29

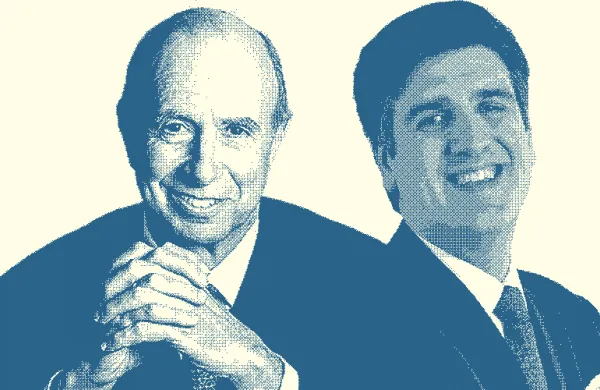

Jeffrey Greenberg & Vincenzo La Ruffa

Chairman and Chief Executive Officer

& Partner

Aquiline Capital Partners

Insurance industry veteran Jeffrey Greenberg believes that technology growth across the economy is having a profound effect on financial services. “Technology is causing companies to think very differently about how they acquire customers, how they interact with them, how they manage themselves, how they underwrite risk, what they retain in-house, what they outsource,” says the 64-year-old chairman and CEO of Aquiline Capital Partners. “The effect is more than just solving a set of problems. For the most-thoughtful companies, it’s really redesigning how they think about their businesses.” Greenberg founded the New York–based private equity firm a decade ago after resigning as CEO of insurance brokerage giant Marsh & McLennan Cos. amid a bid-rigging investigation by then–New York State attorney general Eliot Spitzer. (Marsh later paid $850 million to settle civil charges.) Known primarily for its activity in the insurance, banking and asset management sectors, Aquiline made its first fintech investment in 2009, in hedge fund administrator HedgeServ Holdings, which has grown to more than $300 billion in assets under administration thanks in part to cutting-edge technology. Last year Aquiline brought in Vincenzo La Ruffa from Pennsylvania-based investment firm Susquehanna Growth Equity to head its fintech effort. His team collaborates closely with Aquiline’s industry teams in sourcing investments, performing due diligence and working with companies after the firm has invested. “This is an industry where chatter and know-how, on not just what deals are getting done in the market but what portfolio companies are experiencing, are extraordinarily powerful,” says La Ruffa, 35, who has bachelor’s degrees in classics and economics from the University of Pennsylvania and began his career in the M&A group at Deutsche Bank. Four 2015 investments make this Aquiline’s most active year in fintech; they include Dublin-based Fenergo Group, which produces software that helps banks on-board clients and counterparties, and Virtus Partners, a Houston company providing middle- and back-office solutions for credit hedge funds.

The 2015 Fintech Finance 35

& James Robinson IV RRE Ventures

Evercore Partners

Bain Capital Ventures

Financial Technology Partners

General Atlantic |

Brad Bernstein FTV Capital

Anthemis Group

Goldman Sachs Group

Ribbit Capital

Nyca Partners |

Partnership Fund for New York City

Andreessen Horowitz

Digital Currency Group

Banco Bilbao Vizcaya Argentaria

Santander InnoVentures |

AXA Strategic Ventures

Citi Ventures

Credit Suisse NEXT Fund

SenaHill Partners

Bill & Melinda Gates Foundation |

Accion International

Marlin & Associates

CME Ventures

Illuminate Financial Management

Life.SREDA |

Innotribe SWIFT

Barclays

UBS

& Vincenzo La Ruffa Aquiline Capital Partners

REDI Holdings |

Startupbootcamp FinTech

Bloomberg Beta

Valar Ventures

Innovate Finance

FinTech Hong Kong |

| |