Students around the world have been clamoring for university endowments, particularly here in the U.S., to start taking their interests more seriously. Environmental issues, such as decarbonization, reducing the use of fossil fuels and promoting clean energy, have been particularly pronounced.

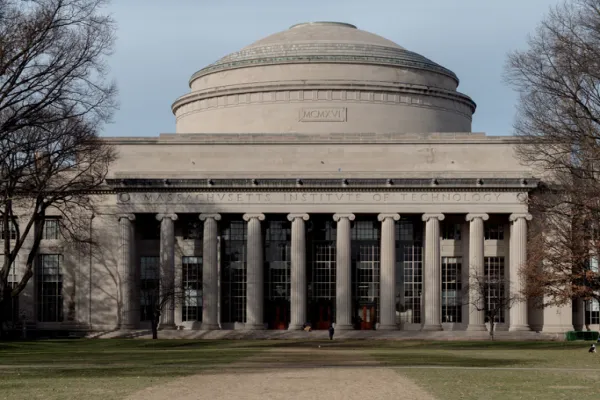

Lately, these student groups have been making some real inroads. Stanford University announced earlier this month that pressure from students had led the Board of Trustees to decide to divest from coal companies. It was a headline-grabbing announcement that placed the Stanford Management Co., which manages the university’s $18.7 billion endowment, at the center of a global debate about how long-term investors should deal with environmental issues. (For details, have a read of Alicia Seiger’s article on II, which reports on the SMC divestment.)

The Stanford decision only affects a small subset of its overall portfolio. (Yes, SMC will still own some coal companies). Nevertheless, the new policy has placed divestment on the agenda of nearly every endowment, pension, foundation and sovereign wealth fund CIO in the world. If you were a CIO, I assure you that somebody somewhere would have sent you an article about the Stanford divestment with a big fat question mark dangling at the end. It’s that big.

But is all this focus on divestment worthwhile? I accept that universities may have a legitimate interest in influencing the investment strategies of their endowments. I also accept that universities may like to give voice and agency to their stakeholders as it pertains to ethics in investment policies. But I also believe there are (far) better ways to drive sustainability than through passive divestment policies. In fact, what I would like to focus on here is a more fundamental (and perhaps more controversial) issue about the ambivalence of endowments on sustainability issues. I am of the view that the endowment model of institutional investment is at odds with the long-term challenges facing our society, especially as it pertains to climate change. I also believe that some endowments may be complicit in the problems they purport to be trying to solve via divestment policies. Let me explain.

The endowment model, as developed by David Swensen at Yale University and copied by many other universities, relies heavily on external managers; it seeks to generate high returns through an aggressive orientation toward alternatives and private equity mandates. The success or failure of this model, it seems to me, is based on access to top-performing managers, as endowments believe that certain managers can and do deliver alpha. The endowments that have privileged access to top managers see themselves as lucky passengers on an investment return rocket ship provided by certain hedge funds, private equity firms and other alternative managers. And so endowments won’t do anything to rock the boat with these managers. As a result, the asset managers would seem to hold the power to discipline and influence asset owners. It’s for this reason that many university endowments are more secretive than the most tight-lipped SWFs. Why? They are protecting their managers from scrutiny (and themselves, from informing the general public about how much they are paying these managers in fees).

And therein lies a fundamental problem with the endowment model: The agents, it would seem, are in charge of the principals.

If your model of investment means you are grateful for simply having access to certain managers, then what influence can you hope to have over the policies of those same managers, let alone the underlying companies they invest in? Yes, you can vote proxies and engage in corporate governance, but the truth is, you’ve neutered your real power to discipline or even influence the agents who are meant to be operating in your long-term interest.

Moreover, the top-decile hedge fund you invest in is unlikely to consider the long-term issues that are so important to sustainable economic growth, such as fossil fuels. Nor are they likely to push their portfolio companies to embrace environmental issues or make capital investments to green their supply chains. It’s not in the managers’ interest to do so for one simple reason: time.

