Equity markets have started to perk up in early 2013, yet lackluster economic growth is posing a challenge to corporate profitability. In this promising but complex environment, we’ve identified five key themes for equity investors that are worth watching as the year unfolds.

Emerging-markets health care. Health care stocks remain attractively valued, even after recent outperformance. Within the sector, companies with exposure to emerging markets look especially appealing. As wealth increases in many emerging economies, more people will be able to afford treatment for the likely increase in noncommunicable diseases such as cancer and diabetes brought on by changing lifestyles. Even when taking into consideration government spending cuts, public spending on healthcare is poised to rise over the next two decades in developed and emerging economies. Pharmaceuticals and other health care companies with high exposure to emerging markets should benefit from this trend.

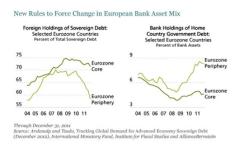

European bank deleveraging. European bank assets have shrunk by $2.5 trillion from their peak in May 2012 — but there is probably more to come. And upcoming regulatory changes, such as Basel III, are likely to force a change in the asset mix of European banks. In particular, we foresee a continuing reduction of risk-weighted assets (RWA), which are used to calculate capital adequacy ratios. This may prompt banks to de-emphasize their commercial books of business in favor of holding sovereign debt, which has a lower regulatory risk rating. The impetus for the mix shift is also coming from local governments, as external ownership of sovereign debt is shrinking, while local ownership is rising (see the chart below). We think these dynamics can create opportunities for non-European banks with strong balance sheets and favorable funding profiles, which can step in to provide credit or to take advantage of potential distressed sales or loans. U.S. large-cap banks, as well as lenders in Asia and Japan, may also benefit.

Pricing Power. Although pricing power has been scarce, it is the key to sustainable earnings growth, as I explained in a recent blog. Companies that are capable of pushing up prices should have an advantage in an environment of sluggish economic growth. There is clear evidence that shares of companies with pricing power dramatically outperform their peers. Our research shows that pricing power is scarce across sectors, although we’re seeing signs of improvement globally in consumer and industrial cyclicals, as well as in North American energy stocks. However, pricing power is eroding in the technology and telecommunications sectors.

Cheap beta. Fears of tail risks, from a breakup of the euro to a global recession, have persisted since the global financial crisis. This has suppressed valuations of high-beta stocks on a price-to-book basis. However, on a price-to-forward-earnings basis, high-beta stocks are now back in line with precrisis levels, following a rally in late 2012 prompted by policy actions across the globe. This means investors need to be more selective about sourcing beta exposure. Against a lackluster economic backdrop, it’s unlikely that a broad acceleration of earnings growth will propel high-beta stocks. Instead, investors should focus on high-beta companies with attractive cash-flow yields, including technology; financials in Europe and North America; transport, defense and capital equipment in Europe; and autos and consumer cyclicals in Asia.

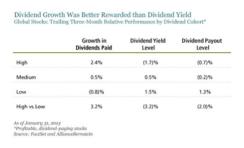

Dividend growth. Investors seeking safe sources of income have crowded into high dividend yielding stocks. We think the high premiums for these stocks — especially in North America — are unsustainable, which explains their recent underperformance (see the chart below). However, in the three months ended January 31, stocks with high dividend growth outperformed those with low dividend growth. So, focusing on companies with strong cash flows that are capable of increasing their dividend payouts is probably a better strategy than piling into expensive stocks with high dividend yields.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Vadim Zlotnikov is Chief Market Strategist for AllianceBernstein.