After having just immersed myself in a week of discussions about passive investing and why active managers are doomed to underperform, including an interview with Gene Fama, the 2013 Nobel laureate in economic sciences who developed the efficient market hypothesis, I feel downright guilty reporting on a study showing how investors can find good stock pickers.

The research, however, comes from Capital Group, adviser to the American Funds family, a well-respected active firm that does a lot of things right. The Los Angeles–based firm shuns hot shots in favor of multiple portfolio managers, each of whom oversees part of a fund. Capital also rewards people for longer-term results and for sharing information among colleagues, and the firm sticks to its investment philosophy, regardless of what’s happening in the outside world. Its team approach gets at one of the biggest enemies of active managers: being too big to find winning investments. “No other organizational design deals so effectively with the daunting challenges of actively managed large funds,” wrote Greenwich Associates founder Charles Ellis in his 2013 book, What It Takes, which includes a detailed analysis of Capital.

As an active manager, American Funds has plenty of incentive to do research showing that a subgroup of stock and bond pickers can outperform index funds, including its own. Investors are increasingly buying the passive argument: Few active managers can beat the market, so why pay them high fees to try? they reason. And even though there are those that produce great results, fat chance you can find them before it’s clear in the numbers and they’re ready to retire.

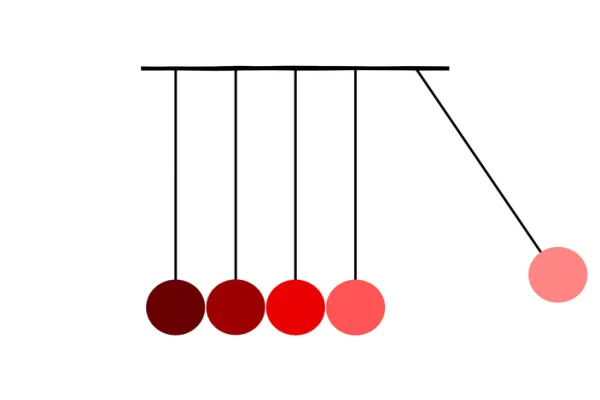

It seems intuitive to me, though, that some simple screens could at least weed out the obviously bad and mediocre firms. As a longtime reporter on asset managers, I meet them all the time (or try to avoid meeting them all the time). Weeding out the mediocre is essentially what Capital Group is doing, albeit in a more scientific way. “People seem surprised that the average active fund doesn’t beat the benchmark,” says Steve Deschenes, head of client analytics, who spearheads the research. “But that’s like taking the average height of all people in a room, and expecting more than half of them to be taller than the average.”

Deschenes interviewed plan sponsors, institutions, consultants and others to assemble a list of the factors that they use to select funds, and then he analyzed each of them to determine which are reliable and predictive indicators of outperformance in the future. Two stood out at first: low-cost funds and portfolios in which managers owned a big share of the money they managed. If investors shunned the three quarters of funds that were the most expensive, they doubled their chance of success in picking winners. In aggregate, using rolling returns, only 24 percent of all active funds beat benchmarks over the past ten years. When investors chose funds in the lowest quartile of expenses, they upped their chances of picking benchmark-beating managers to 40 to 50 percent. When it came to funds in which the managers had significant ownership, the odds of picking an outperforming fund went up even more. In fact, low-cost funds that also had high degrees of ownership by their managers outperformed their benchmarks almost 100 percent of the time. The outperformance was a significant 200 basis points on average. “Manager ownership is a proxy for a good culture, which would correlate with things like lower turnover and low costs,” says Deschenes.

Still investor flow data is grim from an active manager’s perspective. Net sales of indexed mutual funds were positive in every category, except alternative investments, from January 2015 to the end of August, according to Morningstar. Index funds can be a great solution for many investors. They’re transparent, predictable and cheap. But active management remains attractive — and in some cases, preferable. With the first index fund celebrating its 40th year, Deschenes did some calculations. An investor who socked away $10,000 in an S&P 500 index fund four decades ago would now have $560,000. That same wad of money invested in five American funds that mirrored the S&P 500 would be worth $1.15 million — net of fees. Many investors would opt for the latter.

Get more on index funds.