The growth style outperformed the value style on a cumulative basis for the 14 years through 2020, leading some observers to wonder if value was dead (Exhibit 1). In late 2020, promising news about COVID-19 vaccines led to a significant rotation in the market toward companies that stand to benefit more as economies start to reopen. This rotation started off as a “value rally” but quickly morphed into a high-beta rally, leaving investors wondering what will happen in 2021 and what that will mean for investing.

We think the growth-versus-value debate needs to be reframed. Rather than growth versus value, we think in terms of growth and value — focusing not on short-term leadership but on capturing long-term opportunities and managing risks within each style.

Moreover, we believe major benchmarks might not be the best proxies for underlying investment-style performance. We think active managers with broad expertise and a disciplined process will be better positioned to capture the opportunities and manage the risks associated with both growth and value in the years ahead.

Seeking compelling stocks rather than timing the market

Growth’s long run may obscure the fact that on a cumulative basis it has been outperformed by value for the past 70 years, despite periodic stretches of growth leadership (see Exhibit 1). In our view, this history of rotation in style leadership should cause investors to pause and reflect before declaring value dead. We believe that both styles are in fact very much alive, but that the duration and magnitude of either style’s cycle is unknowable.

Rather than trying to time style leadership, we think it wiser to invest in both the growth and value universes, focusing on stocks that are positioned well to add value in the years to come. Our stock-by-stock research currently finds inflated valuations among individual stocks in both styles. One reason is that in 2020 the most expensive stocks outperformed the cheapest in both the value and growth categories. But we think this is unlikely to reoccur for any sustained period.

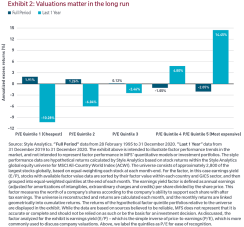

The “growth at any price” approach many investors have favored in recent years carries considerable risks, we believe. Historically, lower valuations have led to strong long-term returns while higher valuations have tended to preface weaker long-term returns (see Exhibit 2).

In both the value and growth universes, valuation is an important consideration as we look for stocks that we believe are poised to deliver robust future returns. We engage in spirited debates about appropriate valuations, with input from both equity and fixed income analysts across our global research platform.

The risks of investing based on style benchmarks

As stated above, it is no longer safe to assume the major benchmarks are suitable proxies for access to a style.Over the past 10 years, concentration in growth indices has risen to historic highs. For example, the five largest stocks in the Russell 1000® Growth Index now constitute nearly 40% of that benchmark. As a result, investors accessing this style through index funds now face unprecedented concentration risk. If the Growth Index was a mutual fund, it would be labeled "nondiversified" under SEC rules.

The indices determine which stocks qualify as growth or value based primarily on price-to-book ratio, arguably an outdated metric. That method presents two potential problems. First, book value can be useful for valuing a company whose business depends primarily on its use of physical property such as farms, factories or shopping malls, but it does not adequately capture the value of intangible assets such as intellectual property and brand value, which are increasingly more important to many companies today. The second potential problem with relying on price-to-book is that is doesn’t account for certain important risks, such as the rise in leverage in pockets of the market.

A time for active management

A combination of fiscal and monetary stimulus, along with an appetite for growth at any price, helped lift the overall markets in recent years. Expanding valuations rather than improving earnings drove all the market gains of 2020.We don’t believe those conditions will continue indefinitely. Investors will eventually return to the factors that have been historically been the most important drivers of returns: earnings and dividends. An active manager that performs deep research into company fundamentals may be best equipped to evaluate which companies can deliver long-term earnings growth and what will be needed in the way of dividends to create value for investors in the coming years.

Collaboration leads to better insights

In today’s complex world, successful analysis requires teams that look at the issues from a variety of perspectives, allowing them to better account for the ways factors — from technological disruption to regulation to financial market dynamics — might affect businesses and their share prices. Active managers leverage those broad perspectives to fully assess a company's prospects on a number of fundamental dimensions — growth, returns, valuation and sustainability. They also comprehensively assess risk, including concentration risk, in order to generate strong risk-adjusted returns over time.We believe these types of analyses work best when analysts do not operate in silos. Our global research platform draws on many perspectives and takes into account a broad range of considerations, from business fundamentals to macroeconomics to environmental, social and governance (ESG) factors.

Every equity and fixed income analyst works on a sector team composed of peers who cover the same sector as them around the world. The analysts bring insights from their experiences living and working in their regions. They work closely with portfolio managers and their peers to fully explore their ideas, helping to develop a comprehensive, holistic view of the risks and opportunities facing each company. This process helps to eliminate biases related to style, region and asset class. We believe this collaboration gives us a differentiated view versus the broader market and leads to better investment decisions and outcomes.

And this, along with the reasons touched on above, is why we believe this type of active approach will help deliver strong risk-adjusted returns for our clients in both growth and value portfolios over the long term.

Click here to learn more about how MFS creates value by allocating capital responsibly.

Frank Russell Company ("Russell") is the source and owner of the Russell Index data contained or reflected in this material and all trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell's express written consent. Russell does not promote, sponsor or endorse the content of this communication.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

The views expressed are those of MFS, and are subject to change at any time. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any MFS investment product.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries

Distributed by: U.S. – MFS Institutional Advisors, Inc. (“MFSI”), MFS Investment Management and MFS Fund Distributors, Inc.; Latin America – MFS International Ltd.; Canada – MFS Investment Management Canada Limited. No securities commission or similar regulatory authority in Canada has reviewed this communication; U.K./EMEA – MFS International (U.K.) Limited (“MIL UK”), a private limited company registered in England and Wales with the company number 03062718, and authorized and regulated in the conduct of investment business by the U.K. Financial Conduct Authority. MIL UK, an indirect subsidiary of MFS, has its registered office at One Carter Lane, London, EC4V 5ER UK/MFS Investment Management (Lux) S.à r.l. (MFS Lux) – MFS Lux is a company is organized under the laws of the Grand Duchy of Luxembourg and an indirect subsidiary of MFS – both provides products and investment services to institutional investors in EMEA. This material shall not be circulated or distributed to any person other than to professional investors (as permitted by local regulations) and should not be relied upon or distributed to persons where such reliance or distribution would be contrary to local regulation; Singapore – MFS International Singapore Pte. Ltd. (CRN 201228809M); Australia/New Zealand – MFS International Australia Pty Ltd (“MFS Australia”) (ABN 68 607 579 537) holds an Australian financial services licence number 485343. MFS Australia is regulated by the Australian Securities and Investments Commission.; Hong Kong – MFS International (Hong Kong) Limited (“MIL HK”), a private limited company licensed and regulated by the Hong Kong Securities and Futures Commission (the “SFC”). MIL HK is approved to engage in dealing in securities and asset management regulated activities and may provide certain investment services to “professional investors” as defined in the Securities and Futures Ordinance (“SFO”).; For Professional Investors in China – MFS Financial Management Consulting (Shanghai) Co., Ltd. 2801-12, 28th Floor, 100 Century Avenue, Shanghai World Financial Center, Shanghai Pilot Free Trade Zone, 200120, China, a Chinese limited liability company regulated to provide financial management consulting services.; Japan – MFS Investment Management K.K., is registered as a Financial Instruments Business Operator, Kanto Local Finance Bureau (FIBO) No.312, a member of the Investment Trust Association, Japan and the Japan Investment Advisers Association. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks, including market fluctuation and investors may lose the principal amount invested. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

FOR INSTITUTIONAL AND INVESTMENT PROFESSIONAL USE ONLY

MFSE-FLY-784689-4/21 48219.1