West Virginia’s Board of Treasury Investments, which manages $8 billion in state operating funds, has dropped BlackRock money market funds from its portfolio, citing concerns over the firm’s focus on environmental, social, and governance investing. The Board of Treasury also cited BlackRock’s holdings in Chinese companies for its decision.

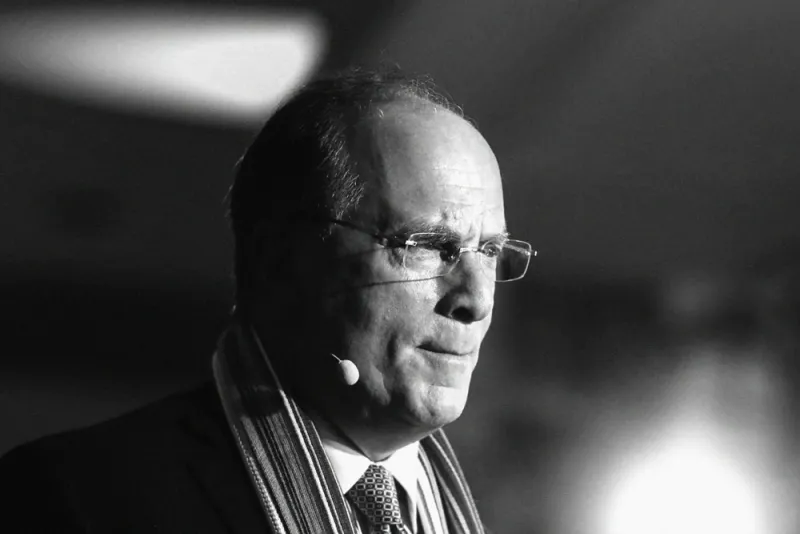

On Monday, hours before BlackRock chief executive officer Larry Fink released his annual letter to CEOs, West Virginia State Treasurer Riley Moore announced the news.

“The decision was based on recent reports that BlackRock has urged companies to embrace ‘net zero’ investment strategies that would harm the coal, oil, and natural gas industries, while increasing investments in Chinese companies that subvert national interests and damage West Virginia’s manufacturing base and job market,” the announcement said.

Although West Virginia’s investment with BlackRock is minuscule — and low fee — compared to the behemoth’s $10 trillion under management, the decision highlights the potential political risk of CEOs like Fink addressing challenges such as the environment, social issues like income inequality, and making decisions based on multiple stakeholders, not just investors in its stock. Last year, in a huge move for an asset manager, Fink declared that “climate risk is investment risk.”

A spokesperson for BlackRock declined to comment on the news. Fink’s letter addressed stakeholder capitalism as well as the asset manager’s emphasis on environmental, social, and governance issues. Among other things, the letter covered the changing world of work, the explosion of new sources of capital, and an initiative to give clients more of a say in proxy voting. “We focus on sustainability not because we’re environmentalists, but because we are capitalists and fiduciaries to our clients,” he wrote.

Fink’s letter showed he is also aware of the criticisms of the firm’s policies based on politics. Fink went on to write, “Stakeholder capitalism is not about politics. It is not a social or ideological agenda. It is not “woke.” It is capitalism, driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper.”

As of December 31, West Virginia’s money market pool held nearly $1.25 million in BlackRock liquidity indexes, according to the state’s monthly holdings reports.

Moore, the Treasurer, said investing with BlackRock “runs contrary” to his duty to ensure that taxpayer dollars are managed responsibly. He also said in a statement that he thinks BlackRock’s decision to invest in China is “a bad strategy,” because he believes the country has engaged in human rights violations and had a role in “creating the COVID-19 global pandemic.” However, the results of a U.S. Intelligence investigation in 2021 found no evidence that the COVID-19 virus was weaponized.

Moore’s message echoes that of a recent ad campaign run by a Washington, D.C.-based “anti-woke” group called Consumers’ Research that targeted BlackRock for these issues. That ad campaign claimed that BlackRock is “investing your money” in China and that the firm’s ESG policies were in violation of fiduciary duty laws. (It’s untrue that BlackRock’s ESG policies are in violation of any fiduciary duty laws.)

West Virginia’s Board of Treasury Investments is one of the first state managers of public funds to explicitly drop an asset manager for its ESG stance, although it may not be the last. In September 2021, a Texas law prohibiting state pension plans from investing with firms that boycott energy companies went into effect. So far, one fund, the Teacher Retirement System of Texas, hasn’t needed to drop any investments from its portfolio, according to the results of a regular year-end audit of compliance with such laws.

Even if TRS had, BlackRock likely would not be on the list of divested firms. According to Fink’s 2022 letter: “Divesting from entire sectors – or simply passing carbon-intensive assets from public markets to private markets – will not get the world to net zero. And BlackRock does not pursue divestment from oil and gas companies as a policy.”

Instead, he added, “We believe the companies leading the transition present a vital investment opportunity for our clients and driving capital towards these phoenixes will be essential to achieving a net-zero world.”