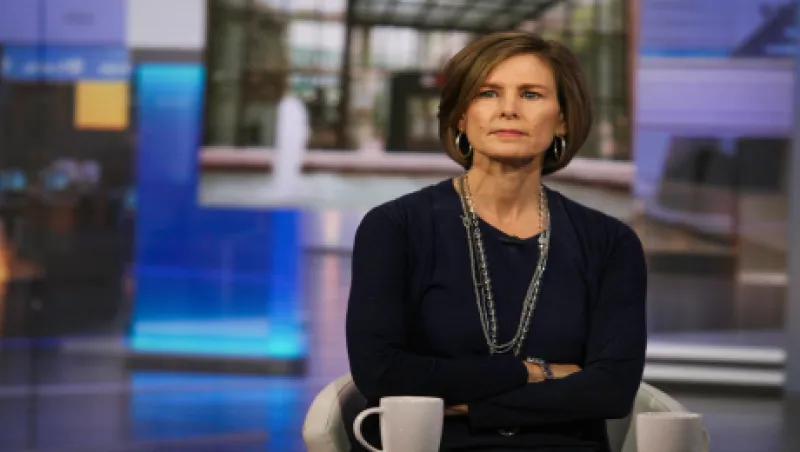

Last May, when BlackRock announced it had hired Deborah Winshel to head up BlackRock Impact, its new impact investment business, the news elicited mixed feelings in the closely knit impact investment community.

Practitioners and supporters of impact investment were delighted to see New York–based BlackRock, the world’s largest money manager, with $4.5 trillion in assets, enter the fray. They were also impressed that the firm tapped someone with the stature of Winshel, who had previously served as president and chief operating officer of Robin Hood Foundation, the antipoverty nonprofit founded by hedge fund manager Paul Tudor Jones.

But although BlackRock’s move into the impact arena gives the nascent sector a serious shot of mainstream credibility, some wondered what Winshel’s bosses, BlackRock CEO Laurence Fink and global head of multiasset strategies Richard Kushel, knew about impact investing or what the firm could bring to a sector still dominated by not-for-profits and early adopters.

Quite a bit, it turns out.

BlackRock has about $200 billion in assets that fall under the oversight of BlackRock Impact. The vast majority of those funds are invested in public securities and screened to exclude issuers involved in activities that investors want to avoid for religious, ethical or other reasons. The total also includes some so-called ESG funds, which actively consider environmental, social and corporate governance factors in investment decisions. And BlackRock has some traditional impact investments, which direct capital to solve specific social or environmental problems. The last category can include infrastructure investing and renewables.

Winshel is a passionate advocate for measurement. The Robin Hood Foundation is perhaps best known for applying Wall Street–style data analytics to the process of giving donations and monitoring grantees. Winshel sees ESG data playing a similar role for corporations and their investors. As reporting and transparency standards improve globally, “the spotlight is on companies to report,” Winshel says. “Checking a policy box is not going to be adequate information for investors.”

It’s not only environmental factors that are weighing on investment decisions. The recent actions of large corporations — Dow Chemical Co., IBM, American Airlines, PayPal and Apple, among them — to oppose anti-LGBT legislation in states such as North Carolina are a sign that more companies understand that they need to take a public stand on social issues. Online forums such as employer-rating site Glassdoor can give data-hungry investors such as BlackRock true insight into issues such as employee diversity and worker retention at large corporations.

As the data and reporting in both the public and private markets improve, so too, Winshel believes, will the ability of investors to measure the impact of their funds. Institutional Investor Senior Writer Imogen Rose-Smith sat down with Winshel today, Earth Day — for which BlackRock Impact launched a new sustainable development exchange-traded fund — to talk about her first year on the job.

Institutional Investor: Why make the decision to move out of the not-for-profit sector into the for-profit asset management industry?

Winshel: I started out at J.P. Morgan, so the for-profit sector is not new to me. Robin Hood was very much about measurement and metrics and how you could bring those disciplines to fighting poverty. When I started talking to BlackRock about impact, it seemed like a remarkable opportunity to take all that I cared about and learned with Robin Hood and at the Metropolitan Museum of Art [where she was chief financial officer for eight years] and bring it to scale.

What does impact investing mean at BlackRock?

We decided early on to define impact in very broad terms: what you could call sustainable investing with a focus on outcomes, measurement and producing competitive financial returns. We have three different businesses: screening; ESG, which has taken on significant relevance to more and more investors; and impact. We talk about how we integrate ESG across all our platforms, and we develop ESG strategies. That is also true of impact in general. Some qualities, especially around transparency and reporting metrics, we are extracting to integrate into our existing portfolios. Our long-term objective is really to build strategies across all asset classes.

One of the real challenges facing impact investors is how to measure the desired social or environmental impact their dollars are having, as well as the economic return on investment. Is this a problem that BlackRock Impact is setting out to tackle?

Everything we look at, we step back and ask, ‘What metric can we introduce and incorporate?’ For example, we recently started work with a client to develop impact metrics for an infrastructure investment. As those measurements get more refined, we could consider using them as a screen. That is a very big part of impact at BlackRock. We are also looking at ways that our quantitative investors can leverage their big-data analytics capabilities to gain additional insights, beyond standard company reporting and disclosure. We at BlackRock also have a tremendous risk management platform, Aladdin. We’ve incorporated ESG data into that, so all of our investors can see the ESG in their portfolios.

Do you see a lot of investor interest in climate-related strategies?

Yes. Climate is one of the easiest areas to put metrics around, and it is very much front of mind for us right now. In addition to our existing funds like CRBN, our low-carbon-target ETF, we recently launched our second renewables fund. Four years ago, when we launched global renewables, the product was very popular, though if you talked about ‘climate change,’ investors were not interested. Now that has changed. At the same time, we want to be broader than climate change alone. For example, today, on Earth Day, we are launching an ETF related to the U.N. Sustainable Development Goals. We also see a lot of opportunity in social areas such as diversity and health. We also see opportunities to transfer what we are doing in the equity markets into fixed income. The insights from our research port from one asset class to another pretty easily.

Among what groups of investors are you seeing the most interest?

There are pockets and elements of interest in virtually every type of investor that we work with. Family offices are interested in impact. Some of the foundations and endowments have been doing this for a while. Others are just dipping their toe in the water. On the retail side, we are finding that there is a broad array of interest. It’s not just screening, although that has been a growth area for us. Millennials and women managing their own finances have tended to care more about these issues.

Insurers are another group showing interest in impact investing, particularly when it comes to climate change. Some insurers are starting to look at climate as a very real risk, and that is starting to cross over to their investing. Interest also varies by region. The European pension investor is looking to make sure asset managers are integrating ESG. Meanwhile, the Department of Labor announcement this past fall concerning the consideration of so-called nonfinancial factors in investment decision making is spurring similar activity from U.S. pensions.

BlackRock Impact itself does not manage money. So how does the fund development process work?

We partner with people inside the different business units. We have a lot of volunteers around the firm. This has generated a lot of enthusiasm; it is catching on with management and also Millennials. Every week I have someone contacting me asking to go for coffee. By starting with partners in areas in which our interests are naturally aligned, the development got to be almost contagious.

What in your first year has surprised you most about impact investing?

It is evolving much faster than I predicted. A couple of things have happened, including the climate agreement in Paris and the announcement in late September of the U.N. Sustainable Development Goals, that are making it move more quickly. By starting the platform last year, we were well positioned to respond to these events. The level of support we have received internally across the entire organization has been tremendous.

Follow Imogen Rose Smith on Twitter at @imogennyc.