Jim Iuorio, for CME Group

At a Glance:

- The quantitative easing policy that began in 2020 has transformed into a quantitative tightening policy as the Federal Reserve looks to combat demand-driven inflation

- The Fed recently reduced the amount of bonds they were allowing to roll off their balance sheet from $35 billion to $25 billion per month

Quantitative Easing vs Tightening

To fully understand what quantitative tightening is, it's helpful to describe the characteristics of the policy’s mirror image, quantitative easing (QE). QE is a program designed to stimulate the economy in several ways.The Federal Reserve creates money and then uses that money to buy government bonds from the U.S. Treasury. The goal is to push up the price of the bonds which decreases the interest rate. By providing a stable bid for U.S. Treasuries, so the government can sell bonds at inorganically higher prices, the government debt service costs are reduced.

The program also is designed to, initially, provide an incentive for other global institutions to buy bonds alongside the Fed. The theory is that if the Fed is the buyer of last resort, then buying the asset the Fed is buying has less principal risk. Over time, the long-end rates are theoretically reduced to levels that make them unattractive to risk capital. Those investors would then potentially move into assets that typically carry more risk like stocks or corporate bonds, and this will have a stimulative effect on the economy.

Balance Sheet Management

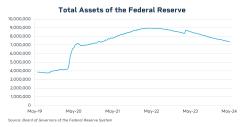

On March 23, 2020, the Federal Reserve announced an unlimited quantitative easing policy. In the subsequent two years, the Fed created $5 trillion that they used to buy bonds from the Treasury. This increased the Fed's balance sheet (bonds they possess) from $4 trillion in the spring of 2020 to $9 trillion in the spring of 2022. The policy also increased the M2 money supply by a similar amount and stimulated the economy. Unfortunately, this came with the side effect of higher inflation.

The Treasury then needs to replace the money they gave back to the Fed and they do so by going into the open market and selling new bonds. The typical net result of QT is that bond prices go lower (rates go higher) due to the increase in supply that needs to be sold without the luxury of a Fed bid.

Fed Intervenes After Bank Failures

Since the Fed began its quantitative tightening policy their balance sheet has declined from $9 trillion to $7.4 trillion as of early May. However, the process has not been without hiccups. In March of 2023, the country experienced a banking mini-crisis as it came to light that many U.S. banks held large amounts of longer-duration Treasury bonds. These bonds had lost approximately 30% of their value, as prices plummeted due in part to the Fed no longer playing the role of buyer of last resort.When the crisis began, the Fed quickly pivoted back to a form of QE by opening the “Bank Term Funding Program” which bought almost $500 billion of bonds from the distressed banks. The Fed paid par value for the bonds despite their market value being significantly lower. This bolstered the troubled bank balance sheets and appeared to halt the crisis. Of course, in doing so, the Fed had to create more money and greatly increase the size of their own balance sheet.

Tackling Inflation

The Federal Reserve’s path of QT over the last two years was to allow $35 billion in bonds to “roll off” each month. At that pace, it would take over 20 years to reduce a $9 trillion balance sheet to zero, if that were the goal. The goal, though, is to reduce excess liquidity in the system and raise rates to combat demand-driven inflation.Despite the recent resurgence in inflation, on May 1 the Federal Reserve announced a reduction in the amount of bonds they were allowing to roll off, from $35 billion per month to $25 billion per month. This is a significant change. Yes, the Fed remains committed to draining liquidity from the monetary system but the move made it seem that they may be a little less committed than we had previously believed.

Watch Jim Iuorio discuss QT on Bloomberg Quicktake

Is this an ease? The answer to that question is complicated and depends on if you think that less tightening than anticipated equals an ease. The market appears to believe so, as gold, silver and stocks all rallied off the news.

Perhaps the Fed is concerned about recent economic data like the 1.6% GDP number on April 25, the disappointing ISM on May 1 and the weaker employment data that was released on May 3.

Currently, the Fed continues to suggest that the economy is solid and that its main focus is its fight against inflation. However, these recent events may convince some investors that the Fed believes there are growing risks to the economy and that perhaps moving away from an aggressive QT strategy may be an important initial step before resorting to conventional rate eases.