Several emerging-markets economies are foundering and depressing their respective financial markets. This volatility can be traced to three key sources: the uncertainty over future Federal Reserve policy moves, the slowing economy in China and the decline in commodity prices. To these, one can add some idiosyncratic emerging-markets risks, such as the political gridlock in Brazil and Turkey.

An initial Fed rate hike, had it been accomplished earlier this year, would not necessarily have been a major negative for emerging-markets economies. It would have reflected the strengthening in the U.S. economy and might have resulted in a decline in global interest rate volatility, both of which would have been positive for emerging-markets debt. Now, however, with all the uncertainty around the state of global demand, a rate hike might not be what emerging markets want. Unfortunately, a delay until at least December — or even early 2016 — might not produce an equally good outcome, as market uncertainty has just been extended to the next meeting, raising the question of whether the Fed has missed its window of opportunity.

Let’s consider another emerging-markets bugbear: slowing growth in China. Although the country’s economy is undoubtedly slowing, there are meaningful concerns in the debates over both the rate of deceleration and the ultimate causes behind it. To be sure, some of the cooldown may be fallout from the shift from an investment- and export-led economy to a consumer-led one. The process has not been smooth, and the markets have been left wondering about the intention and impact of some recent actions. That was particularly apparent in the surprise devaluation of the yuan, which although sensible at one level, shocked markets and introduced significant uncertainty. Given the integral role China plays in contributing to global growth rates overall, the risk of a hard landing — even if low — is quite troubling, and only time will tell how much of the current slowdown is structural, as opposed to cyclical, in nature.

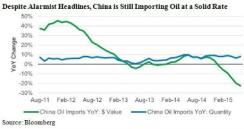

We at BlackRock do think that some of the alarmist analysis regarding China’s slowing is off base. Heightened stock market volatility and broad-based oil price declines are noisy indicators and make for poor proxies of economic activity in China. Although the drop in oil prices has been dramatic, we think it has more to do with supply factors — namely, the rise of shale oil in the U.S. and heavy Saudi supply — than with weak aggregate demand in China. In fact, if we look at China’s oil import activity in terms of volume, rather than U.S. dollar value, it continues to grow at a normal rate. It appears to have declined in dollar terms only on the back of the strengthening U.S. dollar (see chart 1).

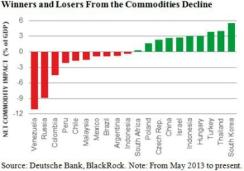

Also, remember that emerging markets are situated on both sides of the commodity trade. Whereas oil exporters such as Russia and Venezuela have seen economic growth hit hard by oil price declines, this situation presents a net economic benefit to oil-importing countries such as Thailand and South Korea (see chart 2). Still, the overall aggregate impact of broad-based commodity price drops will be negative for the emerging-markets debt sector, given the size of commodity exporters in the relevant market indexes, as well as the activity’s importance to fiscal revenues. What, then, are the signposts investors should watch out for when judging when to add to emerging-markets debt positions?

We anticipate that further policy action from China would go some distance toward helping stabilize emerging-markets debt on a broader scale. Already, policymakers may have reanchored the currency’s exchange rate. Alongside tighter capital controls, this monetary policy change should reduce the pace of capital outflows. With policy moves that could provide stability and then improvement to China purchasing managers’ index readings, we would look for consolidation of the current trading range in various commodities, most particularly oil. Until signposts come into better view, we would maintain a more defensive attitude toward emerging-markets debt. Rather than China, we are leaning toward economies more closely linked to U.S. growth dynamics, like Mexico, or those in which the necessary rebalancing is more advanced, like Russia. There will be a point at which emerging markets are offering investors very solid opportunities. In the meantime, keep your eyes out for signposts of balancing in emerging markets.

Pablo Goldberg, managing director, is portfolio manager and senior strategist with BlackRock’s emerging-markets debt team in New York.

Get more on emerging markets.