Erika Murphy, Portfolio Manager, for Fidelity Investments

Key takeaways

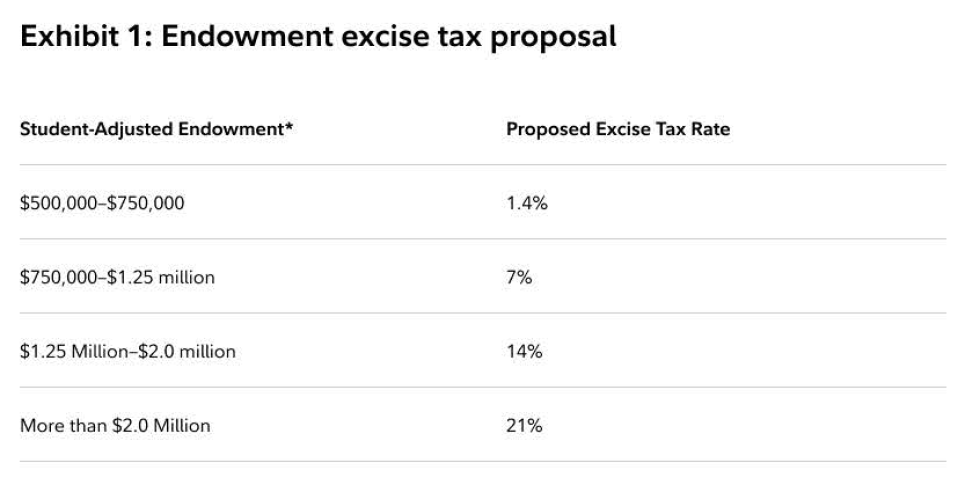

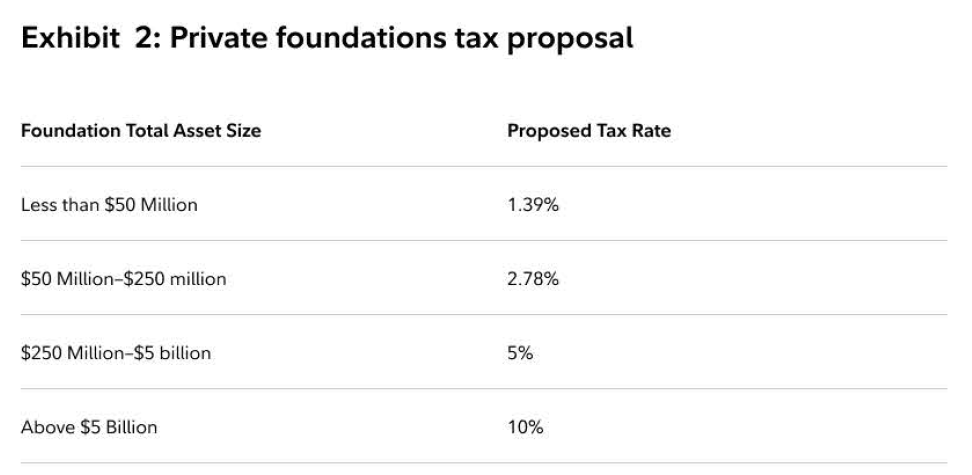

- The “One Big, Beautiful” tax bill targets certain endowments and private foundations with a tiered excise tax structure, imposing rates of up to 21% and 10%, respectively.

- Organizations may need to increase risk to maintain after-tax return targets and consider asset allocation shifts such as a greater emphasis on private equity and tax-efficient strategies.

- Thoughtful manager and fund selection will be critical to sustaining long-term growth, with a strategic tilt toward active, tax-aware, and ETF-based strategies that help minimize tax drag.

- Nonprofits should also reassess their spending policies, potentially lowering annual spending rates to help preserve long-term wealth.

Nonprofits brace for higher taxes

The House of Representatives in late May narrowly passed proposed legislation that could cut taxes–including extending the 2017 Tax Cuts and Jobs Act (TCJA) provisions–if the Senate approves. To help offset the tax breaks, lawmakers must come up with at least $1.5 trillion to $2 trillion in spending cuts and find additional revenue sources.

As a result, nonprofits are in the crosshairs as the “One Big, Beautiful Bill” proposes increasing the existing tax on educational institutions’ endowments and private foundations.1 The bill would replace the current flat 1.4% excise tax on the net investment income of certain2 private colleges and universities’ endowments with a tiered structure as shown in Exhibit 1 below, depending on several variables including the endowments assets and the number of full-time students who meet certain requirements.

Source: H.R.1 - One Big Beautiful Bill Act. 119th Congress (2025-2026). May 27, 2025.

*The term student-adjusted endowment means the aggregate fair market value of the assets (determined as of the end of the preceding tax year), other than those assets which are used directly in carrying out the institution’s exempt purpose, divided by the number of eligible students of the institution.

The bill also proposes increasing the tax rate on the net investment income of certain private foundations, applying a tiered tax scheme of as much as 10% for the largest such organizations. Previously, such private foundations were subject to a 1.39% excise tax on their net investment income.

Source: H.R.1 - One Big Beautiful Bill Act. 119th Congress (2025-2026). May 27, 2025.

While the Senate may still revise the proposal, the current political landscape–and the significant challenge of identifying trillions in spending cuts–makes it increasingly likely that endowments and private foundations will face higher taxes in the near term.

An increase in the tax would effectively impose an additional return hurdle on these nonprofit organizations, making it more challenging for them to meet their long-term return objectives. In response, these organizations may need to adjust their investment strategies–by raising their return and risk targets, focusing on maximizing after-tax returns, and/or reducing their annual spending.

