To many, North Dakota conjures images of bleak, snow-covered landscapes like those in the 1996 Coen brothers movie Fargo — an Academy Award–winning, if gruesome, satirical classic (which, despite the name, takes place in and was filmed almost entirely in Minnesota). But in real life, North Dakota represents an emerging market within U.S. borders whose oil boom, along with developments in key shale basins in Texas and Canada, will help lead North America to energy independence over the next dozen years.

Pimco’s December 2012 viewpoint, “Energy Face-Off,” profiled the explosion in U.S. and Canadian crude oil production as a game-changing event that will have long-term impacts on global supply and demand.

Pimco believes this growth in fossil fuel production will make North America energy independent by roughly 2025. Based on forecasts from Denver-based energy market analytics company Bentek Energy, growth of U.S. and Canadian crude oil production is expected to average 10 percent per year from 2013 through 2017. Additionally, Bentek estimates, from 2013 to 2020 about 50 percent of global incremental crude oil production will come from North America, totaling 4.5 million barrels per day. Some top-producing regions in the area that stand to bolster production include the Eagle Ford Shale in south Texas; the Bakken Shale in North Dakota, Montana and parts of Canada; the Permian Basin in west Texas; the Green River Formation oil shale play in Colorado, Utah and Wyoming; the Athabasca oil sands in northern Alberta; and the oil shale deposits in Canada’s Maritime Provinces, especially New Brunswick and Nova Scotia.

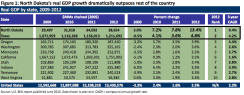

North Dakota has gotten a jolt from the energy surge. The state’s gross domestic product grew by a staggering 13.4 percent in 2012, according to a June 2013 report published by the U.S. Bureau of Economic Analysis (BEA). To put that figure into perspective, North Dakota’s GDP growth was more than five times greater than the national average and almost three times greater than the second fastest-growing state, Texas (see Figure 1). Also rich in fossil fuels, Texas is another economic powerhouse, with the second-largest GDP of all states: $1.2 trillion. Texas has achieved a three-year compound annual growth rate of 4.2 percent, more than two-and-a-half times faster than the growth rates of California, New York, Florida and Illinois, the four next-largest states as measured by absolute GDP.

Click image to enlarge

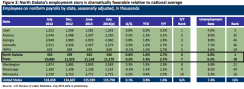

The BEA cited mining, construction and transportation as the primary drivers of GDP and employment growth in North Dakota and Texas. North Dakota’s state employment growth ranks sixth in the U.S., with Texas just behind at the No. 7 spot. North Dakota’s unemployment rate is a shockingly low 3 percent, according to the U.S. Bureau of Labor Statistics (see Figure 2). The state’s unemployment rate is the lowest in the U.S.: 60 percent lower than the national average of 7.4 percent and near the all-time low of 2.1 percent set by Connecticut in October 2000.

Click image to enlarge

Notably, this economic and employment growth occurred despite North Dakota being the least-visited state, according to CNNMoney. With just under 700,000 residents as of July 2012, according to estimates by the U.S. Census Bureau , North Dakota ranks as the 48th state by population, with Vermont and Wyoming ranked 49th and 50th, respectively.

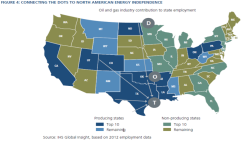

Because of technological advancements combining hydraulic fracturing with horizontal drilling, crude oil production in the U.S. and Canada has grown dramatically during the past three years, according to Bentek Energy. Additionally, Pimco believes that due to ample access to capital, increased productivity and added drilling infrastructure, production growth in Texas, North Dakota and western Canada should grow 10 percent annually during the next three years. In Pimco’s opinion, North Dakota, Oklahoma and Texas are critical states in terms of production, pipeline route, storage and end-market consumption. We believe these states stand to benefit disproportionately from strong growth in the energy sector, particularly in onshore U.S. oil and gas shale development (see Figure 3).

Click image to enlarge

In the U.S. and Canada the adoption of advanced drilling technology has revitalized crude oil production. Emerging shale plays have led to solid volume growth as well as the need for future investment to expand pipeline capacity. Additionally, strong asset quality, high barriers to entry, long-term contracts, inflation protection, noncyclical cash flows and significant growth in pipeline capacity have created attractive opportunities for bond and equity investors.

Given these tremendous growth prospects, Pimco’s approach has been to identify and invest in those companies, including pipeline operators, that are most favorably positioned to benefit from prolific oil production in specific markets such as North Dakota and Texas, as well as from the energy landscape in the U.S. and Canada as a whole (see Figure 4). In Pimco’s opinion, growth in the midstream energy sector stands to outpace that of the overall U.S. economy during the next several years.

Click Image to enlarge

North America needs growth and job creation more than ever. Given the longer-term outlook for increasing crude oil production, the midstream energy sector represents one of the best possible scenarios for growth. The energy industry and markets are cyclical and subject to unpredictable swings in both supply and demand, however. In a recession, global demand for energy can fall significantly, leading to lower prices and reduced transportation volumes. Geopolitical risks also need to be taken into account, especially given the Middle East’s substantial contribution to the global oil supply. Additionally, proposed pipeline projects in the U.S. and Canada require the respective approvals of the Federal Energy Regulatory Commission and the National Energy Board to proceed. The process can take upwards of a year and has attracted increasing opposition in light of environmental concerns and fears that a more balanced supply-demand market for commodities will lead to higher prices to consumers.

Overall, the emerging trends in the North American energy sector, especially in crude oil production, are likely to have dramatic knock-on effects on U.S. manufacturing, foreign policy, defense spending, current account balance and the looming budget deficit. Even if the timeline for regional energy independence is extended, onshore production growth in the near term will likely allow the U.S. to wean itself from non-Canadian waterborne imports and significantly increase long-term national energy security.

To capitalize on these trends, investors should consider buying shares of high-quality midstream energy companies with abundant assets in areas with strong production and new development. Moreover, Pimco has identified a selection of pipeline and rail transportation systems in both Canada and the U.S. that represent attractive opportunities for investing in oil-producing U.S. states.

John Devir is an executive vice president and convertible portfolio manager at Pimco’s Newport Beach, California, office, where he analyzes opportunities for investment in the pipeline and master limited partnership sectors in North America.

Get more from Pimco.