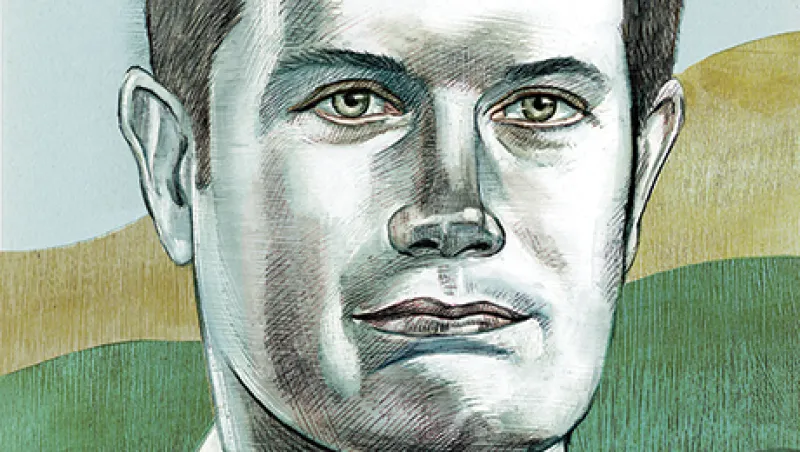

Tilden Park Capital Management co-founder and CIO Joshua Birnbaum possesses the classic traits of a great trader: discipline, patience and intestinal fortitude, as well as the ability to see the big picture and think on his feet. All were on display the morning of April 27, 2010, when Birnbaum and three other Goldman Sachs Group executives appeared before a U.S. Senate subcommittee to testify on their firm’s role in the 2008 financial crisis.

“It was political theater,” says Birnbaum, 41, who as co-head of Goldman’s structured products group had generated $3.7 billion for the bank in 2007 by shorting the subprime mortgage market. During the five-and-a-half-hour hearing, the four executives came under repeated attack as senators questioned why Goldman sold subprime securities to investors at the same time that it was shorting them. Birnbaum calmly defended his actions, describing the factors that led him to turn negative on the subprime market in late 2006, the short positions his group put on and the instructions by senior management to reduce those positions in the spring and summer of 2007.

“It was frustrating to us that the tenor of our holding period wasn’t commensurate with the opportunity,” explains Birnbaum, who says Goldman could have made two to three times what it did if management had kept the short positions. “Nothing against our managers at the time — Goldman is a bank, it’s not a hedge fund, and they were doing their jobs — but we realized that this was not necessarily the right platform for us.”

Birnbaum left Goldman in April 2008, after more than 14 years with the bank. He was followed by Jeremy Primer, a Goldman research strategist who had developed computer models to assess the likelihood that the mortgages underlying the securities the firm traded would be paid off early. By the second half of 2006, Primer and his team at Goldman had built a model to analyze options on the newly created Asset-Backed Securities Index (ABX), which tracked the value of subprime mortgages. That model tipped off Birnbaum that the subprime market was severely mispriced, confirming his assessment of the sector’s rapidly deteriorating fundamentals. “What I saw in Josh was that he was not just a trader but a builder of businesses,” says Primer, 49, Tilden’s chief risk officer and head of research, who has a master’s in math from Harvard University. “So I left Goldman to participate in the growth of a new firm.”

The two longtime Goldman colleagues soon had a third partner, Sam Alcoff, who had known Birnbaum since they were undergraduates at the University of Pennsylvania in the early ’90s. In 2008, Alcoff was working in the technology and risk management group at New York–based hedge fund firm Drake Capital Management, but the bulk of his career had been spent at asset management giant BlackRock. As co-head of BlackRock Solutions’ software engineering group, he helped develop the architecture for its trading system applications and infrastructure.

|

By summer 2008, Alcoff, Birnbaum and Primer had leased office space in New York and begun to build their business. They made the unconventional decision to turn away outside money initially and focus instead on building valuation, analytical, risk management and back-office systems and growing their team. “Part of what made us successful was that we were very process-driven, and that meant having a robust set of tools that allowed us to come up with our investment approach,” Birnbaum says. “We took the approach that we were going to build this stuff on our own dollar.”

The build-out took 18 months. Tilden — named after a park near Oakland, California, where Birnbaum grew up — started investing in February 2010 with a $25 million managed account. “We used to joke that we were the smallest fund with the biggest infrastructure,” says Alcoff, who has a JD from Villanova University School of Law in addition to his BS in engineering from Penn. A year later the firm launched the Tilden Park Investment Master Fund. Today it has 25 people and manages $2.3 billion. Through April the master fund delivered a total cumulative return of 101.8 percent and experienced just two down months.

Tilden Park invests both long and short across a variety of asset classes, including mortgage-backed securities, nonmortgage asset-backed securities, collateralized loan obligations, equities and credit default swaps. The firm does capital structure analysis, rotating between stocks and credit depending on where it sees value. “In 2012 we were essentially constructive on credit versus stocks,” says Birnbaum, who graduated from Penn’s Wharton School with a degree in finance before joining the mortgage group at Goldman. “We flipped that switch in 2013, fortunately, because stocks ripped.”

Tilden’s investment strategy combines top-down macro themes with bottom-up securities selection. At the macro level Birnbaum and his investment team try to identify broad trends, employing both their quantitative models and qualitative judgment. At the same time, Tilden’s traders look for attractive individual investment opportunities. “If you boil it down to its most simplistic level, what we’ve been effective at doing is identifying cheap options,” Birnbaum explains.

In the spring of 2012, one of Tilden Park’s traders came across an option whose price was seriously out of whack. Further investigation led the firm to the source of that option, Bruno Iksil, the JPMorgan Chase & Co. trader known as the London Whale because of the size of his positions. Tilden Park was one of just a handful of hedge fund firms to make money betting against the London Whale, whose ill-fated trading strategy led to $6.2 billion in losses for JPMorgan that year — and more fame for Birnbaum.