A combination of issuers viewed as sustainability leaders and improvers – companies that got off to a slow start from a sustainability perspective but now demonstrate a clear commitment to sustainability – may provide an attractive risk-reward profile in a sustainability-themed fixed income portfolio. This thesis has been put forth and tested by a team at Aegon Asset Management led by James Rich, Senior Portfolio Manager on the firm’s sustainable fixed income strategy.

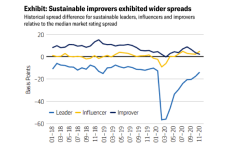

The report, “Sustainability & Credit Spreads: From Leaders to Improvers,” suggests that issuers viewed as sustainability leaders may provide downside protection during heightened volatility, and that improvers may provide higher spreads and upside potential. Based on the analysis of IG corporate issuers within the firm’s sustainable investment universe, sustainable improvers have offered a higher-than-average spread relative to leaders or influencers – a group that is well along the sustainability journey but not quite in the leader category – over a three-year period, after adjusting for duration and credit quality.

After reading the report and its intriguing perspective, II spoke with Rich about it.

How did you arrive at the conclusions you suggest in the paper?

James Rich: Here’s a simple explanation of the analysis: We took our universe of investment grade corporate sustainable leaders, improvers, and influencers and we looked at the spreads of those issuers over time. For all of the bonds of an issuer, we controlled for duration and credit quality by measuring the spread of each security using a regression analysis. Then we aggregated the results into our sustainable categories and looked at how a bond traded relative to other bonds in the Bloomberg Barclays U.S. Corporate Bond Index with a similar credit quality and duration. What we found is that those issuers that meet our proprietary definition of improvers tended to trade wider than average. Leaders tended to trade tighter than average. In other words, adding improvers to a sustainability-themed portfolio may provide opportunities to increase yield. Further, as the improvers enhance their sustainability profile and transition from improvers to leaders, we expect their spreads to compress over time, thus providing potential long-term excess return opportunities.

Are you saying that as improvers adopt more sustainable products and practices, you expect credit risk will decrease over time?

Rich: Yes. We believe that those issuers aligned with long-term secular shifts, such as the pivot toward global sustainability, are also better positioned to manage risk and achieve a durable competitive advantage. In other words, issuers may have higher credit risk when they have lower alignment. But if they’re serious about transitioning and increasing their alignment to sustainability we would expect credit risk to decline and spreads to tighten as the company accelerates its sustainable progress, all else equal.

What criteria do you use to identify a company as a sustainable improver?

Rich: We built a proprietary approach to assess issuers’ alignment with long-term sustainable megatrends. The process is tailored to each fixed income issuer type and considers three key dimensions of sustainability: product and services; business practices; and momentum or commitment to sustainability. For corporate credit, this assessment typically focuses on the percentage of revenue aligned to sustainable initiatives. We also look for a stated intention and demonstrated commitment to continue to grow that percentage. For example, one company we considered an improver hasn’t actually improved – the percentage of alignment with sustainable initiatives is the same today as it was two years ago. They aren’t demonstrating their commitment, so we are downgrading them from improver status to neutral status, which also serves to remove them from the eligible investment universe for our sustainability-themed fixed income strategy.

Why does it make sense to have a sustainability-themed strategy in the first place?

Rich: As long-term investors, we aim to align our clients’ portfolios with long-term secular trends. Whether that be the shift toward e-commerce, digitization, or automation, just to name a few, our job is to identify the long-term winners and losers, and ultimately generate the highest risk-adjusted returns. In our view, sustainability is a key secular shift that is already starting to transform the global economy. Over time, we expect companies that have a high alignment with sustainability will have a better chance of securing a competitive advantage. And businesses that don’t take it seriously are increasingly at risk of falling behind their peers. In some cases, even entire sectors are at risk of falling behind. That is the core of our sustainability-themed fixed income approach.

The paper also posits that sustainable leaders may provide downside protection during periods of heightened volatility. How did you arrive at that conclusion?

