While much of the United States is zeroed in on the outcome of the 2020 election, institutional investors are more focused on other issues — at least when it comes to investment decision-making.

According to industry insiders, the coronavirus pandemic and central banks’ actions are seen as outweighing the significance of the contentious election for institutional portfolios.

“The truth is for markets, it’s not just terribly important,” Michael Rosen, founder of Angeles Investment Advisors, said of the election. “It's important for a lot of reasons. For our country, society, our children, their children. But not the markets.”

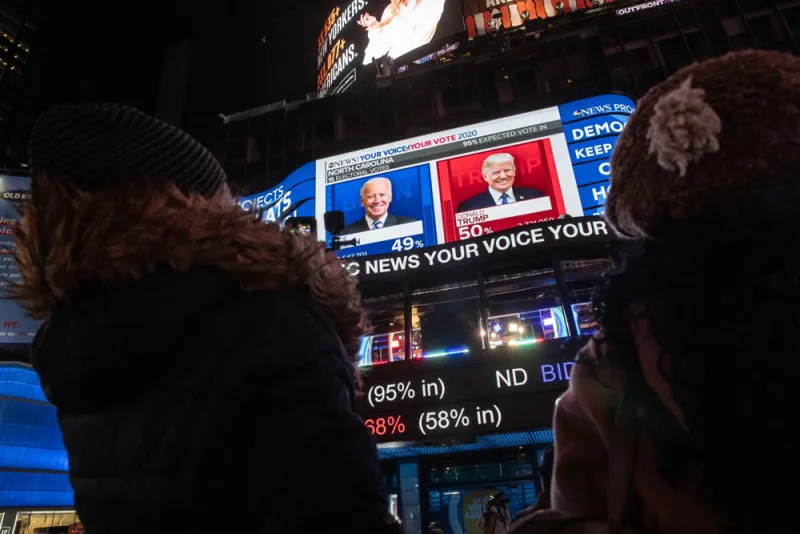

Although the markets popped on Wednesday as votes were being tallied, Rosen and his peers in the industry do not believe the effects are long-lasting.

“We think that there may be noise in the short term,” said Scott Freemon, head of strategy and risk at Secor Asset Management. He added that the attractiveness of one asset class over another will not change based on the election’s results.

“The primary issue for the market remains recovering from Covid-19 and the speed of that recovery,” he said.

Institutional consulting firm North Pier Search Consulting echoed this sentiment in a report published ahead of the election. “At the end of the day, it will likely come down to the trajectory of the virus,” the search firm said.

That’s not to say that institutional investors were not concerned about the election.

“I think there have been very few moments in the last decade when clients haven’t expressed a high level of anxiety and worry about the state of affairs of the world,” Rosen said. “The source of that anxiety and worry and concern changes, but it seems like it’s ever-present.”

Some investors positioned themselves defensively: Secor, for example, went long volatility and underweight equities, according to Freemon. The asset management firm won’t be making any swift allocation decisions though.

“We've talked about the elections, and our firm-wide view is to really be patient and only act through extreme circumstances where the market is either overly exuberant or negative,” Freemon said.

Most outsourced chief investment officers were similarly not making big portfolio decisions, according to the October 28 report from North Pier. However, one OCIO professional interviewed for the report said that their team was expecting volatility to rise before and after the election and that they were looking at potential tactical trading opportunities.

[II Deep Dive: Some of Biden’s Biggest Fundraisers Come From Wall Street]

Although votes were still being counted on Wednesday afternoon, both Rosen and Secor’s head of portfolio solutions Dmitri Smolansky said that a divided government would likely be the best outcome for the market.

“It looks like the markets are assuming that [Joe] Biden is going to win the election and that Republicans will hold the Senate,” Smolansky said. “It seems that that is one of the better scenarios that investors could come up with.”

Rosen added that there is “ample evidence” that markets have performed better with a party split between the legislative and executive branches.

“Having a check and balance on one branch of government is generally seen as prudent,” he said.