Click here to download a PDF of the report.

With the better part of 2017 now in the rearview mirror, it can be said that it was a year of tremendous engagement and movement in ESG-related investing. Shareholder proposals focused on environmental issues passed for the first time at some notable S&P 500 companies, including Exxon Mobil. Average support for climate change-related shareholder proposals at all public companies jumped to 32 percent, up from 24 percent just a year ago, according to statistics compiled by the global law firm Gibson, Dunn and Crutcher. In its 2017 Annual Corporate Directors Survey, PwC noted that it anticipates such “shareholder initiatives will have even more widespread backing going forward.”

In the same report, PwC noted that, despite its survey’s finding that 40 percent of U.S. directors do not think that ESG issues such as income inequality, immigration, and climate change should have any effect on company strategy, “these are issues that major institutional shareholders are urging companies to address.” In addition, the report noted that “many investors emphasize that their environmental focus relates to risk issues … for example, climate change could have effects from supply chain to marketplace, both from a revenue growth and risk management perspective.”

A global imperative

As early adopters with an unswerving commitment to

ESG investing, Europe continues to set an example the world can follow. Globally, sustainable assets invested are at nearly $23 trillion — and Europe accounts for 53% of that total.

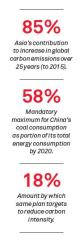

No region, however, plays a more pivotal role in ESG issues and investing than Asia. To start, for China, and Asia as a whole, climate change is not an abstract concern, according to Vivek Tanneeru, Portfolio Manager, Matthews Asia, the largest dedicated Asia-only investment specialist in the U.S.

“Many global ESG issues cannot be addressed effectively unless they are first addressed and solved in Asia,” says Tanneeru. It’s a difficult assessment to dispute, given that 4.4 billion of the world’s 7.4 billion people live in Asia, and that many of them have for years faced severe quality of life issues, such as air pollution and access to clean water. On the flip side, Asia’s dynamic economies continue to lead the global growth story.

The Matthews Asia ESG investment strategy starts with identifying solid businesses with sustainable, quality cash flow and strong leadership, and then digging further to identify their ESG impact. “There are quite a few companies in India, China and South Korea, especially on the biosimilar side of the pharmaceutical sector, that are producing world-class products of fantastic quality at an extremely affordable price point,” Tanneeru says. “They grow their profit streams nicely over the long term, and address the urgent need for access to affordable healthcare.”

A combination of investment in R&D and supportive government policies dovetail with other factors to place Asian companies at the forefront of effectively addressing ESG-related challenges. Electric vehicles are a prime example. “Asia represents almost 100 percent of the global supply chain for the battery cells that go into an electric vehicle anywhere in the world,” says Tanneeru. “It’s a huge barrier to entry.”

Asia, it turns out, is brimming with entrepreneurs and small- and mid-cap companies that don’t have the resources to shout from the mountaintop about their worthiness for ESG investors, but that “are very progressive and far ahead of larger peers in their industries in terms of ESG,” says Tanneeru of the roughly 2,500 businesses he and his colleagues visit in person each year. “I have had some pleasant surprises, and find it very rewarding, to discover world-class management teams in frontier markets such as Vietnam and Bangladesh. The ESG investment opportunities are not exclusive to the more developed parts of Asia.”