Rich: We looked at the performance of sustainable leaders during the March and April timeframe of 2020, when there was a huge downdraft of risk assets. Because leaders trade tighter than average when controlling for credit quality and duration, you might think that in a market downdraft they would be at the highest risk of widening. But what we found in the March and April timeframe was that the spreads of these investment grade corporate issuers did not widen relative to the average for their credit quality and duration – they actually tightened on average. If you look at the data, the leaders were humming along right around 10 basis points tighter than average until early 2020, then they dropped all the way to 50 basis points tighter than average. In other words, the leaders provided stability to the portfolio. Interestingly, the improvers also dipped down, but not as much. So, the combination of the leaders in a downdraft environment and improvers when the market is sailing potentially provide a nice portfolio of downside protection and upside opportunity in a fixed income context.

Source: Aegon AM. Spread data begins January 1, 2018 through December 31, 2020. Reflects the historical mean spread relative to the median rating spread. Includes US corporate bonds in Aegon AM’s sustainable investment universe as of December 31, 2020 based on the firm’s proprietary sustainability assessment. For illustrative purposes only. Refer to the full research paper for additional information.

Does your approach rely on a set percentage of leaders, influencers, and improvers?

Rich: No. We try to find the best long-term investment ideas across the three eligible sustainable categories – leader, influencer and improver. We exclude issuers categorized as neutral or detrimental that do not demonstrate sufficient alignment with sustainable megatrends. In favor of flexibility, we don’t mandate a certain percentage in each eligible category. This allows portfolio managers the ability to identify the most attractive investments within the eligible universe and position the portfolio to reflect their views across sectors, industries, duration, credit quality, etc. Further, as our research suggests, a combination of issuers at various stages in their sustainable journey can provide an attractive risk-reward profile.

Does demand for sustainable investment strategies drive lazy solutions in some cases?

Rich: The risk of greenwashing is certainly picking up. Some asset managers that label their strategies as “sustainable” or even “impact” tend to be more of what we would define as a best-in-class ESG strategy. Such strategies may be overweight companies with the best ESG characteristics relative to industry peers and underweighting those with business practices that lag. Both approaches have their merits, but using third-party research instead of proprietary research, the lack of standards, and convoluted terminology require that investors conduct deep due diligence to truly understand the sustainability profile of the strategy. Other sustainability-themed strategies may focus only on the labeled bond market – green bonds, social and sustainability bonds, etc. Labeled bonds are certainly one way to invest in sustainability, and they are part of our sustainability-themed investing approach, but they’re not the predominant source of sustainable investing opportunities, and greenwashing risk in this segment is rising rapidly as demand grows

For all the reasons I mentioned, we favor a comprehensive approach to sustainability-themed investing that centers on proprietary fundamental research and assesses sustainability across multiple dimensions – products and services, business practices, and commitment to advancing sustainability. We’ve found that those three elements provide a far larger opportunity set of compelling sustainable investment opportunities across the fixed income spectrum.

Related content:

Sustainability & Credit Spreads: From Leaders to Improvers

Green Bonds: Peeling Back the Label

Disclosures

This material is for media use only. It contains current opinions of the manager and such opinions are subject to change without notice. Aegon AM US is under no obligation, expressed or implied, to update the material contained herein. This material contains general information only on investment matters; it should not be considered a comprehensive statement on any matter and should not be relied upon as such

All investments contain risk and may lose value. Responsible investing is qualitative and subjective by nature, and there is no guarantee that the criteria utilized, or judgment exercised by any company of Aegon Asset Management will reflect the beliefs or values of any one particular investor. There is no guarantee that responsible investing products or strategies will produce returns similar to traditional investments.

There is no guarantee that any investment strategy will work under all market conditions or is suitable for all investors. Investors should evaluate their ability to invest over the long-term, especially during periods of increased market volatility. All investments contain risk and may lose value.

This article contains forward-looking statements which are based on the firm's beliefs, as well as on a number of assumptions concerning future events, based on information currently available, and are subject to change without notice. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance and actual outcomes and returns may differ materially from statements set forth herein.

Aegon Asset Management US is a US-based SEC registered investment adviser and is also registered as a Commodity Trading Advisor (CTA) with the Commodity Futures Trading Commission (CFTC) and is a member of the National Futures Association (NFA). Aegon Asset Management US is part of Aegon Asset Management, the global investment management brand of the Aegon Group.

©2021 Aegon Asset Management or its affiliates. All rights reserved.