Institutional investors are buying into factor investing, but the portfolios they’re constructing may come up short of their expectations.

In a recent proprietary study of 20 smart beta strategies, Northern Trust Asset Management found that 83 percent of the risks were unintended while the rest were associated with actual factors such as a company’s size. As a result, investors are ending up taking equity risks without getting corresponding returns.

Smart beta funds, one of the fastest growing investment categories, generally involve strategies that use computer algorithms to find stocks with certain characteristics such as a small market value. Investors are gravitating to these funds as a low-cost alternative to active managers, and as a more refined version of simple indexing, such as buying a fund that tracks a benchmark like the Standard & Poor’s 500.

“In the last few years the market has been flooded with new factor products, and they are not all created equal,” said Mark Carhart, chief investment officer at Kepos Capital. Many “strategies marketed as factors suffer from limited diversity and short track records.”

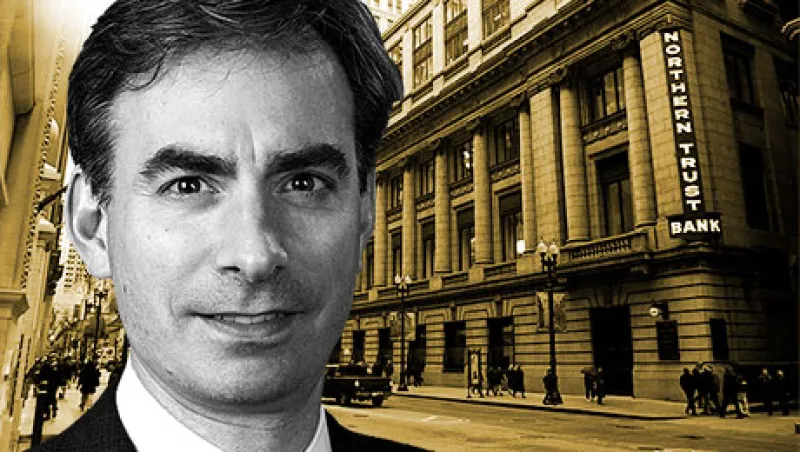

Matthew Peron, managing director of global equity at Northern Trust, said “investors aren’t harnessing the power of factor investing.”

Northern Trust, which has $1 trillion in assets under management, has been providing factor-based investments for 22 years. Several institutional investors now call Peron ‘The Fixer,’ because he’s been called into restructure big portfolios that aren’t benefiting from their factor strategies. Peron, who declined to name investors he’s now working with, says the mistake is in portfolio construction.

By mixing multiple factor, or smart beta, funds that aren’t designed efficiently, investors end up with a portfolio where one fund’s benefits can cancel out another’s advantages. Peron recommends that an institution use factor-based funds for 60 percent of a portfolio, with the remaining 40 percent allocated to traditional index funds.

Many investors now use factor-based funds to replace their active managers, which is around 30 percent of portfolios on average. Peron’s portfolio model would increase factor-based investments from 30 percent to 60 percent.

“Factors should be at the core,” said Peron. “And you have to take a strategic long-term view because factors, like active managers, have periods of underperformance.”

Peron stresses that inefficiently designed factor funds won’t deliver good results. For example, he points to a European institution that redesigned its portfolio, mixing three simple indices: quality, value and low volatility. But the quality index inadvertently included some expensive stocks and the value index picked up some high volatility securities. “They weren’t purely capturing the factor, so they ended up canceling each other out,” he said.

Peron says institutions need to rethink their factor-based portfolios, in part because markets are expected to slow in the next five years. When markets slow, research shows that factors such as quality and low volatility perform significantly better than broad market indexes.