Strategies to potentially maximize post-tax returns

There are several strategies endowments and private foundations can employ to enhance after-tax returns. These include adjustments to strategic asset allocation, careful selection of managers and funds, more deliberate use of active asset allocation tilts, implementation of more tax-efficient strategies, and the adoption of flexible withdrawal schedules.

1. Strategic asset allocation

- Target higher returns. Taking on more risk–typically by increasing equity exposure–may be necessary to achieve a higher pre-tax return to help offset the impact of taxes.

- Incorporate selective private assets, especially in private equity. Historically top-tier private equity funds have helped boost returns compared with investing solely in publicly traded equities. Private equity investments can be particularly advantageous in this context, as their long-term time horizon may help defer the realization of taxable net income. For other private assets that are income-oriented, it is important to assess the returns on an after-tax basis to ensure that absolute returns are high enough to warrant an allocation.

2. Manager and fund selection

Returns after-tax are hard to estimate at the asset class level, and at the fund or manager level due to the unpredictability of realized gains. As a result, tax-sensitive allocators must weigh their conviction in expected pre-tax returns (including potential excess returns) against the potential tax drags associated with each building block in their portfolio. In some cases, certain funds or managers may offer attractive returns on investments even after accounting for taxes. When such strategies are hard to find, other options to help maximize after-tax returns may include:

- Allocating to more passive funds since these tend to trade and distribute realized gains less frequently than active strategies.

- Allocating to tax-aware active managers who proactively harvest tax losses and seek to offset realized gains where possible.

- Allocating to ETFs (both active and passive) as their unique structures provide more favorable tax treatment compared to mutual funds and other commonly used institutional fund structures.

- For larger organizations, investing through tax-managed separately managed accounts (SMAs) where tax-loss harvesting at the individual security level can be an effective tool to minimize realized net income.

3. Active asset allocation and rebalancing

Given the need to target higher pre-tax returns, some endowments and private foundations may want to consider tilting their portfolio toward their highest conviction asset allocation ideas. Active tilts should avoid unnecessary turnover and be guided by a tested and risk-managed process. This strategy should only be implemented if the expected net income or gain from these tilts are higher than the expected tax drag. In addition, organizations may wish to widen rebalancing bands to minimize realization events caused by programmatic rebalancing processes.

4. Withdrawals

Withdrawals from investments to support a nonprofit's annual spending needs could result in realized net income, which may trigger tax liabilities for organizations subject to the tax.

- To mitigate this, we recommend raising cash opportunistically to fund annual spending, specifically during periods of weak portfolio returns, rather than adhering to a fixed quarterly or annual withdrawal schedule.

- For endowments and private foundations with more spending flexibility or a strong focus on preserving long-term real wealth, another option is to lower their annual spending rate to minimize taxes. This must be carefully weighed against other trade-offs, particularly those related to advancing the organization’s mission.

Conclusion

For investors who may be subject to higher taxes and who engage Fidelity as their outsourced chief investment officer (OCIO), we recommend a hybrid approach: modestly increasing the return and risk profile of their strategic asset allocation, incorporating private equity, and integrating tax-efficient strategies where appropriate – without compromising our highest-conviction investment ideas.

As noted consultant to endowments and foundations Charles Skorina recently wrote, “OCIOs, as taxable entities, are adept at minimizing capital gains and maximizing after-tax returns. For nonprofits facing increasing investment complexity and regulatory demands, now may be an opportune time to consider shifting some assets to an OCIO. These firms can effectively replicate a full investment office, offering the structure and expertise needed to navigate today’s financial landscape.”

Learn more about Fidelity Institutional Solutions for Endowments and Foundations

To access more content, please visit Fidelity’s Communities on Alternative Investments.

Erika Murphy, CFA, CAIA, is a portfolio manager in the Global Institutional Solutions (GIS) group at Fidelity Investments. In her role, she designs and manages custom multi-asset class mandates for institutional investors including endowments, foundations, and nonprofit organizations. The team is dedicated to serving the needs of institutional asset owners that seek support in strategic asset allocation, ongoing portfolio management, and customized portfolio design and implementation.

Charles A. Skorina, managing director executive search & OCIO consulting, contributed to this piece.

Unless otherwise expressly disclosed to you in writing, the information provided in this material is for educational purposes only. Any viewpoints expressed by Fidelity are not intended to be used as a primary basis for your investment decisions and are based on facts and circumstances at the point in time they are made and are not particular to you. Accordingly, nothing in this material constitutes impartial investment advice or advice in a fiduciary capacity, as defined or under the Employee Retirement Income Security Act of 1974 or the Internal Revenue Code of 1986, both as amended. Fidelity and its representatives may have a conflict of interest in the products or services mentioned in this material because they have a financial interest in the products or services and may receive compensation, directly or indirectly, in connection with the management, distribution, and/or servicing of these products or services, including Fidelity funds, certain third-party funds and products, and certain investment services. Before making any investment decisions, you should take into account all of the particular facts and circumstances of your or your client’s individual situation and reach out to an investment professional, if applicable.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the authors and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Registered investment products (including mutual funds and ETFs) and collective investment trusts managed by Fidelity Management Trust Company (FMTC) are offered by Fidelity Distributors Company LLC (FDC LLC), a registered broker-dealer.

Fidelity Institutional Asset Management (FIAM) investment management services and products are managed by the Fidelity Investments companies of FIAM LLC, a U.S. registered investment adviser, or Fidelity Institutional Asset Management Trust Company, a New Hampshire trust company. FIAM products and services may be presented by FDC LLC, a non-exclusive financial intermediary affiliated with FIAM and compensated for such services.

Fidelity Investments is an independent company, unaffiliated with Institutional Investor LLC. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity Investments, nor is such a relationship created or implied by the information herein. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Investments® provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC; and institutional advisory services through Fidelity Institutional Wealth Adviser LLC.

1208297.2.0