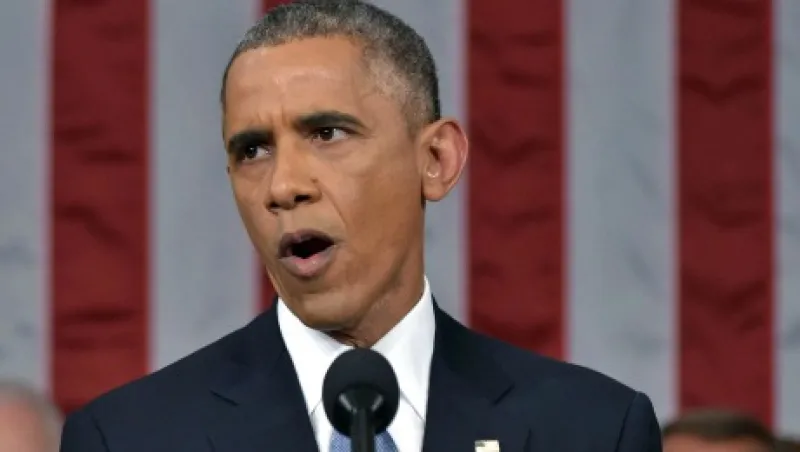

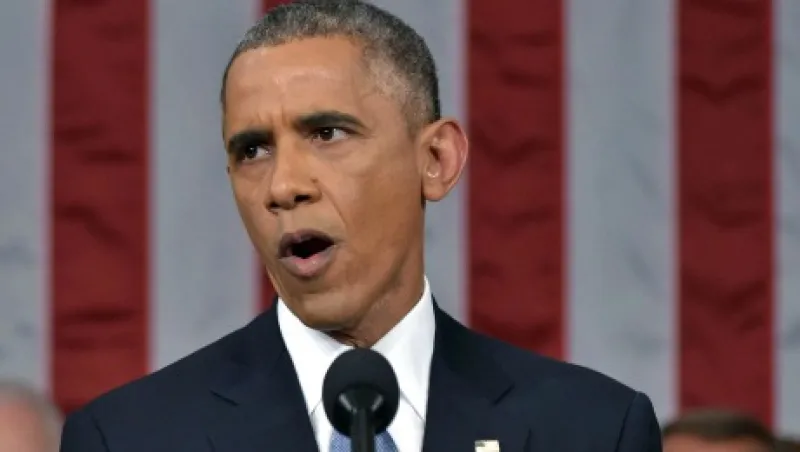

Daily Agenda: Can U.S. Strength Kick-start Global Growth?

As European markets brace for Greek demands and Obama completed his three-day trip to India, the U.S. economy remains the bright spot for global investors.

Andrew Barber

January 27, 2015