distinguishing characteristic of our EM franchise, and has been the key to successfully delivering performance for our clients over time.”

Aberdeen Standard Investments is a brand of the investment businesses of Aberdeen Asset Management and Standard Life Investments. Unless otherwise indicated, this document refers only to the investment products, teams, processes and opinions of Standard Life Investments as at the date of publication.

The information shown relates to the past. Past performance is not a guide to the future. The value of an investment can go down as well as up. All information, opinions and estimates in this document are those of Standard Life Investments, and constitute our best judgement as of the date indicated and may be superseded by subsequent market events or other reasons. This material is for informational purposes

Standard Life Investments Limited is registered in Scotland (SC123321) at 1 George Street, Edinburgh EH2 2LL. Standard Life Investments Limited is authorized and regulated in the UK by the Financial Conduct Authority. Standard Life Investments (Hong Kong) Limited is licensed with and regulated by the Securities and Futures Commission in Hong Kong and is a wholly-owned subsidiary of Standard Life Investments Limited. Standard Life Investments Limited (ABN 36 142 665 227) is incorporated in Scotland (No. SC123321) and is exempt from the requirement to hold an Australian financial services license under paragraph 911A(2) (l) of the Corporations Act 2001 (Cth) (the ‘Act’) in respect of the provision of financial services as defined in Schedule A of the relief instrument no.10/0264 dated 9 April 2010 issued to Standard Life Investments Limited by the Australian Securities and Investments Commission. These financial services are provided only to wholesale clients as defined in subsection 761G(7) of the Act. Standard Life Investments Limited is authorized and regulated in the United Kingdom by the Financial Conduct Authority under the laws of the United Kingdom, which differ from Australian laws. Standard Life Investments Limited, a company registered in Ireland (904256) 90 St Stephen’s Green Dublin 2 and is authorized and regulated in the UK by the Financial Conduct Authority. Standard Life Investments (USA) Limited is registered as an Exempt Market Dealer with the Ontario Securities Commission and as an Investment Adviser with the US Securities and Exchange Commission. Standard Life Investments (Corporate Funds) Limited is registered as an Investment Adviser with the US Securities and Exchange Commission.

In the United States, Aberdeen Standard Investments is the marketing name for the following affiliated, registered investment advisers: Aberdeen Asset Management Inc., Aberdeen Asset Managers Ltd., Aberdeen Asset Management Ltd., Aberdeen Asset Management Asia Ltd., Aberdeen Asset Capital Management, LLC, Standard Life Investments (Corporate Funds) Ltd., and Standard Life Investments (USA) Ltd.

Calls may be monitored and/or recorded to protect both you and us and help with our training.

www.aberdeenstandard.com © 2018 Standard Life Aberdeen