Emerging markets showed signs of stabilizing last month after a calamitous start to the year. Late-January interest rate hikes by central banks in the so-called Fragile Five countries — Brazil, India, Indonesia, South Africa and Turkey — halted the slides in their currencies. Equity prices began to respond globally, with the MSCI Emerging Markets Index rising 6 percent in the first two weeks of February.

Mathematically, emerging-market stocks look like a screaming buy after three years of heavily underperforming the Standard & Poor’s 500. They’re trading at a 40 percent discount to developed-markets companies on a price-earnings basis, compared to a historical average of 25 to 30 percent and a mere 8 percent during the last emerging-markets boom in 2010, says Russ Koesterich, chief investment strategist at New York–based BlackRock. “The pessimism about emerging markets has gone too far,” Koesterich said on a recent conference call. Yet he immediately qualified his enthusiasm for the beleaguered asset class. Emerging markets are “by no means out of the woods yet,” Koesterich noted. At this point, BlackRock is recommending only “tactical opportunities.”

Koesterich’s caution is echoed by Todd Henry, a Baltimore-based portfolio specialist for emerging markets with asset manager T. Rowe Price. “Are emerging markets oversold?” Henry asks. “Yes. Could they become even more oversold? Also yes.” He predicts a solid rally in emerging-markets equities late this year or early next as better news flow and tempered growth expectations alter the mood of the retail investors who have driven a 10 percent decline in the MSCI Emerging Markets over the past four months.

Money managers don’t expect a dramatic improvement in emerging-markets economies or any new surge in the commodities prices that buoy many of them. But they think investors will adjust to a new normal — China growing at 6 to 7 percent a year rather than 9 to 10 percent, for example — that isn’t nearly as bad as some recent prognostications. “We’ve had some pretty big overshoots in the past few months, driven by fears of a systemic event like the Asian crisis of the 1990s or the Mexican crisis of the 1980s,” says Scott Mather, deputy CIO at Newport Beach, California–based Pacific Investment Management Co. “Today’s environment is very different, with inflation more or less under control and flexible exchange rates in most markets.”

The prospect of rising U.S. interest rates as the Federal Reserve reduces its Treasury bond purchases will continue to drag on emerging markets as it sucks out some of the capital that flowed to them thanks to near-zero returns elsewhere. But that should be offset by accelerating global growth and a resulting jolt in emerging-markets exports. “The Fed tapering seems less threatening when you consider that the U.S., the EU and China are all growing simultaneously,” says Joseph Quinlan, chief market strategist at Bank of America’s investment strategies group.

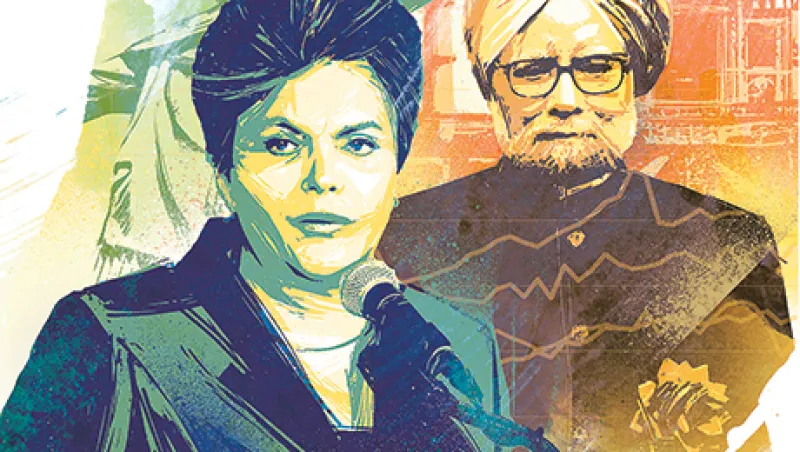

Emerging markets should also pick up as calmer investors start differentiating among them more effectively, experts say. Quinlan’s country picks are Mexico, Poland and South Korea. This diverse group shares political stability, sustainable debt and current-account balances, and strong links to reviving export markets: the U.S., the EU and China, respectively. Henry of T. Rowe Price likes India on the premise that opposition leader Narendra Modi, who has overseen an economic boom as governor of Gujarat state for the past 12 years, will sweep to national power in this spring’s elections. Incumbent Prime Minister Manmohan Singh has said he will step down whatever the result. Henry also focuses on growth sectors within other BRIC markets, like Chinese utilities as they bring new alternative-energy capacity onstream and Russian consumer staples as listed companies consolidate a fragmented market.

Pimco’s Mather likes the prospects for emerging-market bonds as interest rate hikes lure back capital, bolster currencies and attack inflation. The collateral damage to growth is more of an equities investor’s problem, he contends: “Low growth and low inflation is a good environment for fixed income.” Mather is particularly bullish on sovereign bonds issued by Mexico and Brazil. For the latter, the “eclectic policy mix” of President Dilma Rousseff has masked sound credit fundamentals. “There is a big market overreaction to every little negative number out of Brazil,” he says.

But perception is a large part of reality in financial markets, all the more so this year as 23 developing countries face national elections, including Brazil and Indonesia along with India. Mather argues that the most remarkable aspect of this political megacycle may be that no high-profile country is threatened by a radical change of course no matter who wins. But the transitions will sow uncertainty anyway, the last thing battered emerging markets need.