The rewards from taking these environmental factors into consideration won’t be reaped for decades, which means private managers aren’t interested or incentivized to focus on them. Endowments, however, have a different time horizon. They have the ability to look ten and 20 years out and think about how best to position their portfolio for future scenarios. But if that long-term endowment is chasing super-star managers who aren’t interested in long-term issues, it’s quite unlikely that those long-term issues will play a role.

I guess what I’m asking is this: Can an investment model that relies on short- to medium-term intermediaries that are immune to influence or even discipline ever hope to be a part of the solution to these long-term issues? More to the point: Is the endowment model complicit in the endemic short-termism we see in the world today?

And this brings me to what I would like the current divestment debate to evolve into: How do we help long-term investors ... be long-term investors? Because if you really want to move the needle on climate change or other environment issues, then student groups should be pushing for their university endowments to start acting like long-term investors (i.e., owners). They should be pushing endowments to put their long-term capital to work in long-term ways. Read the words of McKinsey & Co. global managing director Dominic Barton and Canada Pension Plan Investment Board CEO Mark Wiseman. They also see asset owners’ behavior as critical to resolving the pervasive short-termism we have today in the global economy:

“The single most realistic and effective way to move forward is to change the investment strategies and approaches of the players who form the cornerstone of our capitalist system: the big asset owners,” they write in a recent Harvard Business Review article, “Focusing Capital on the Long Term.” “If they adopt investment strategies aimed at maximizing long-term results, then other key players — asset managers, corporate boards, and company executives — will likely follow suit.”

That, my friends, is how an institutional investor can have a meaningful impact on sustainability, climate change and a plethora of difficult and intractable issues. A halfhearted divestment from coal companies that only applies to a tiny subset of an entire portfolio? Sorry, Stanford, no. To be clear, I am grateful to Stanford for the opportunity to raise these issues, but the divestment policy itself is not meaningful.

If endowments truly want to have an impact in the domain of sustainability, they would have to develop an investment organization that could take advantage of its long-term mission — as many sovereign funds and Canadian pension funds have done. They would seek to drive higher returns with a more sustainable portfolio. I’m not talking about impact investing, ESG or even socially responsible investing; I am talking about long-term investing. I’m talking about fundamentally changing the model of how endowments access investment opportunities so as to focus on sustainable returns rather than rent seeking. This would mean they would have fewer managers and hold more assets directly. Admittedly, that’s hard. And developing such a capability may not generate headlines or placate student groups. But it might just deliver the long-term capital for a more sustainable future.

Wouldn’t endowment returns suffer? you might ask. No. Stanford generated a 10 percent return over the past decade, which is good. But Singapore’s Temasek Holdings generated 13 percent over the same period running a different model. Even the South Dakota Investment Council — whose operating costs, including in-house and external managers, are just 43 basis points — has generated annualized returns of 10.6 percent for 40 years. Endowments’ returns are good, but they’re nothing that can’t be reproduced by alternative models of institutional investment that are better rooted in the real economy.

Consider that there’s no portfolio of assets a short-term investor can hold that a long-term investor cannot also hold. And yet long-term investors can and do hold portfolios that short-term investors can’t. And that means that being a long-term investor is, thanks to the power of diversification, better than being a short-term investor.

In sum, to have a real impact on the world, large institutional investors have to develop a long-term capability. They have to look ten to 20 years ahead and encourage companies to make the investments necessary to be relevant in a more environmentally sustainable world ... or fail. In the process, I believe they can do well while doing good.

As for endowments, I think they have forsaken their long-term competitive advantage at the altar of alpha. That decision has created lots of unintended consequences in the real economy. To be credible participants in the sustainability movement, these funds will have to change the way they do business. Anything else is just greenwashing.

(Note: I work for Stanford, but I have no affiliation with SMC. I hide out in a generic-sounding research center in the engineering school that has a mandate to “re-root finance in the real economy.”)