The managers of Highbridge Capital Management are in discussions to buy the alternative investment firm back from its commercial bank parent, JPMorgan Chase & Co., which would undo the biggest tie-up between a hedge fund manager and a major bank, according to sources with knowledge of the talks.

JPMorgan could agree to sell all, or part, of Highbridge, which manages $26 billion in assets. Sources say Highbridge executives have been considering a management buyout for some time, and that discussions with JPMorgan have been going on for at least six months.

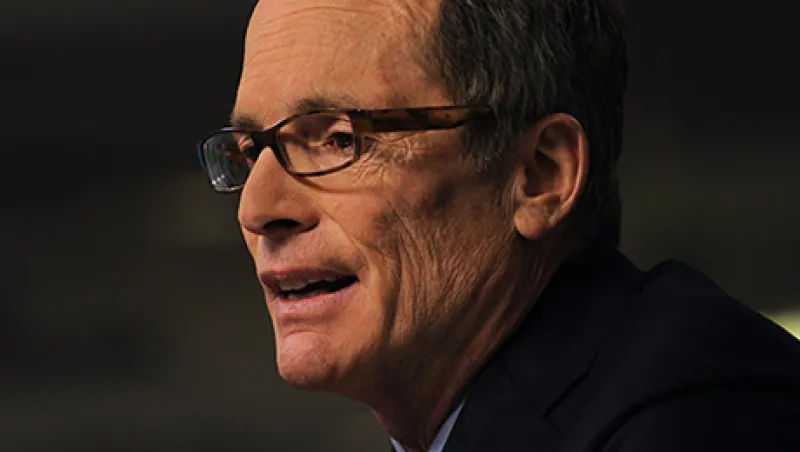

The Highbridge management team, which is led by CEO Scott Kapnick, will need financing for the deal and could seek an investment from a third party. A spokesman for JPMorgan declined to comment. Highbridge CEO Scott Kapnick did not respond to email requests for comment.

The talks are mostly focused on the firm’s $18.6 billion credit business, Highbridge Principal Strategies, a credit and private markets investment arm that Kapnick has developed since he was recruited from Goldman Sachs Group in 2007. The firm’s public markets hedge fund business has $7.3 billion in assets. Its multistrategy fund, which was Highbridge’s flagship vehicle before the crisis and had $9.7 billion in September 2008, is much smaller today because of middling performance and redemptions.

An alternative investment firm will typically sell for around five times revenue, according to an investment banker, compared with three times revenue for a long-only asset manager.

New York–based Highbridge was founded in 1992 by Glenn Dubin and Henry Swieca, friends since they had grown up together in the same Washington Heights neighborhood. The firm began as a convertible arbitrage manager before diversifying to become a multistrategy fund. In 2004, right before the blowout of the convertible arbitrage market, Highbridge sold a 55 percent stake to JPMorgan. Terms were never disclosed, but the purchase was reported to cost the bank $1.3 billion. Highbridge always maintained a separate identity, and separate offices, from J.P. Morgan Asset Management, the bank’s conventional investment management arm.

At the end of 2007, JPMorgan was the world biggest hedge fund manager with $44.7 billion in assets, including $27.8 billion at Highbridge and $16.9 billion at J.P. Morgan Asset Management, according to the Hedge Fund 100 ranking published by Institutional Investor’s Alpha magazine. The bank is No. 2 in this year’s ranking, behind Bridgewater Associates, with $59 billion in hedge funds assets, including $12 billion at Highbridge.

The stock market collapse of 2008 hit hedge funds hard, and Highbridge suffered more than many. Its flagship multistrategy fund ended the year down 27 percent, compared with a 19 percent decline in the HFRI Fund Weighted Composite Index. By the start of 2010, the firm’s total assets had dropped to $18.6 billion. In 2009, JPMorgan acquired the remaining 45 percent stake and CIO Swieca left the firm, leaving Dubin as chief executive. Four years later, in July 2013, Dubin announced that he would be stepping down as chief executive, though he would remain at the firm as chairman. Kapnick was named CEO, appointed over Highbridge President Todd Builione, who had previously been seen as a candidate to succeed Dubin. Builione left to join New York–based private-equity firm KKR.

Since taking control of the firm, Kapnick has concentrated on building Highbridge Principal Strategies. That unit has launched a series of new funds including a $469 million collateralized loan obligation, Highbridge Loan Management 2014-4, and a $3 billion-plus Specialty Loan fund.

Highbridge’s liquid hedge fund business, meanwhile, has produced average returns. Its multistrategy fund’s class A series shares, which account for $1.6 billion in assets, returned 6.5 percent in 2013, 9.79 percent in 2012, -5.11 percent in 2011 and 4 percent in 2010. The HFRI composite returned 9.13 percent, 6.36 percent, -5.25 percent and 10.25 percent, respectively, those years. The shares are outperforming this year, up 5.38 percent through October 31 compared with a 3 percent gain for the index.

One major impetus for Highbridge management to seek to break free from JPMorgan is the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. That law’s so-called Volcker Rule puts strict limits on how much banks can invest in alternatives. Those limits, in turn, put Highbridge at a competitive disadvantage to the less heavily regulated large asset management and alternative investment firms.

Another frustration for Kapnick, according to an industry colleague who has spoken to him about the matter, is having to compensate employees with bank stock. Having to use the currency of this more highly regulated entity puts him at a perceived disadvantage to privately held hedge funds and the successful public asset management firms when it comes to hiring and retaining talent. JPMorgan currently trades at around $61 a share, which is above the bank’s pre-2008 high.

Another key difference for Highbridge between 2009 and today is management. Not only has Highbridge’s leadership changed but so too has the top brass at J.P. Morgan Asset Management. James (Jes) Staley, who headed the bank’s asset management business from 2001 to 2009, was instrumental in orchestrating the Highbridge acquisition. He was promoted to CEO of the group’s investment bank in 2009 and then left the firm in 2013. The asset management business is run today by his successor and protégé, Mary Callahan Erdoes.

To pull off a management buyout, Highbridge will need capital. Sources say potential backers could include J. Christopher Flowers, chairman of J.C. Flowers & Co., a New York–based private equity firm focused on the financial services sector; Blackstone Group, the big investment and advisory firm that has a fund dedicated to investing in hedge fund businesses; Affiliated Managers Group, a Massachusetts-based owner of investment management boutiques; Hellman & Friedman, a San Francisco–based private equity firm, and TA Associates, a Boston-based PE firm.

Get more on hedge funds and alternatives.

Follow Imogen Rose-Smith on Twitter at @imogennyc.