Brett Cornwell, CFA, Client Portfolio Manager

Oleg Gershkovich, ASA, MAAA, LDI Solutions Strategist

Sponsors were set up nicely for 2022, but June had other plans. Now, in a competitive field of long bond buyers, we see a lot to like in intermediate corporates, private placements and securitized credit.

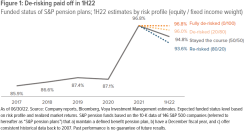

By the end of 2021, corporate pension plans were in their best shape in years. Aggregate funded status among the 146 companies in the S&P 500 with defined benefit plans (“S&P pension plans”) had improved to 97%—up a walloping 10% from 2020 and breaking 90% for the first time since before the financial crisis. The momentum carried into 2022 despite the market downturn, as rising rates led to lower liability values, offsetting asset losses and allowing plans to eke out an additional 2–4% funding improvement. That was through May.

In June, the 8.4% slump in the S&P 500, without a corresponding rise in rates, darkened the silver linings to which sponsors had clung. Pension plans that hadn’t de-risked experienced an estimated 2–3% decline in funded status. By contrast, plans that had begun the shift to fixed income likely saw much smaller deterioration (Fig. 1).

Pivoting to fixed income, the 2022 way

To be blunt, the signals to pivot heading into 2022 were hard to ignore. The industry was abuzz with glide paths breaching multiple times and ALMs re-evaluating—and re-evaluating again—asset mixes, hedge ratios and overlays. Funding ratios were almost too good, and many sponsors raced to solidify gains by shifting to fixed income. At year-end 2021, S&P pension plans had increased average bond allocations to 48%—a major departure from the sub-40% levels of the past decade. Meanwhile, sponsor contributions had declined, as improved funded positions relieved them of both required contributions and their planned discretionary contributions. Many pensions were also benefiting from lower service costs as corporations discontinued plan accruals or closed plans to new entrants.We know anecdotally that the rotation into fixed income likely continued into 2022. Faced with a multitude of uneasy questions about the economy, the merits of de-risking remain clear. But the options for plan sponsors are shrinking.

The good news—The historic decline in investment grade long corporates has created inexpensive buys for pension plans, allowing them to button up their duration matches across the curve with more yield for less risk. This should help them meet their EROA targets and reduce pension expenses.

The less good news—There is a potentially major supply/demand imbalance unfolding. As issuers paused amid market volatility in the first half of 2022, long-dated investment grade supply declined 14% from the same prior-year period to just $733 billion. Our full-year projections point to half a trillion less in issuance compared with 2020, just as plan sponsors are increasing demand for long-duration bonds to hedge interest rate and spread risk exposures of their liabilities. Rising demand in the face of slowing supply could tighten spreads and prompt plan sponsors to expand their investable universe.

Here are some alternatives:

Intermediate credit

Intermediate credit is increasingly seducing sponsors for reasons ranging from economic considerations to plan design issues and derivative-based solutions.1) As discount rates for pensions rose roughly 165–175 basis points during the first half of 2022, durations for the FTSE Pension Liability Index declined about 13%, from 21 years at the start of the year to just over 18 years at the mid-way point. Over the same time frame, the FTSE “Short” Plan Index duration declined from over 13 years to below 12 years.

2) Cash balance plans, theoretically with zero duration, are emerging as a greater portion of liability in pension plans. This has been laid bare by “retiree lift-outs” that are sweeping the pension landscape. The reason: The 30-year Treasury rate, which typically serves as the basis for the annual interest credit to cash-balance accounts, is a negative offset to a plan’s overall duration, thereby accelerating the decrease in a plan’s duration.

3) The flattening yield curve has made the financials of investing in the intermediate portion of the curve more compelling, as it offers similar levels of yield with less risk than long corporates. However, sponsors should mind the credit spread of long corporates, which may garner better excess returns in an environment of tighter spreads. We also recommend evaluating participant plan profiles and duration targets when weighing allocations to intermediate and long corporates. The yield that could be achieved with intermediate is seductive and would need to be paired with overlays to sustain interest rate hedging across the curve.

Private placements and securitized credit

De-risking in the first half of 2022 was matched with an intense focus on diversification. An emerging playbook of combining various assets—including investment grade private placements, commercial mortgage loans (CMLs), agency collateralized mortgage obligations (CMOs) and other securitized credit instruments—has proven to be successful.

Our analysis has shown that diversifying assets, used in combination, have the potential to reduce tracking error to traditional benchmarks or to the liability itself more efficiently than traditional long-duration products. For example, a custom LDI multi-sector solution that blends public and private investment grade credit with modest allocation to CMLs has historically outperformed intermediate corporates over multiple standardized periods, including notable periods of volatility.

Key takeaways

- With funded ratios remaining high in the face of heightened economic uncertainty, we believe the merits of de-risking have only grown stronger.

- A systematic program of allocating across fixed income assets can help mitigate economic risks and manage portfolio duration, as well as aid in plan design.

- Sponsors may consider broadening their investable universe to include intermediate corporates and a combination of LDI diversifiers, such as high-quality private placements CMLs and securitized credit.

| Past performance does not guarantee future results. This commentary has been prepared by Voya Investment Management for informational purposes. Nothing contained herein should be construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained herein are statements of future expectations and other forward‑looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults, (5) changes in laws and regulations, and (6) changes in the policies of governments and/or regulatory authorities. |

| There is no guarantee that any forecasts or opinions expressed in this article will be realized. Information should not be construed as legal, estate tax, retirement or financial planning advice. |

| For financial professional or qualified institutional investor use only. Not for inspection by, distribution or quotation to the general public. |

| CID:2343995 |

| Voya Investment Management 230 Park Ave. New York, NY, 10169, USA (800) 334-3444 investmentmanagement@voya.com |