By Chan Samadder, Head of Equity ETF

Around now, our thoughts tend to turn to summer holidays and relaxing days by the beach. But before you take time off, make sure your portfolio won’t do the same – check the forecasts and ensure it has the requisite protection. Like an unruly child venturing too far out into the surf (or an English central defender dwelling on the ball), today’s markets and politics demand constant attention. Here’s Lyxor’s guide to improving your chances of a successful and stress-free summer:

Be prepared for bad weather

We advise caution in the current atmosphere of trade wars, geopolitical tensions, rising populism, and the omnipresent uncertainly over the timing and/or extent of the withdrawal from ‘super loose’ monetary policies. We expect some stormy conditions – especially among equities – as the cost of debt spirals and the global economy peaks. Decent returns will be harder to find, especially in more mainstream destinations, so for peace of mind we’re focusing on getting off the beaten track and using risk reducers and other protection strategies.

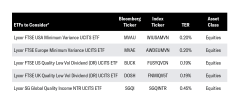

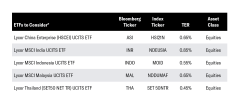

ETFs to consider*

Choose your destination wisely

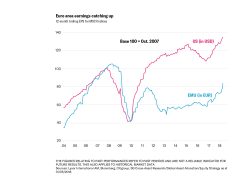

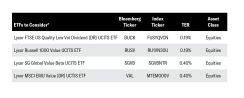

There are some bright spots, however, so we’re not entirely risk-averse. Europe’s busy political agenda could delay policy tightening, and the current soft patch is temporary in our eyes. Any rebound should trigger a catch-up of earnings growth and support stocks. For now, though, due to political issues, we’re not as positive as we once were – but France looks attractive on the back of strong structural reforms. We continue to favour cyclical sectors such as consumer discretionary, as well as construction and materials. They are well positioned to benefit from the domestic recovery and have been deleveraging and improving their solvency in the last couple of years. We’re steering clear of most conventional European bonds.

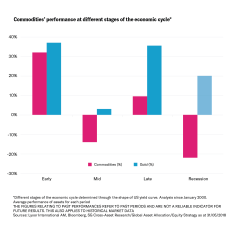

We remain positive on commodities, but prefer base metals and oil, both of which should continue to be supported by strong fundamentals as recovering demand meets with struggling supply. Oil comes with a little more downside risk, however. We’re also interested in those commodity-linked assets, such as the FTSE 100, which lagged the initial commodity price recovery.

Inflation as an asset class remains of interest, and breakevens may represent the path of least resistance over the coming months. They also offer diversification benefits which could prove beneficial as we head for the exit from a low inflation, low volatility world.

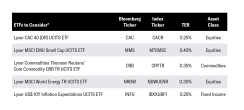

ETFs to consider*

With developed markets overcrowded and overvalued, it could be time to spread your wings to some more exotic destinations. We like China, but it could be time to include a few more emerging markets in your plans. A number of other countries offer external surpluses, low inflation, and reasonable growth, and could now be better value after the recent sell-off. This should provide protection when the greenback’s run of strength eventually gives way. It could be time to renew your focus on Asia’s domestic stories given external risks might rising. Onshore Chinese equities benefit from reasonable growth, increased accessibility, and low correlation with developed equities. ASEAN markets also appeal as could, in time, India.

ETFs to consider*

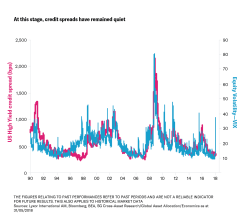

Travel only in good company

The US economy has been more resilient than its counterparts in Japan and the eurozone. However, its economic surprise indicator has already passed its peak. Corporate bonds should come under pressure as corporate debt piles up – further encouraged by fiscal reform – and the Fed tightens. If you do have to hold credit, we’d suggest making any journey brief. When debt fears rise and balance sheets come under the microscope, equity volatility also tends to increase, providing an incentive to reduce or reshape your equity exposures. A greater weighting to quality income or value stocks could be a solution at this late stage of the cycle.

FOR PROFESSIONAL CLIENTS ONLY

All views & opinion: Lyxor Equity ETF & Lyxor Cross Asset Research teams, as at 13 June 2018. Charts sourced from SG Cross Asset Research team (“Expect less for longer”). Past performance is no guide to future returns. *All TERs correct as at 13 June 2018.